Apollon Wealth Management LLC acquired a new stake in shares of Paycom Software, Inc. (NYSE:PAYC - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm acquired 7,123 shares of the software maker's stock, valued at approximately $1,186,000.

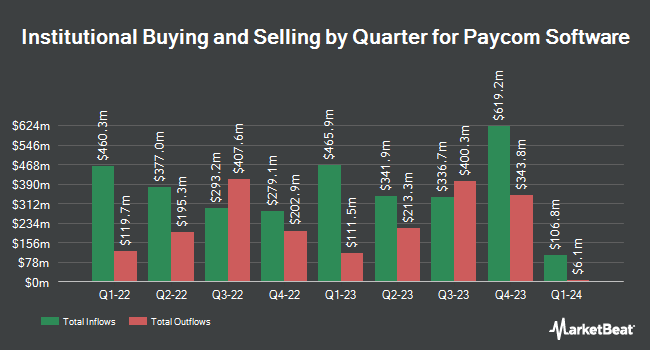

Other hedge funds and other institutional investors have also bought and sold shares of the company. Sylebra Capital LLC bought a new position in shares of Paycom Software during the first quarter valued at $253,196,000. Federated Hermes Inc. lifted its holdings in Paycom Software by 1,011.2% during the 2nd quarter. Federated Hermes Inc. now owns 581,964 shares of the software maker's stock worth $83,244,000 after buying an additional 529,591 shares during the period. International Assets Investment Management LLC lifted its holdings in Paycom Software by 9,997.5% during the 3rd quarter. International Assets Investment Management LLC now owns 281,315 shares of the software maker's stock worth $46,859,000 after buying an additional 278,529 shares during the period. Confluence Investment Management LLC grew its position in shares of Paycom Software by 147.3% in the 3rd quarter. Confluence Investment Management LLC now owns 377,876 shares of the software maker's stock valued at $62,943,000 after buying an additional 225,081 shares during the last quarter. Finally, Raymond James & Associates increased its stake in shares of Paycom Software by 769.2% in the second quarter. Raymond James & Associates now owns 201,366 shares of the software maker's stock valued at $28,803,000 after buying an additional 178,198 shares during the period. Institutional investors own 87.77% of the company's stock.

Paycom Software Trading Down 2.1 %

PAYC stock traded down $4.79 during midday trading on Friday, hitting $219.88. The company's stock had a trading volume of 476,881 shares, compared to its average volume of 812,393. The company has a market cap of $12.68 billion, a PE ratio of 26.46, a P/E/G ratio of 3.05 and a beta of 1.14. The firm's 50-day moving average is $178.94 and its 200-day moving average is $165.73. Paycom Software, Inc. has a 12 month low of $139.50 and a 12 month high of $233.69.

Paycom Software Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 9th. Stockholders of record on Monday, November 25th will be issued a dividend of $0.375 per share. The ex-dividend date is Monday, November 25th. This represents a $1.50 annualized dividend and a dividend yield of 0.68%. Paycom Software's payout ratio is 18.05%.

Insider Activity at Paycom Software

In other news, CEO Chad R. Richison sold 1,950 shares of the company's stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $162.27, for a total transaction of $316,426.50. Following the completion of the sale, the chief executive officer now owns 2,961,308 shares of the company's stock, valued at $480,531,449.16. This represents a 0.07 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Insiders have sold a total of 60,450 shares of company stock worth $10,672,818 over the last quarter. Company insiders own 14.50% of the company's stock.

Analysts Set New Price Targets

PAYC has been the subject of a number of analyst reports. BMO Capital Markets lifted their target price on shares of Paycom Software from $183.00 to $197.00 and gave the stock a "market perform" rating in a research note on Thursday, October 31st. Barclays boosted their price objective on Paycom Software from $172.00 to $181.00 and gave the company an "equal weight" rating in a research note on Thursday, October 31st. Citigroup raised their target price on Paycom Software from $172.00 to $196.00 and gave the stock a "neutral" rating in a research note on Thursday, October 31st. Jefferies Financial Group lifted their price objective on shares of Paycom Software from $170.00 to $175.00 and gave the company a "hold" rating in a research note on Thursday, October 31st. Finally, TD Cowen increased their target price on shares of Paycom Software from $171.00 to $188.00 and gave the stock a "hold" rating in a research note on Monday, September 23rd. Twelve investment analysts have rated the stock with a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat.com, Paycom Software presently has a consensus rating of "Hold" and a consensus target price of $193.67.

Check Out Our Latest Research Report on Paycom Software

Paycom Software Profile

(

Free Report)

Paycom Software, Inc provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States. It offers functionality and data analytics that businesses need to manage the employment life cycle from recruitment to retirement.

Recommended Stories

Before you consider Paycom Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paycom Software wasn't on the list.

While Paycom Software currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.