Holocene Advisors LP bought a new stake in shares of TopBuild Corp. (NYSE:BLD - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund bought 8,850 shares of the construction company's stock, valued at approximately $3,600,000.

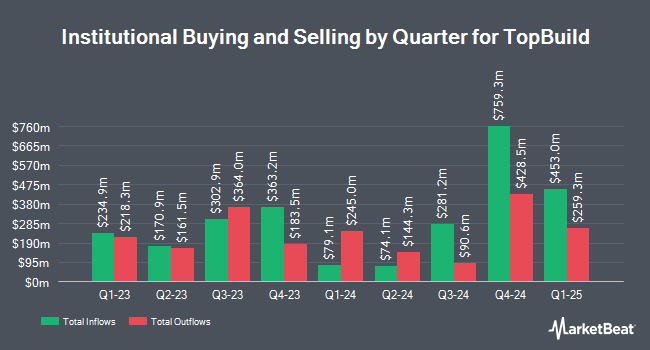

Several other hedge funds also recently modified their holdings of the stock. Assenagon Asset Management S.A. lifted its position in shares of TopBuild by 0.4% during the 2nd quarter. Assenagon Asset Management S.A. now owns 6,176 shares of the construction company's stock worth $2,379,000 after buying an additional 23 shares in the last quarter. Andina Capital Management LLC increased its position in shares of TopBuild by 3.2% during the second quarter. Andina Capital Management LLC now owns 870 shares of the construction company's stock valued at $335,000 after acquiring an additional 27 shares during the last quarter. CIBC Asset Management Inc lifted its holdings in TopBuild by 3.5% during the second quarter. CIBC Asset Management Inc now owns 887 shares of the construction company's stock worth $342,000 after acquiring an additional 30 shares during the period. Fifth Third Bancorp boosted its position in TopBuild by 10.3% in the second quarter. Fifth Third Bancorp now owns 332 shares of the construction company's stock worth $128,000 after purchasing an additional 31 shares during the last quarter. Finally, Hanseatic Management Services Inc. grew its stake in TopBuild by 1.7% in the 2nd quarter. Hanseatic Management Services Inc. now owns 1,847 shares of the construction company's stock valued at $712,000 after purchasing an additional 31 shares during the period. Hedge funds and other institutional investors own 95.67% of the company's stock.

TopBuild Stock Performance

TopBuild stock traded up $1.82 during mid-day trading on Friday, reaching $375.93. The company's stock had a trading volume of 234,234 shares, compared to its average volume of 287,878. The company has a market capitalization of $11.09 billion, a P/E ratio of 18.88, a PEG ratio of 2.47 and a beta of 1.79. The firm's fifty day moving average price is $379.90 and its two-hundred day moving average price is $394.83. TopBuild Corp. has a 12-month low of $314.52 and a 12-month high of $495.68. The company has a debt-to-equity ratio of 0.64, a quick ratio of 1.49 and a current ratio of 2.01.

TopBuild (NYSE:BLD - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The construction company reported $5.68 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $5.62 by $0.06. TopBuild had a return on equity of 26.40% and a net margin of 11.66%. The company had revenue of $1.37 billion for the quarter, compared to analyst estimates of $1.39 billion. During the same period in the previous year, the company posted $5.43 EPS. The firm's revenue for the quarter was up 3.6% compared to the same quarter last year. Sell-side analysts predict that TopBuild Corp. will post 20.99 EPS for the current fiscal year.

Wall Street Analyst Weigh In

A number of research firms have recently commented on BLD. Stephens lowered their target price on TopBuild from $435.00 to $400.00 and set an "equal weight" rating on the stock in a research note on Thursday, August 8th. Evercore ISI lowered their price objective on shares of TopBuild from $491.00 to $443.00 and set an "outperform" rating on the stock in a research report on Wednesday, November 6th. DA Davidson reduced their target price on shares of TopBuild from $460.00 to $450.00 and set a "buy" rating for the company in a research report on Thursday, November 7th. StockNews.com raised shares of TopBuild from a "hold" rating to a "buy" rating in a report on Tuesday, October 29th. Finally, Jefferies Financial Group dropped their price objective on TopBuild from $525.00 to $515.00 and set a "buy" rating on the stock in a research note on Wednesday, October 9th. Two research analysts have rated the stock with a hold rating and nine have issued a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $440.44.

Get Our Latest Stock Analysis on TopBuild

TopBuild Profile

(

Free Report)

TopBuild Corp., together with its subsidiaries, engages in the installation and distribution of insulation and other building material products to the construction industry. The company operates in two segments, Installation and Specialty Distribution. It provides insulation products and accessories, glass and windows, rain gutters, garage doors, fireplaces, roofing materials, closet shelving, and other products.

Featured Stories

Before you consider TopBuild, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TopBuild wasn't on the list.

While TopBuild currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.