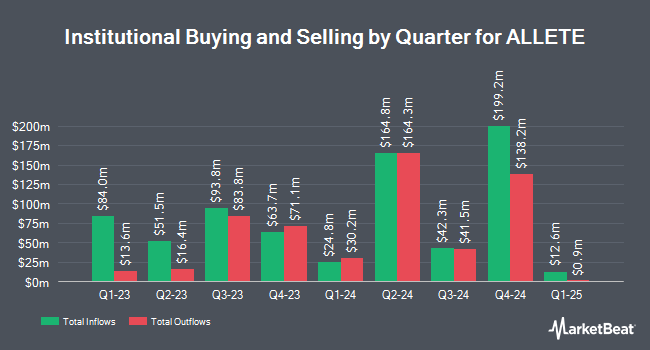

Melqart Asset Management UK Ltd acquired a new position in ALLETE, Inc. (NYSE:ALE - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor acquired 76,879 shares of the utilities provider's stock, valued at approximately $4,982,000. Melqart Asset Management UK Ltd owned 0.13% of ALLETE at the end of the most recent reporting period.

Several other institutional investors have also added to or reduced their stakes in the company. Barclays PLC grew its holdings in shares of ALLETE by 187.1% in the third quarter. Barclays PLC now owns 100,079 shares of the utilities provider's stock worth $6,425,000 after purchasing an additional 65,222 shares during the last quarter. Wilmington Savings Fund Society FSB purchased a new stake in ALLETE in the 3rd quarter valued at about $282,000. Franklin Resources Inc. grew its stake in ALLETE by 9.8% in the 3rd quarter. Franklin Resources Inc. now owns 65,056 shares of the utilities provider's stock worth $4,190,000 after acquiring an additional 5,799 shares in the last quarter. CWA Asset Management Group LLC increased its position in shares of ALLETE by 13.5% during the fourth quarter. CWA Asset Management Group LLC now owns 19,613 shares of the utilities provider's stock worth $1,271,000 after acquiring an additional 2,339 shares during the period. Finally, Hennion & Walsh Asset Management Inc. raised its stake in shares of ALLETE by 6.7% during the fourth quarter. Hennion & Walsh Asset Management Inc. now owns 20,197 shares of the utilities provider's stock valued at $1,309,000 after acquiring an additional 1,269 shares in the last quarter. Institutional investors own 76.55% of the company's stock.

Analyst Ratings Changes

Separately, StockNews.com began coverage on ALLETE in a report on Friday, January 10th. They issued a "hold" rating for the company.

View Our Latest Report on ALE

ALLETE Trading Down 0.2 %

NYSE:ALE opened at $65.18 on Friday. The company has a market capitalization of $3.78 billion, a P/E ratio of 21.03 and a beta of 0.69. The company has a current ratio of 1.08, a quick ratio of 0.69 and a debt-to-equity ratio of 0.50. ALLETE, Inc. has a 12 month low of $59.00 and a 12 month high of $65.99. The firm has a fifty day simple moving average of $65.27 and a 200-day simple moving average of $65.02.

ALLETE (NYSE:ALE - Get Free Report) last released its quarterly earnings data on Tuesday, February 18th. The utilities provider reported $0.87 EPS for the quarter, missing the consensus estimate of $1.02 by ($0.15). ALLETE had a net margin of 11.72% and a return on equity of 5.97%.

ALLETE Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Sunday, June 1st. Stockholders of record on Thursday, May 15th will be paid a dividend of $0.73 per share. This represents a $2.92 annualized dividend and a dividend yield of 4.48%. ALLETE's payout ratio is 94.19%.

ALLETE Profile

(

Free Report)

ALLETE, Inc operates as an energy company. The company operates through Regulated Operations, ALLETE Clean Energy, and Corporate and Other segments. It generates electricity from coal-fired, biomass co-fired / natural gas, hydroelectric, wind, and solar. In addition, the company provides regulated utility electric services in northwestern Wisconsin to approximately 15,000 electric customers, 13,000 natural gas customers, and 10,000 water customers, as well as regulated utility electric services in northeastern Minnesota to approximately 150,000 retail customers and 14 non-affiliated municipal customers.

Featured Stories

Want to see what other hedge funds are holding ALE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for ALLETE, Inc. (NYSE:ALE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ALLETE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ALLETE wasn't on the list.

While ALLETE currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.