Holocene Advisors LP bought a new position in shares of Yelp Inc. (NYSE:YELP - Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund bought 81,510 shares of the local business review company's stock, valued at approximately $2,859,000. Holocene Advisors LP owned approximately 0.12% of Yelp as of its most recent SEC filing.

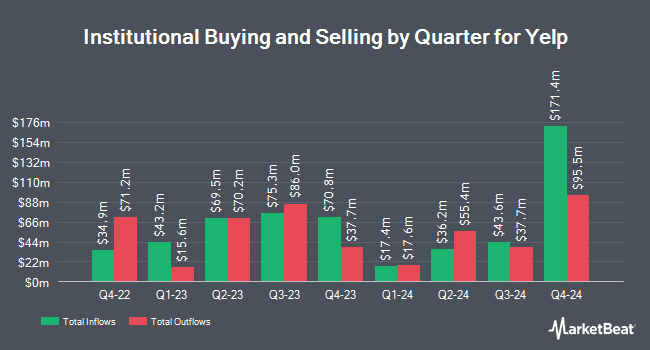

A number of other institutional investors and hedge funds have also modified their holdings of YELP. DekaBank Deutsche Girozentrale boosted its holdings in Yelp by 424.2% in the 1st quarter. DekaBank Deutsche Girozentrale now owns 17,080 shares of the local business review company's stock worth $661,000 after buying an additional 13,822 shares during the last quarter. CWM LLC increased its position in shares of Yelp by 24.7% during the second quarter. CWM LLC now owns 1,903 shares of the local business review company's stock worth $70,000 after purchasing an additional 377 shares in the last quarter. Blue Trust Inc. increased its position in shares of Yelp by 148.0% during the second quarter. Blue Trust Inc. now owns 2,921 shares of the local business review company's stock worth $115,000 after purchasing an additional 1,743 shares in the last quarter. Hennion & Walsh Asset Management Inc. acquired a new position in Yelp in the 2nd quarter valued at $266,000. Finally, Summit Global Investments grew its holdings in shares of Yelp by 26.6% during the second quarter. Summit Global Investments now owns 17,074 shares of the local business review company's stock worth $631,000 after buying an additional 3,583 shares in the last quarter. Hedge funds and other institutional investors own 90.11% of the company's stock.

Yelp Stock Up 1.5 %

NYSE YELP traded up $0.56 during trading on Friday, hitting $38.80. The stock had a trading volume of 360,916 shares, compared to its average volume of 725,667. The company has a market capitalization of $2.55 billion, a PE ratio of 22.89, a PEG ratio of 0.69 and a beta of 1.35. The firm has a 50 day moving average price of $35.53 and a 200 day moving average price of $35.47. Yelp Inc. has a twelve month low of $32.56 and a twelve month high of $48.99.

Insider Activity

In related news, insider Carmen Amara sold 12,854 shares of Yelp stock in a transaction on Tuesday, November 12th. The stock was sold at an average price of $38.17, for a total value of $490,637.18. Following the completion of the transaction, the insider now directly owns 88,813 shares in the company, valued at approximately $3,389,992.21. This trade represents a 12.64 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, COO Joseph R. Nachman sold 7,000 shares of Yelp stock in a transaction dated Friday, October 4th. The shares were sold at an average price of $34.02, for a total value of $238,140.00. Following the completion of the transaction, the chief operating officer now owns 255,558 shares of the company's stock, valued at $8,694,083.16. The trade was a 2.67 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 41,865 shares of company stock valued at $1,537,218. 7.40% of the stock is currently owned by company insiders.

Analyst Ratings Changes

Several brokerages recently issued reports on YELP. The Goldman Sachs Group cut shares of Yelp from a "buy" rating to a "neutral" rating and dropped their price objective for the company from $46.00 to $38.00 in a research note on Monday, October 14th. Robert W. Baird cut their price objective on shares of Yelp from $39.00 to $37.00 and set a "neutral" rating for the company in a research report on Friday, November 8th. Evercore ISI raised Yelp to a "hold" rating in a research note on Monday, November 11th. Bank of America began coverage on Yelp in a research report on Monday, September 16th. They set an "underperform" rating and a $30.00 price objective for the company. Finally, JPMorgan Chase & Co. decreased their target price on shares of Yelp from $38.00 to $35.00 and set a "neutral" rating on the stock in a research report on Monday, August 12th. Two analysts have rated the stock with a sell rating, six have given a hold rating, one has issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company has an average rating of "Hold" and an average price target of $37.00.

Check Out Our Latest Stock Report on Yelp

Yelp Profile

(

Free Report)

Yelp Inc operates a platform that connects consumers with local businesses in the United States and internationally. The company's platform covers various categories, including restaurants, shopping, beauty and fitness, health, and other categories, as well as home, local, auto, professional, pets, events, real estate, and financial services.

See Also

Before you consider Yelp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yelp wasn't on the list.

While Yelp currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.