Tri Locum Partners LP bought a new stake in shares of Evolus, Inc. (NASDAQ:EOLS - Free Report) during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 742,574 shares of the company's stock, valued at approximately $8,198,000. Evolus makes up 1.7% of Tri Locum Partners LP's investment portfolio, making the stock its 22nd largest holding. Tri Locum Partners LP owned about 1.17% of Evolus at the end of the most recent quarter.

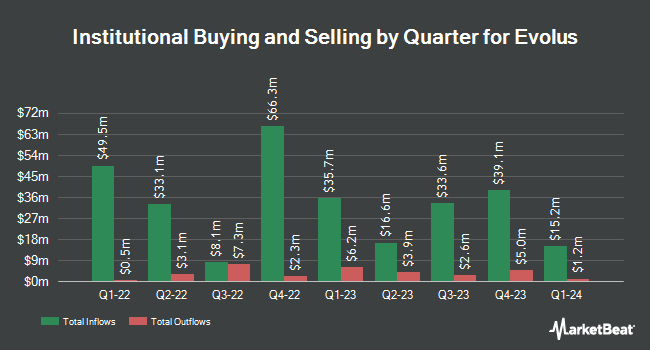

Several other hedge funds have also bought and sold shares of the stock. KBC Group NV purchased a new position in shares of Evolus during the 4th quarter valued at about $49,000. IFP Advisors Inc lifted its holdings in Evolus by 17,440.7% during the fourth quarter. IFP Advisors Inc now owns 4,736 shares of the company's stock valued at $52,000 after purchasing an additional 4,709 shares in the last quarter. KLP Kapitalforvaltning AS purchased a new position in Evolus during the fourth quarter valued at approximately $106,000. Quantbot Technologies LP bought a new position in shares of Evolus in the fourth quarter worth approximately $118,000. Finally, Tradition Wealth Management LLC increased its stake in shares of Evolus by 18.2% in the fourth quarter. Tradition Wealth Management LLC now owns 13,000 shares of the company's stock worth $144,000 after purchasing an additional 2,000 shares in the last quarter. Institutional investors own 90.69% of the company's stock.

Insider Transactions at Evolus

In other news, CMO Tomoko Yamagishi-Dressler sold 4,536 shares of the company's stock in a transaction dated Tuesday, March 18th. The shares were sold at an average price of $13.26, for a total transaction of $60,147.36. Following the sale, the chief marketing officer now directly owns 95,671 shares in the company, valued at approximately $1,268,597.46. This represents a 4.53 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider David Moatazedi sold 6,251 shares of Evolus stock in a transaction dated Thursday, March 27th. The stock was sold at an average price of $12.40, for a total value of $77,512.40. Following the completion of the transaction, the insider now owns 508,619 shares of the company's stock, valued at approximately $6,306,875.60. This represents a 1.21 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 60,575 shares of company stock valued at $794,369 in the last ninety days. Corporate insiders own 6.10% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts recently weighed in on the stock. Barclays lifted their target price on shares of Evolus from $22.00 to $25.00 and gave the company an "overweight" rating in a research note on Wednesday, March 5th. HC Wainwright reiterated a "buy" rating and set a $27.00 target price on shares of Evolus in a research report on Thursday, April 10th. BTIG Research assumed coverage on Evolus in a research note on Thursday, April 17th. They set a "buy" rating and a $21.00 target price on the stock. Finally, Needham & Company LLC restated a "buy" rating and issued a $22.00 price target on shares of Evolus in a research note on Wednesday, April 9th. Five equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat, Evolus has a consensus rating of "Buy" and an average target price of $23.75.

View Our Latest Stock Analysis on EOLS

Evolus Price Performance

NASDAQ:EOLS opened at $11.65 on Friday. The company has a market capitalization of $740.79 million, a P/E ratio of -12.80 and a beta of 0.97. The business's 50-day moving average is $12.25 and its 200 day moving average is $12.92. The company has a current ratio of 2.47, a quick ratio of 2.23 and a debt-to-equity ratio of 20.58. Evolus, Inc. has a 12 month low of $8.67 and a 12 month high of $17.82.

Evolus Profile

(

Free Report)

Evolus, Inc, a performance beauty company, focuses on delivering products in the cash-pay aesthetic market in the United States, Canada, and Europe. The company offers Jeuveau, a proprietary 900 kilodalton purified botulinum toxin type A formulation for the temporary improvement in the appearance of moderate to severe glabellar lines in adults.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Evolus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evolus wasn't on the list.

While Evolus currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.