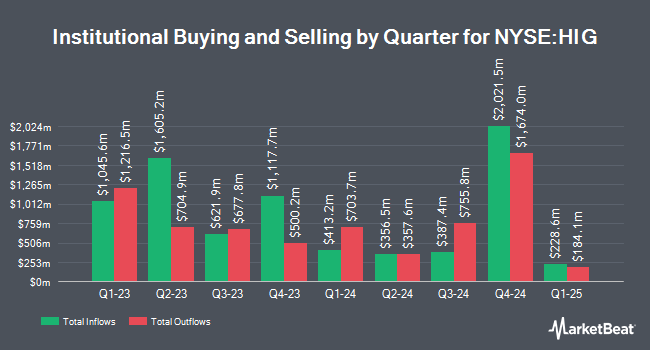

SVB Wealth LLC bought a new position in shares of The Hartford Financial Services Group, Inc. (NYSE:HIG - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund bought 7,822 shares of the insurance provider's stock, valued at approximately $856,000.

A number of other institutional investors and hedge funds have also modified their holdings of the stock. Farther Finance Advisors LLC lifted its holdings in shares of The Hartford Financial Services Group by 63.0% in the 3rd quarter. Farther Finance Advisors LLC now owns 4,746 shares of the insurance provider's stock worth $558,000 after acquiring an additional 1,834 shares during the last quarter. Harbor Capital Advisors Inc. increased its position in shares of The Hartford Financial Services Group by 9.4% in the 3rd quarter. Harbor Capital Advisors Inc. now owns 6,437 shares of the insurance provider's stock valued at $757,000 after purchasing an additional 554 shares during the last quarter. Robeco Institutional Asset Management B.V. increased its position in shares of The Hartford Financial Services Group by 22.7% in the 3rd quarter. Robeco Institutional Asset Management B.V. now owns 1,199,542 shares of the insurance provider's stock valued at $141,078,000 after purchasing an additional 221,778 shares during the last quarter. Intact Investment Management Inc. purchased a new stake in shares of The Hartford Financial Services Group in the 3rd quarter valued at approximately $74,000. Finally, National Pension Service grew its position in shares of The Hartford Financial Services Group by 10.3% in the 3rd quarter. National Pension Service now owns 489,877 shares of the insurance provider's stock valued at $57,614,000 after buying an additional 45,835 shares during the last quarter. Hedge funds and other institutional investors own 93.42% of the company's stock.

The Hartford Financial Services Group Price Performance

Shares of The Hartford Financial Services Group stock traded down $2.63 during trading on Tuesday, reaching $117.14. The company's stock had a trading volume of 2,332,661 shares, compared to its average volume of 1,768,343. The stock has a market capitalization of $33.43 billion, a P/E ratio of 11.32, a price-to-earnings-growth ratio of 1.12 and a beta of 0.97. The Hartford Financial Services Group, Inc. has a one year low of $94.47 and a one year high of $124.90. The company has a current ratio of 0.32, a quick ratio of 0.32 and a debt-to-equity ratio of 0.27. The stock has a 50-day moving average price of $111.92 and a two-hundred day moving average price of $114.58.

The Hartford Financial Services Group (NYSE:HIG - Get Free Report) last issued its quarterly earnings data on Thursday, January 30th. The insurance provider reported $2.94 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.68 by $0.26. The Hartford Financial Services Group had a return on equity of 19.55% and a net margin of 11.72%. As a group, sell-side analysts anticipate that The Hartford Financial Services Group, Inc. will post 11.11 EPS for the current fiscal year.

The Hartford Financial Services Group Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, April 2nd. Investors of record on Monday, March 3rd will be paid a $0.52 dividend. This represents a $2.08 dividend on an annualized basis and a yield of 1.78%. The ex-dividend date of this dividend is Monday, March 3rd. The Hartford Financial Services Group's dividend payout ratio (DPR) is presently 20.10%.

Wall Street Analyst Weigh In

A number of analysts recently weighed in on HIG shares. StockNews.com cut shares of The Hartford Financial Services Group from a "buy" rating to a "hold" rating in a research note on Tuesday, February 25th. Barclays upgraded shares of The Hartford Financial Services Group from an "equal weight" rating to an "overweight" rating and raised their price objective for the company from $130.00 to $135.00 in a research note on Monday, January 6th. Royal Bank of Canada restated a "sector perform" rating and set a $125.00 target price on shares of The Hartford Financial Services Group in a report on Monday, February 3rd. Keefe, Bruyette & Woods raised their target price on shares of The Hartford Financial Services Group from $139.00 to $140.00 and gave the company an "outperform" rating in a report on Wednesday, February 5th. Finally, Piper Sandler lifted their price target on shares of The Hartford Financial Services Group from $127.00 to $130.00 and gave the stock an "overweight" rating in a report on Monday, February 3rd. Ten research analysts have rated the stock with a hold rating, eight have issued a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $122.94.

Get Our Latest Stock Report on HIG

The Hartford Financial Services Group Company Profile

(

Free Report)

The Hartford Financial Services Group, Inc, together with its subsidiaries, provides insurance and financial services to individual and business customers in the United States, the United Kingdom, and internationally. Its Commercial Lines segment offers insurance coverages, including workers' compensation, property, automobile, general and professional liability, package business, umbrella, fidelity and surety, marine, livestock, accident, health, and reinsurance through regional offices, branches, sales and policyholder service centers, independent retail agents and brokers, wholesale agents, and reinsurance brokers.

Featured Stories

Before you consider The Hartford Financial Services Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hartford Financial Services Group wasn't on the list.

While The Hartford Financial Services Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.