Edgestream Partners L.P. bought a new stake in shares of WisdomTree, Inc. (NYSE:WT - Free Report) in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund bought 78,172 shares of the company's stock, valued at approximately $781,000. Edgestream Partners L.P. owned 0.05% of WisdomTree at the end of the most recent reporting period.

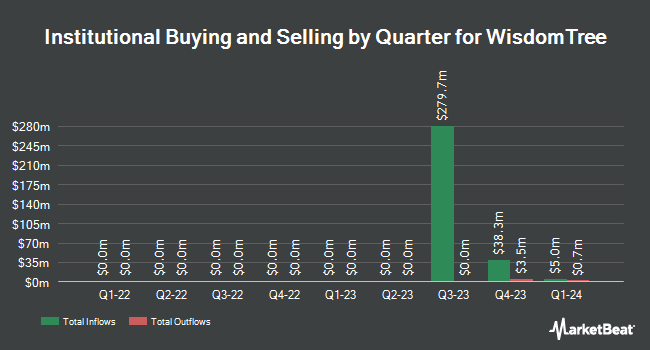

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the stock. Verition Fund Management LLC boosted its stake in shares of WisdomTree by 243.3% in the third quarter. Verition Fund Management LLC now owns 42,552 shares of the company's stock worth $425,000 after acquiring an additional 30,158 shares during the last quarter. Crawford Fund Management LLC lifted its stake in shares of WisdomTree by 34.0% in the 3rd quarter. Crawford Fund Management LLC now owns 499,874 shares of the company's stock valued at $4,994,000 after purchasing an additional 126,700 shares during the last quarter. Public Sector Pension Investment Board grew its holdings in shares of WisdomTree by 2.8% during the 3rd quarter. Public Sector Pension Investment Board now owns 252,568 shares of the company's stock worth $2,523,000 after purchasing an additional 6,900 shares during the period. Quantbot Technologies LP raised its holdings in WisdomTree by 586.0% in the 3rd quarter. Quantbot Technologies LP now owns 250,017 shares of the company's stock valued at $2,498,000 after buying an additional 213,571 shares during the period. Finally, FMR LLC lifted its position in WisdomTree by 390.7% in the third quarter. FMR LLC now owns 2,859,073 shares of the company's stock valued at $28,562,000 after buying an additional 2,276,452 shares during the last quarter. 78.64% of the stock is owned by institutional investors and hedge funds.

Insider Activity at WisdomTree

In other news, insider Peter M. Ziemba sold 100,000 shares of WisdomTree stock in a transaction dated Friday, November 15th. The shares were sold at an average price of $11.43, for a total value of $1,143,000.00. Following the sale, the insider now owns 948,386 shares of the company's stock, valued at $10,840,051.98. The trade was a 9.54 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Etfs Capital Limited. sold 3,000,000 shares of the stock in a transaction dated Monday, December 2nd. The stock was sold at an average price of $11.34, for a total transaction of $34,020,000.00. Following the transaction, the insider now directly owns 12,250,000 shares of the company's stock, valued at $138,915,000. This represents a 19.67 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 7.80% of the stock is owned by corporate insiders.

WisdomTree Stock Down 0.4 %

Shares of WT traded down $0.05 during mid-day trading on Thursday, reaching $11.45. The company's stock had a trading volume of 1,247,679 shares, compared to its average volume of 1,325,890. The company's 50 day moving average is $10.74 and its 200 day moving average is $10.29. The stock has a market cap of $1.67 billion, a PE ratio of 39.64 and a beta of 1.46. WisdomTree, Inc. has a 12-month low of $6.24 and a 12-month high of $12.45. The company has a debt-to-equity ratio of 1.36, a current ratio of 2.88 and a quick ratio of 2.16.

WisdomTree Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Wednesday, November 20th. Investors of record on Wednesday, November 6th were given a $0.03 dividend. The ex-dividend date was Wednesday, November 6th. This represents a $0.12 dividend on an annualized basis and a yield of 1.05%. WisdomTree's dividend payout ratio (DPR) is presently 41.38%.

Analysts Set New Price Targets

A number of brokerages have issued reports on WT. UBS Group boosted their target price on WisdomTree from $12.00 to $14.00 and gave the company a "buy" rating in a research report on Tuesday, October 22nd. Northcoast Research lowered shares of WisdomTree from a "strong-buy" rating to a "hold" rating in a report on Sunday, September 15th. Three equities research analysts have rated the stock with a hold rating and four have given a buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $12.25.

Get Our Latest Stock Analysis on WT

About WisdomTree

(

Free Report)

WisdomTree, Inc, through its subsidiaries, operates as an exchange-traded funds (ETFs) sponsor and asset manager. It offers ETFs in equities, currency, fixed income, and alternatives asset classes. The company also licenses its indexes to third parties for proprietary products, as well as offers a platform to promote the use of WisdomTree ETFs in 401(k) plans.

Recommended Stories

Before you consider WisdomTree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WisdomTree wasn't on the list.

While WisdomTree currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.