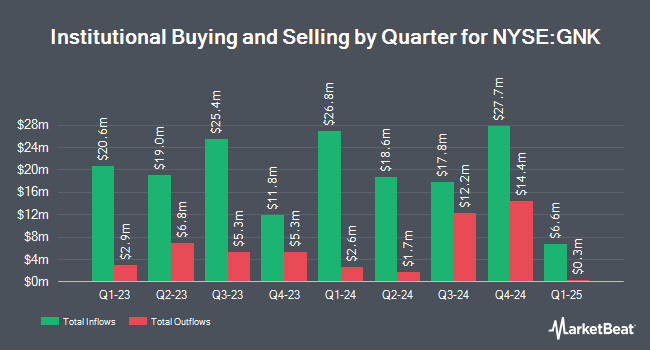

PDT Partners LLC purchased a new stake in Genco Shipping & Trading Limited (NYSE:GNK - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm purchased 68,722 shares of the shipping company's stock, valued at approximately $1,340,000. PDT Partners LLC owned 0.16% of Genco Shipping & Trading as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also modified their holdings of GNK. Moors & Cabot Inc. raised its holdings in Genco Shipping & Trading by 2.0% in the 2nd quarter. Moors & Cabot Inc. now owns 31,404 shares of the shipping company's stock worth $669,000 after acquiring an additional 628 shares during the period. SummerHaven Investment Management LLC increased its stake in shares of Genco Shipping & Trading by 1.3% in the second quarter. SummerHaven Investment Management LLC now owns 54,318 shares of the shipping company's stock worth $1,158,000 after purchasing an additional 682 shares during the period. CWM LLC lifted its position in shares of Genco Shipping & Trading by 109.5% during the 2nd quarter. CWM LLC now owns 1,909 shares of the shipping company's stock worth $41,000 after purchasing an additional 998 shares during the last quarter. Wealth Enhancement Advisory Services LLC boosted its stake in Genco Shipping & Trading by 12.6% during the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 11,453 shares of the shipping company's stock valued at $244,000 after purchasing an additional 1,279 shares during the period. Finally, Point72 Asset Management L.P. grew its holdings in Genco Shipping & Trading by 7.6% in the 2nd quarter. Point72 Asset Management L.P. now owns 18,300 shares of the shipping company's stock valued at $390,000 after buying an additional 1,300 shares during the last quarter. 58.62% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

GNK has been the subject of a number of research analyst reports. Jefferies Financial Group reiterated a "buy" rating and set a $25.00 price target on shares of Genco Shipping & Trading in a report on Thursday, November 7th. Stifel Nicolaus cut shares of Genco Shipping & Trading from a "buy" rating to a "hold" rating and cut their target price for the company from $26.00 to $17.00 in a research note on Wednesday, October 23rd. Finally, Deutsche Bank Aktiengesellschaft assumed coverage on shares of Genco Shipping & Trading in a research report on Wednesday, September 4th. They issued a "buy" rating and a $22.00 price target on the stock. Three equities research analysts have rated the stock with a hold rating and four have given a buy rating to the company. According to MarketBeat, Genco Shipping & Trading currently has a consensus rating of "Moderate Buy" and a consensus target price of $24.20.

View Our Latest Stock Report on Genco Shipping & Trading

Genco Shipping & Trading Stock Performance

GNK traded down $0.35 during trading on Monday, reaching $15.52. 482,869 shares of the company's stock were exchanged, compared to its average volume of 584,473. The company has a market capitalization of $663.64 million, a P/E ratio of 9.89, a PEG ratio of 0.25 and a beta of 0.98. The company has a quick ratio of 2.49, a current ratio of 3.09 and a debt-to-equity ratio of 0.08. The business has a 50 day moving average price of $17.22 and a 200 day moving average price of $18.81. Genco Shipping & Trading Limited has a fifty-two week low of $14.02 and a fifty-two week high of $23.43.

Genco Shipping & Trading (NYSE:GNK - Get Free Report) last posted its earnings results on Wednesday, November 6th. The shipping company reported $0.41 earnings per share for the quarter, meeting analysts' consensus estimates of $0.41. The business had revenue of $99.33 million for the quarter, compared to analysts' expectations of $72.02 million. Genco Shipping & Trading had a net margin of 15.63% and a return on equity of 8.46%. The firm's revenue for the quarter was up 19.2% on a year-over-year basis. During the same quarter in the previous year, the firm posted ($0.09) earnings per share. As a group, analysts predict that Genco Shipping & Trading Limited will post 1.74 earnings per share for the current fiscal year.

Genco Shipping & Trading Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, November 25th. Shareholders of record on Monday, November 18th were issued a dividend of $0.40 per share. The ex-dividend date of this dividend was Monday, November 18th. This is a boost from Genco Shipping & Trading's previous quarterly dividend of $0.34. This represents a $1.60 dividend on an annualized basis and a dividend yield of 10.31%. Genco Shipping & Trading's dividend payout ratio (DPR) is presently 101.91%.

Genco Shipping & Trading Company Profile

(

Free Report)

Genco Shipping & Trading Limited, together with its subsidiaries, engages in the ocean transportation of drybulk cargoes worldwide. The company owns and operates dry bulk vessels to transports iron ore, grains, coal, steel products, and other drybulk cargoes. It charters its vessels primarily to trading houses, including commodities traders; producers; and government-owned entities.

Recommended Stories

Before you consider Genco Shipping & Trading, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genco Shipping & Trading wasn't on the list.

While Genco Shipping & Trading currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.