HighTower Advisors LLC acquired a new position in shares of Powell Industries, Inc. (NASDAQ:POWL - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund acquired 8,146 shares of the industrial products company's stock, valued at approximately $1,805,000. HighTower Advisors LLC owned 0.07% of Powell Industries as of its most recent filing with the Securities and Exchange Commission.

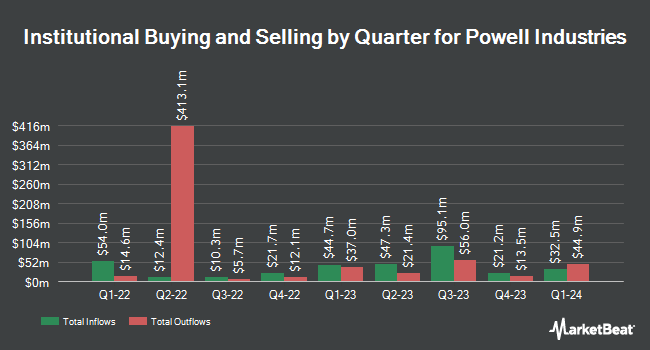

Several other institutional investors and hedge funds also recently made changes to their positions in POWL. Raymond James & Associates increased its holdings in shares of Powell Industries by 39.3% during the 2nd quarter. Raymond James & Associates now owns 17,891 shares of the industrial products company's stock worth $2,566,000 after purchasing an additional 5,052 shares during the period. Carnegie Investment Counsel increased its stake in Powell Industries by 21.0% in the second quarter. Carnegie Investment Counsel now owns 12,929 shares of the industrial products company's stock valued at $1,854,000 after acquiring an additional 2,247 shares during the period. Bank of New York Mellon Corp increased its stake in Powell Industries by 1.0% in the second quarter. Bank of New York Mellon Corp now owns 99,517 shares of the industrial products company's stock valued at $14,271,000 after acquiring an additional 1,015 shares during the period. Cambridge Investment Research Advisors Inc. increased its stake in Powell Industries by 77.8% in the second quarter. Cambridge Investment Research Advisors Inc. now owns 11,888 shares of the industrial products company's stock valued at $1,705,000 after acquiring an additional 5,201 shares during the period. Finally, Zurcher Kantonalbank Zurich Cantonalbank increased its stake in Powell Industries by 42.0% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 2,344 shares of the industrial products company's stock valued at $336,000 after acquiring an additional 693 shares during the period. Institutional investors own 89.77% of the company's stock.

Powell Industries Stock Performance

Powell Industries stock traded down $3.76 during mid-day trading on Friday, reaching $252.00. The company's stock had a trading volume of 388,884 shares, compared to its average volume of 386,178. The business's 50 day simple moving average is $277.93 and its 200 day simple moving average is $205.54. The company has a market capitalization of $3.03 billion, a price-to-earnings ratio of 20.50, a price-to-earnings-growth ratio of 1.37 and a beta of 0.85. Powell Industries, Inc. has a 12 month low of $76.29 and a 12 month high of $364.98.

Powell Industries Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Wednesday, November 20th will be given a $0.265 dividend. This represents a $1.06 annualized dividend and a dividend yield of 0.42%. The ex-dividend date of this dividend is Wednesday, November 20th. Powell Industries's payout ratio is presently 8.62%.

Insider Activity

In related news, major shareholder Thomas W. Powell sold 25,000 shares of the company's stock in a transaction that occurred on Wednesday, September 25th. The shares were sold at an average price of $213.56, for a total transaction of $5,339,000.00. Following the completion of the transaction, the insider now directly owns 682,265 shares in the company, valued at $145,704,513.40. This represents a 3.53 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. In the last ninety days, insiders sold 60,000 shares of company stock worth $14,679,842. 2.20% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of research firms recently weighed in on POWL. Roth Capital raised shares of Powell Industries to a "strong-buy" rating in a research note on Tuesday, December 10th. StockNews.com raised shares of Powell Industries from a "hold" rating to a "buy" rating in a research note on Tuesday, December 10th. Finally, Roth Mkm assumed coverage on shares of Powell Industries in a research note on Wednesday. They issued a "buy" rating and a $312.00 target price on the stock.

Get Our Latest Stock Analysis on Powell Industries

About Powell Industries

(

Free Report)

Powell Industries, Inc, together with its subsidiaries, designs, develops, manufactures, sells, and services custom-engineered equipment and systems. The company's principal products include integrated power control room substations, custom-engineered modules, electrical houses, medium-voltage circuit breakers, monitoring and control communications systems, motor control centers, switches, and bus duct systems, as well as traditional and arc-resistant distribution switchgears and control gears.

Read More

Before you consider Powell Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Powell Industries wasn't on the list.

While Powell Industries currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.