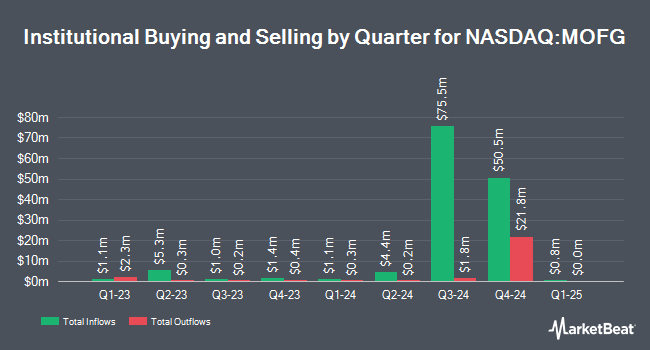

Jennison Associates LLC bought a new position in shares of MidWestOne Financial Group, Inc. (NASDAQ:MOFG - Free Report) in the third quarter, according to the company in its most recent filing with the SEC. The fund bought 777,653 shares of the financial services provider's stock, valued at approximately $22,186,000. Jennison Associates LLC owned 4.93% of MidWestOne Financial Group as of its most recent filing with the SEC.

A number of other institutional investors and hedge funds have also recently bought and sold shares of MOFG. SG Americas Securities LLC purchased a new stake in MidWestOne Financial Group during the third quarter worth approximately $163,000. Renaissance Technologies LLC purchased a new stake in MidWestOne Financial Group during the 2nd quarter worth $247,000. Hsbc Holdings PLC acquired a new stake in MidWestOne Financial Group in the 2nd quarter valued at $329,000. GSA Capital Partners LLP purchased a new position in MidWestOne Financial Group in the third quarter valued at about $361,000. Finally, Bank of Montreal Can acquired a new position in shares of MidWestOne Financial Group during the second quarter worth about $388,000. Institutional investors and hedge funds own 65.42% of the company's stock.

Wall Street Analyst Weigh In

MOFG has been the topic of several analyst reports. Piper Sandler dropped their target price on MidWestOne Financial Group from $33.00 to $31.50 and set a "neutral" rating on the stock in a report on Monday, October 28th. StockNews.com lowered shares of MidWestOne Financial Group from a "hold" rating to a "sell" rating in a research note on Monday, October 28th. Finally, Keefe, Bruyette & Woods reissued a "market perform" rating and set a $28.00 target price (up from $25.00) on shares of MidWestOne Financial Group in a research report on Monday, July 29th. One equities research analyst has rated the stock with a sell rating and three have given a hold rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $27.00.

Get Our Latest Report on MidWestOne Financial Group

Insider Transactions at MidWestOne Financial Group

In other news, Director Matthew J. Hayek purchased 2,000 shares of the stock in a transaction dated Monday, September 30th. The stock was acquired at an average cost of $25.00 per share, for a total transaction of $50,000.00. Following the acquisition, the director now owns 11,293 shares of the company's stock, valued at $282,325. The trade was a 21.52 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which is accessible through this link. Also, CEO Charles N. Reeves acquired 7,000 shares of MidWestOne Financial Group stock in a transaction that occurred on Monday, September 30th. The shares were purchased at an average price of $25.00 per share, for a total transaction of $175,000.00. Following the completion of the purchase, the chief executive officer now directly owns 45,712 shares of the company's stock, valued at $1,142,800. The trade was a 18.08 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last 90 days, insiders have purchased 9,400 shares of company stock valued at $235,000. Insiders own 2.80% of the company's stock.

MidWestOne Financial Group Stock Up 2.9 %

MOFG traded up $0.95 on Friday, reaching $33.70. The company's stock had a trading volume of 135,167 shares, compared to its average volume of 89,658. MidWestOne Financial Group, Inc. has a 1 year low of $19.43 and a 1 year high of $34.00. The business's 50 day moving average is $29.60 and its 200 day moving average is $26.24. The company has a debt-to-equity ratio of 0.20, a current ratio of 0.78 and a quick ratio of 0.77. The stock has a market cap of $699.95 million, a price-to-earnings ratio of -7.22 and a beta of 1.01.

MidWestOne Financial Group Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be paid a $0.243 dividend. The ex-dividend date of this dividend is Monday, December 2nd. This represents a $0.97 dividend on an annualized basis and a dividend yield of 2.88%. MidWestOne Financial Group's dividend payout ratio (DPR) is presently -20.77%.

About MidWestOne Financial Group

(

Free Report)

MidWestOne Financial Group, Inc operates as the bank holding company for MidWestOne Bank that provides commercial and retail banking products and services to individuals, businesses, governmental units, and institutional customers. It offers range of deposit products, including noninterest bearing and interest bearing demand deposits, savings, money market, and time deposits accounts.

See Also

Before you consider MidWestOne Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MidWestOne Financial Group wasn't on the list.

While MidWestOne Financial Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.