Cibc World Markets Corp bought a new position in Cavco Industries, Inc. (NASDAQ:CVCO - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the SEC. The institutional investor bought 774 shares of the construction company's stock, valued at approximately $345,000.

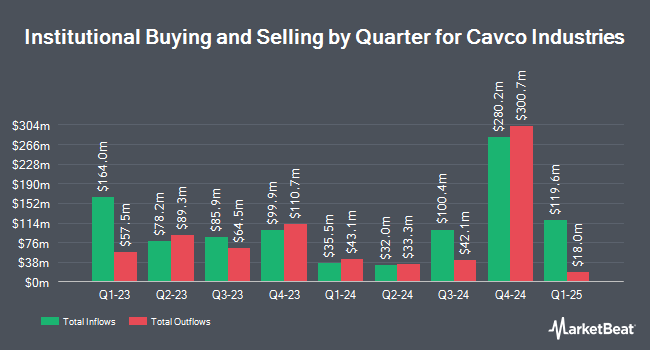

Other institutional investors have also bought and sold shares of the company. Proficio Capital Partners LLC bought a new stake in shares of Cavco Industries during the fourth quarter valued at approximately $5,376,000. Charles Schwab Investment Management Inc. grew its stake in Cavco Industries by 1.4% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 110,977 shares of the construction company's stock valued at $49,521,000 after acquiring an additional 1,524 shares in the last quarter. Fisher Asset Management LLC increased its holdings in Cavco Industries by 8.5% in the 3rd quarter. Fisher Asset Management LLC now owns 71,487 shares of the construction company's stock valued at $30,614,000 after acquiring an additional 5,620 shares during the last quarter. Cerity Partners LLC increased its holdings in Cavco Industries by 91.8% in the 3rd quarter. Cerity Partners LLC now owns 46,915 shares of the construction company's stock valued at $20,091,000 after acquiring an additional 22,451 shares during the last quarter. Finally, Principal Financial Group Inc. lifted its stake in Cavco Industries by 1.9% in the 4th quarter. Principal Financial Group Inc. now owns 42,123 shares of the construction company's stock worth $18,797,000 after purchasing an additional 790 shares in the last quarter. Hedge funds and other institutional investors own 95.56% of the company's stock.

Cavco Industries Price Performance

Shares of Cavco Industries stock traded down $6.64 during trading hours on Thursday, reaching $526.55. The company's stock had a trading volume of 50,450 shares, compared to its average volume of 60,661. The firm has a 50 day moving average price of $513.18 and a 200-day moving average price of $473.44. The stock has a market cap of $4.27 billion, a P/E ratio of 25.91 and a beta of 1.34. Cavco Industries, Inc. has a one year low of $331.08 and a one year high of $544.08.

Cavco Industries (NASDAQ:CVCO - Get Free Report) last released its quarterly earnings results on Thursday, January 30th. The construction company reported $6.90 EPS for the quarter, topping the consensus estimate of $4.89 by $2.01. Cavco Industries had a return on equity of 16.17% and a net margin of 8.75%. As a group, sell-side analysts forecast that Cavco Industries, Inc. will post 21.93 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Several brokerages have recently issued reports on CVCO. StockNews.com raised Cavco Industries from a "hold" rating to a "buy" rating in a report on Monday, February 3rd. Wedbush reaffirmed a "neutral" rating and issued a $550.00 price objective (up previously from $480.00) on shares of Cavco Industries in a research note on Monday, February 3rd.

Read Our Latest Analysis on CVCO

Insider Transactions at Cavco Industries

In other news, Director David A. Greenblatt sold 4,000 shares of the stock in a transaction on Wednesday, March 5th. The shares were sold at an average price of $528.88, for a total value of $2,115,520.00. Following the sale, the director now owns 15,286 shares of the company's stock, valued at approximately $8,084,459.68. This represents a 20.74 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Susan L. Blount sold 750 shares of Cavco Industries stock in a transaction dated Wednesday, January 15th. The stock was sold at an average price of $471.70, for a total transaction of $353,775.00. Following the transaction, the director now directly owns 2,836 shares of the company's stock, valued at approximately $1,337,741.20. This represents a 20.91 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 8,644 shares of company stock worth $4,494,608. 1.60% of the stock is currently owned by company insiders.

About Cavco Industries

(

Free Report)

Cavco Industries, Inc designs, produces, and retails factory-built homes primarily in the United States. It operates in two segments, Factory-Built Housing and Financial Services. The company markets its factory-built homes under the Cavco, Fleetwood, Palm Harbor, Nationwide, Fairmont, Friendship, Chariot Eagle, Destiny, Commodore, Colony, Pennwest, R-Anell, Manorwood, MidCountry, and Solitaire brands.

Featured Stories

Before you consider Cavco Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cavco Industries wasn't on the list.

While Cavco Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.