89bio (NASDAQ:ETNB - Get Free Report) was upgraded by analysts at Raymond James to a "strong-buy" rating in a research report issued on Thursday,Zacks.com reports.

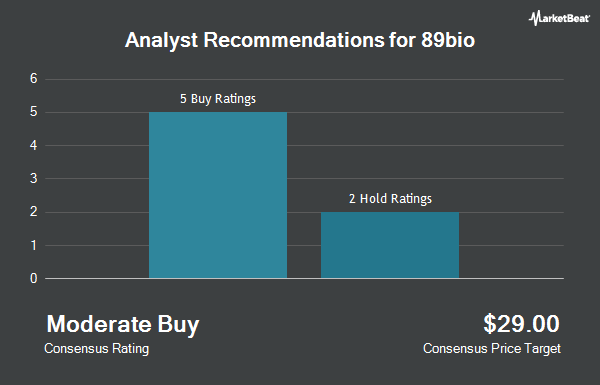

ETNB has been the subject of several other research reports. Cantor Fitzgerald restated an "overweight" rating and issued a $29.00 target price on shares of 89bio in a research note on Friday, September 20th. HC Wainwright restated a "buy" rating and issued a $29.00 price objective on shares of 89bio in a research report on Monday, November 11th. Two analysts have rated the stock with a hold rating, four have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $30.33.

View Our Latest Analysis on 89bio

89bio Stock Performance

ETNB traded down $0.16 during trading hours on Thursday, hitting $7.69. The stock had a trading volume of 1,072,927 shares, compared to its average volume of 948,553. The stock has a market cap of $816.11 million, a PE ratio of -2.64 and a beta of 1.12. 89bio has a 1 year low of $7.00 and a 1 year high of $16.63. The company has a quick ratio of 11.66, a current ratio of 11.66 and a debt-to-equity ratio of 0.09. The company's fifty day simple moving average is $8.42 and its 200 day simple moving average is $8.36.

Insider Transactions at 89bio

In other 89bio news, Director Charles Mcwherter bought 10,000 shares of the firm's stock in a transaction that occurred on Thursday, December 5th. The shares were bought at an average price of $8.00 per share, for a total transaction of $80,000.00. Following the transaction, the director now directly owns 10,000 shares in the company, valued at $80,000. This trade represents a ∞ increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Rohan Palekar purchased 5,000 shares of the business's stock in a transaction on Friday, December 6th. The shares were acquired at an average price of $7.89 per share, with a total value of $39,450.00. Following the completion of the transaction, the chief executive officer now owns 471,236 shares of the company's stock, valued at approximately $3,718,052.04. This trade represents a 1.07 % increase in their ownership of the stock. The disclosure for this purchase can be found here. In the last three months, insiders bought 25,000 shares of company stock worth $202,950. 2.80% of the stock is currently owned by corporate insiders.

Institutional Trading of 89bio

Institutional investors have recently made changes to their positions in the stock. Quest Partners LLC raised its position in 89bio by 226.2% during the 2nd quarter. Quest Partners LLC now owns 8,113 shares of the company's stock valued at $65,000 after purchasing an additional 5,626 shares during the last quarter. Northwestern Mutual Wealth Management Co. bought a new position in shares of 89bio during the second quarter valued at approximately $66,000. China Universal Asset Management Co. Ltd. lifted its stake in 89bio by 76.2% in the third quarter. China Universal Asset Management Co. Ltd. now owns 20,370 shares of the company's stock worth $151,000 after acquiring an additional 8,810 shares during the period. Intech Investment Management LLC bought a new stake in 89bio in the third quarter valued at $160,000. Finally, SG Americas Securities LLC purchased a new position in 89bio during the 2nd quarter valued at $203,000.

89bio Company Profile

(

Get Free Report)

89bio, Inc, a clinical-stage biopharmaceutical company, focuses on the development and commercialization of therapies for the treatment of liver and cardio-metabolic diseases. Its lead product candidate is pegozafermin, a glycoPEGylated analog of fibroblast growth factor 21 for the treatment of nonalcoholic steatohepatitis; and for the treatment of severe hypertriglyceridemia.

Read More

Before you consider 89bio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 89bio wasn't on the list.

While 89bio currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.