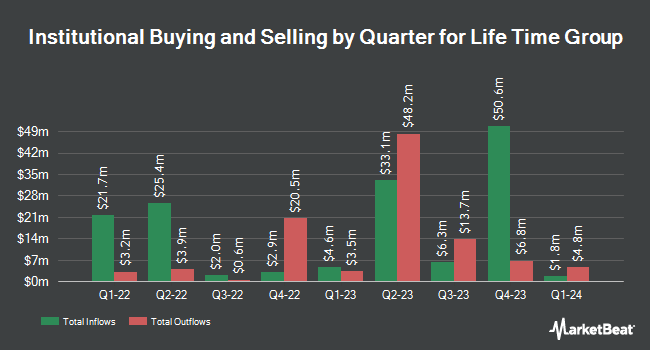

Royce & Associates LP acquired a new stake in Life Time Group Holdings, Inc. (NYSE:LTH - Free Report) during the third quarter, according to its most recent disclosure with the SEC. The institutional investor acquired 82,000 shares of the company's stock, valued at approximately $2,002,000.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Farther Finance Advisors LLC increased its holdings in shares of Life Time Group by 105.8% during the third quarter. Farther Finance Advisors LLC now owns 1,762 shares of the company's stock worth $43,000 after purchasing an additional 906 shares during the period. Amalgamated Bank increased its stake in Life Time Group by 38.2% during the 2nd quarter. Amalgamated Bank now owns 2,036 shares of the company's stock worth $38,000 after acquiring an additional 563 shares during the period. Blue Trust Inc. increased its stake in Life Time Group by 345.5% during the 3rd quarter. Blue Trust Inc. now owns 2,940 shares of the company's stock worth $72,000 after acquiring an additional 2,280 shares during the period. Dnca Finance bought a new stake in shares of Life Time Group during the 2nd quarter valued at $72,000. Finally, SG Americas Securities LLC bought a new stake in shares of Life Time Group during the 2nd quarter valued at $141,000. 79.40% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

LTH has been the topic of several analyst reports. Wells Fargo & Company increased their price target on shares of Life Time Group from $21.00 to $25.00 and gave the stock an "equal weight" rating in a research report on Wednesday, October 16th. Northland Securities boosted their price target on Life Time Group from $28.50 to $29.00 and gave the stock an "outperform" rating in a report on Friday, October 25th. Bank of America boosted their price objective on shares of Life Time Group from $29.00 to $30.00 and gave the stock a "buy" rating in a research note on Friday, September 6th. The Goldman Sachs Group raised their target price on Life Time Group from $15.00 to $22.00 and gave the stock a "neutral" rating in a research report on Friday, August 2nd. Finally, Morgan Stanley upped their price target on Life Time Group from $21.00 to $29.00 and gave the company an "equal weight" rating in a research report on Wednesday, October 16th. Three research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $27.63.

Read Our Latest Stock Report on Life Time Group

Insider Buying and Selling

In related news, CFO Erik Weaver sold 4,662 shares of the company's stock in a transaction that occurred on Tuesday, October 15th. The stock was sold at an average price of $25.88, for a total transaction of $120,652.56. Following the transaction, the chief financial officer now directly owns 75,866 shares of the company's stock, valued at approximately $1,963,412.08. This represents a 5.79 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 12.50% of the stock is owned by insiders.

Life Time Group Trading Down 1.8 %

LTH traded down $0.45 during trading on Wednesday, reaching $24.12. 274,665 shares of the stock traded hands, compared to its average volume of 1,110,627. The company has a quick ratio of 0.46, a current ratio of 0.59 and a debt-to-equity ratio of 0.64. The stock's 50-day moving average is $24.43 and its 200 day moving average is $21.33. Life Time Group Holdings, Inc. has a 12 month low of $11.89 and a 12 month high of $27.11. The stock has a market capitalization of $4.99 billion, a PE ratio of 35.61, a P/E/G ratio of 1.52 and a beta of 1.89.

Life Time Group (NYSE:LTH - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The company reported $0.19 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.20 by ($0.01). Life Time Group had a net margin of 5.67% and a return on equity of 6.42%. The business had revenue of $693.20 million during the quarter, compared to analyst estimates of $684.13 million. During the same period in the prior year, the firm earned $0.09 earnings per share. The firm's revenue for the quarter was up 18.5% compared to the same quarter last year. Equities analysts anticipate that Life Time Group Holdings, Inc. will post 0.56 earnings per share for the current year.

About Life Time Group

(

Free Report)

Life Time Group Holdings, Inc provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada. It primarily engages in designing, building, and operating of sports and athletic, professional fitness, family recreation, and spa centers in a resort-like environment, principally in suburban and urban locations of metropolitan areas.

Featured Stories

Before you consider Life Time Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Life Time Group wasn't on the list.

While Life Time Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.