Chartwell Investment Partners LLC bought a new position in shares of Wingstop Inc. (NASDAQ:WING - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund bought 8,772 shares of the restaurant operator's stock, valued at approximately $3,650,000.

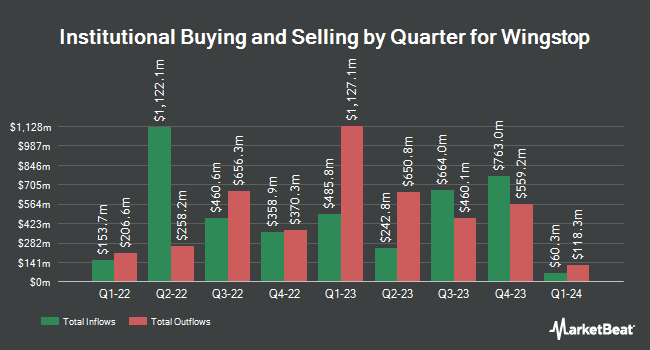

A number of other hedge funds and other institutional investors have also made changes to their positions in the business. Vanguard Group Inc. lifted its stake in Wingstop by 3.7% in the first quarter. Vanguard Group Inc. now owns 2,924,326 shares of the restaurant operator's stock valued at $1,071,473,000 after buying an additional 104,780 shares during the period. Price T Rowe Associates Inc. MD boosted its position in shares of Wingstop by 4.7% during the first quarter. Price T Rowe Associates Inc. MD now owns 2,273,542 shares of the restaurant operator's stock valued at $833,026,000 after buying an additional 101,917 shares during the last quarter. Renaissance Technologies LLC grew its holdings in Wingstop by 36.6% during the second quarter. Renaissance Technologies LLC now owns 602,990 shares of the restaurant operator's stock valued at $254,860,000 after purchasing an additional 161,600 shares during the period. Massachusetts Financial Services Co. MA boosted its holdings in Wingstop by 2.8% in the 2nd quarter. Massachusetts Financial Services Co. MA now owns 600,905 shares of the restaurant operator's stock valued at $253,979,000 after purchasing an additional 16,526 shares during the period. Finally, Millennium Management LLC grew its holdings in Wingstop by 284.1% in the second quarter. Millennium Management LLC now owns 383,184 shares of the restaurant operator's stock worth $161,957,000 after purchasing an additional 283,412 shares during the period.

Wall Street Analyst Weigh In

WING has been the topic of a number of research analyst reports. BTIG Research upgraded shares of Wingstop from a "neutral" rating to a "buy" rating and set a $370.00 target price on the stock in a research note on Thursday, October 31st. The Goldman Sachs Group upgraded shares of Wingstop from a "neutral" rating to a "buy" rating and reduced their price target for the company from $458.00 to $377.00 in a research report on Friday. Truist Financial lifted their target price on Wingstop from $407.00 to $423.00 and gave the stock a "hold" rating in a research report on Thursday, August 1st. Morgan Stanley upped their price target on Wingstop from $390.00 to $400.00 and gave the company an "equal weight" rating in a report on Tuesday, July 16th. Finally, Benchmark raised shares of Wingstop from a "hold" rating to a "buy" rating and set a $340.00 price target on the stock in a report on Thursday, October 31st. Six analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Wingstop currently has a consensus rating of "Moderate Buy" and a consensus price target of $368.74.

Read Our Latest Stock Report on Wingstop

Wingstop Stock Down 1.5 %

WING stock traded down $5.13 during trading on Tuesday, hitting $338.38. 587,981 shares of the company's stock traded hands, compared to its average volume of 461,977. The stock has a market capitalization of $9.88 billion, a price-to-earnings ratio of 100.15, a price-to-earnings-growth ratio of 3.17 and a beta of 1.76. The stock has a fifty day moving average price of $379.68 and a two-hundred day moving average price of $385.91. Wingstop Inc. has a 52 week low of $210.94 and a 52 week high of $433.86.

Wingstop (NASDAQ:WING - Get Free Report) last issued its earnings results on Wednesday, October 30th. The restaurant operator reported $0.88 EPS for the quarter, missing analysts' consensus estimates of $0.97 by ($0.09). The firm had revenue of $162.50 million during the quarter, compared to analyst estimates of $160.24 million. Wingstop had a net margin of 17.05% and a negative return on equity of 22.69%. The business's revenue for the quarter was up 38.8% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.69 earnings per share. As a group, equities research analysts expect that Wingstop Inc. will post 3.68 EPS for the current fiscal year.

Wingstop Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, December 6th. Investors of record on Friday, November 15th will be issued a $0.27 dividend. This represents a $1.08 annualized dividend and a yield of 0.32%. The ex-dividend date of this dividend is Friday, November 15th. Wingstop's payout ratio is presently 31.49%.

About Wingstop

(

Free Report)

Wingstop Inc, together with its subsidiaries, franchises and operates restaurants under the Wingstop brand. Its restaurants offer classic wings, boneless wings, tenders, and hand-sauced-and-tossed in various flavors, as well as chicken sandwiches with fries and hand-cut carrots and celery that are cooked-to-order.

See Also

Before you consider Wingstop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wingstop wasn't on the list.

While Wingstop currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.