Pekin Hardy Strauss Inc. bought a new position in shares of Pitney Bowes Inc. (NYSE:PBI - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm bought 89,250 shares of the technology company's stock, valued at approximately $636,000.

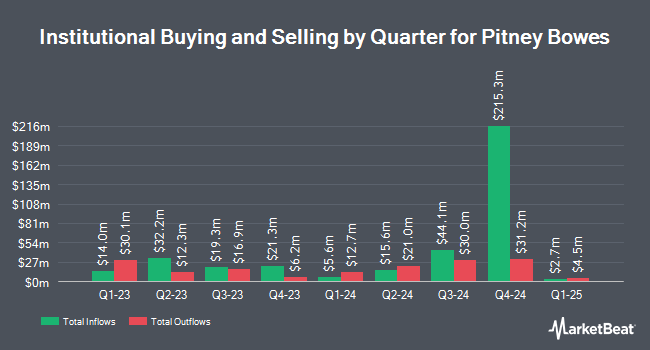

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the business. Cutter & CO Brokerage Inc. lifted its stake in Pitney Bowes by 6.7% in the 2nd quarter. Cutter & CO Brokerage Inc. now owns 31,933 shares of the technology company's stock worth $162,000 after purchasing an additional 2,000 shares in the last quarter. Envestnet Portfolio Solutions Inc. lifted its position in shares of Pitney Bowes by 15.6% in the second quarter. Envestnet Portfolio Solutions Inc. now owns 15,189 shares of the technology company's stock worth $77,000 after buying an additional 2,054 shares in the last quarter. Louisiana State Employees Retirement System boosted its stake in Pitney Bowes by 3.0% during the second quarter. Louisiana State Employees Retirement System now owns 78,300 shares of the technology company's stock valued at $398,000 after buying an additional 2,300 shares during the last quarter. ProShare Advisors LLC grew its holdings in Pitney Bowes by 7.5% during the 1st quarter. ProShare Advisors LLC now owns 34,900 shares of the technology company's stock valued at $151,000 after buying an additional 2,440 shares in the last quarter. Finally, Federated Hermes Inc. increased its stake in Pitney Bowes by 6.8% in the 2nd quarter. Federated Hermes Inc. now owns 79,420 shares of the technology company's stock worth $403,000 after acquiring an additional 5,073 shares during the last quarter. Institutional investors own 67.88% of the company's stock.

Pitney Bowes Stock Performance

Shares of NYSE:PBI traded up $0.10 on Monday, reaching $8.16. The company's stock had a trading volume of 2,117,605 shares, compared to its average volume of 1,759,708. The company has a 50-day simple moving average of $7.21 and a 200 day simple moving average of $6.47. Pitney Bowes Inc. has a 52-week low of $3.68 and a 52-week high of $8.80. The company has a market cap of $1.48 billion, a P/E ratio of -3.74, a PEG ratio of 1.41 and a beta of 1.97.

Pitney Bowes (NYSE:PBI - Get Free Report) last released its quarterly earnings results on Friday, November 8th. The technology company reported $0.21 EPS for the quarter, topping the consensus estimate of $0.13 by $0.08. Pitney Bowes had a negative return on equity of 12.85% and a negative net margin of 13.02%. The company had revenue of $499.46 million during the quarter, compared to analyst estimates of $467.80 million. On average, equities research analysts forecast that Pitney Bowes Inc. will post 0.38 EPS for the current fiscal year.

Pitney Bowes Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, December 6th. Stockholders of record on Monday, November 18th will be given a dividend of $0.05 per share. This represents a $0.20 annualized dividend and a dividend yield of 2.45%. The ex-dividend date is Monday, November 18th. Pitney Bowes's dividend payout ratio is currently -9.17%.

Wall Street Analyst Weigh In

Separately, StockNews.com downgraded Pitney Bowes from a "strong-buy" rating to a "buy" rating in a research report on Wednesday, August 21st.

Check Out Our Latest Report on PBI

Insider Activity at Pitney Bowes

In other news, Director Paul J. Evans purchased 29,000 shares of the company's stock in a transaction that occurred on Wednesday, November 20th. The stock was purchased at an average cost of $7.80 per share, with a total value of $226,200.00. Following the purchase, the director now owns 29,000 shares in the company, valued at approximately $226,200. This trade represents a ∞ increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. 14.30% of the stock is currently owned by insiders.

About Pitney Bowes

(

Free Report)

Pitney Bowes Inc, a shipping and mailing company, provides technology, logistics, and financial services to small and medium-sized businesses, large enterprises, retailers, and government clients in the United States and internationally. It operates through Global Ecommerce, Presort Services, and SendTech Solutions segments.

Further Reading

Before you consider Pitney Bowes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pitney Bowes wasn't on the list.

While Pitney Bowes currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.