KLP Kapitalforvaltning AS acquired a new stake in WNS (Holdings) Limited (NYSE:WNS - Free Report) during the fourth quarter, according to its most recent 13F filing with the SEC. The fund acquired 7,500 shares of the business services provider's stock, valued at approximately $355,000.

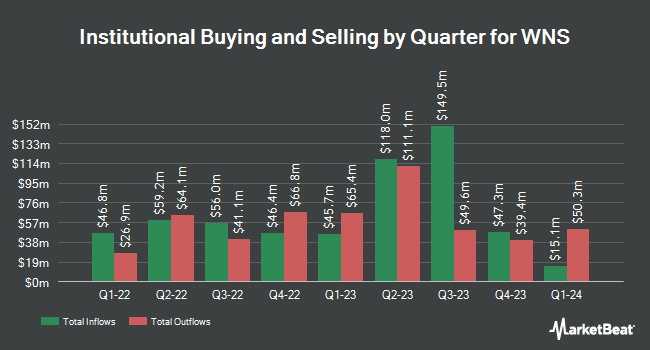

Several other institutional investors have also added to or reduced their stakes in the business. Jane Street Group LLC increased its stake in shares of WNS by 728.1% in the third quarter. Jane Street Group LLC now owns 52,974 shares of the business services provider's stock worth $2,792,000 after purchasing an additional 46,577 shares in the last quarter. State Street Corp grew its stake in WNS by 40.5% in the 3rd quarter. State Street Corp now owns 743,343 shares of the business services provider's stock valued at $39,182,000 after buying an additional 214,417 shares in the last quarter. Nisa Investment Advisors LLC raised its holdings in WNS by 15,848.8% during the 4th quarter. Nisa Investment Advisors LLC now owns 85,645 shares of the business services provider's stock valued at $4,059,000 after acquiring an additional 85,108 shares during the period. MetLife Investment Management LLC lifted its position in shares of WNS by 117.3% during the third quarter. MetLife Investment Management LLC now owns 25,388 shares of the business services provider's stock worth $1,338,000 after acquiring an additional 13,702 shares in the last quarter. Finally, SG Americas Securities LLC boosted its holdings in shares of WNS by 30.4% in the fourth quarter. SG Americas Securities LLC now owns 20,196 shares of the business services provider's stock worth $957,000 after acquiring an additional 4,705 shares during the period. 97.36% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of analysts recently issued reports on the company. Jefferies Financial Group dropped their price objective on WNS from $60.00 to $55.00 and set a "buy" rating on the stock in a report on Tuesday, January 21st. Robert W. Baird increased their price target on shares of WNS from $58.00 to $66.00 and gave the stock an "outperform" rating in a report on Friday, January 24th. Barrington Research raised their price objective on shares of WNS from $63.00 to $75.00 and gave the company an "outperform" rating in a research report on Wednesday, March 26th. StockNews.com upgraded shares of WNS from a "hold" rating to a "buy" rating in a research note on Friday, January 24th. Finally, Needham & Company LLC raised their price target on shares of WNS from $65.00 to $70.00 and gave the company a "buy" rating in a report on Tuesday, March 11th. Three research analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to data from MarketBeat.com, WNS has an average rating of "Moderate Buy" and a consensus target price of $62.25.

Read Our Latest Stock Analysis on WNS

WNS Price Performance

NYSE:WNS traded down $1.39 during mid-day trading on Thursday, reaching $64.56. The stock had a trading volume of 1,766,303 shares, compared to its average volume of 548,291. The stock has a market capitalization of $2.98 billion, a P/E ratio of 22.57, a P/E/G ratio of 2.10 and a beta of 0.96. The firm has a 50 day moving average price of $60.50 and a two-hundred day moving average price of $53.65. The company has a debt-to-equity ratio of 0.19, a quick ratio of 1.81 and a current ratio of 1.81. WNS has a one year low of $39.85 and a one year high of $72.11.

WNS (NYSE:WNS - Get Free Report) last issued its quarterly earnings data on Thursday, January 23rd. The business services provider reported $0.89 earnings per share for the quarter, missing analysts' consensus estimates of $1.04 by ($0.15). WNS had a return on equity of 22.25% and a net margin of 10.03%. As a group, analysts expect that WNS will post 3.8 earnings per share for the current year.

WNS Profile

(

Free Report)

WNS (Holdings) Limited, a business process management (BPM) company, provides data, voice, analytical, and business transformation services worldwide. The company operates through TSLU, MRHP, HCLS, and BFSI segments. It engages in diversified business, including manufacturing, retail, consumer packaged goods, media and entertainment, and telecommunication; travel and leisure, utilities, shipping, and logistics; healthcare and life sciences; banking, financial services, and insurance; and Hi-tech and professional services, as well as procurement.

See Also

Before you consider WNS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WNS wasn't on the list.

While WNS currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.