Charles Schwab Investment Management Inc. bought a new stake in Ryanair Holdings plc (NASDAQ:RYAAY - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 90,015 shares of the transportation company's stock, valued at approximately $4,067,000.

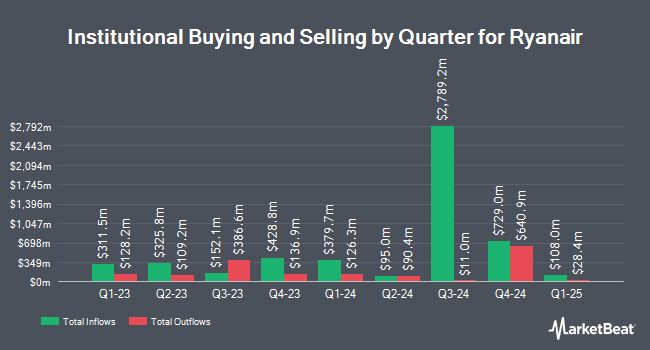

Several other large investors also recently bought and sold shares of the business. Mackenzie Financial Corp raised its holdings in Ryanair by 826.7% during the 2nd quarter. Mackenzie Financial Corp now owns 621,773 shares of the transportation company's stock valued at $72,399,000 after buying an additional 554,680 shares during the period. Scientech Research LLC raised its stake in shares of Ryanair by 306.5% in the second quarter. Scientech Research LLC now owns 7,260 shares of the transportation company's stock valued at $845,000 after acquiring an additional 5,474 shares during the period. Janney Montgomery Scott LLC boosted its stake in shares of Ryanair by 149.1% during the 3rd quarter. Janney Montgomery Scott LLC now owns 19,055 shares of the transportation company's stock worth $861,000 after purchasing an additional 11,404 shares during the period. Natixis Advisors LLC boosted its stake in shares of Ryanair by 12.4% during the 3rd quarter. Natixis Advisors LLC now owns 393,030 shares of the transportation company's stock worth $17,757,000 after purchasing an additional 43,449 shares during the period. Finally, Primecap Management Co. CA grew its holdings in Ryanair by 148.5% during the 3rd quarter. Primecap Management Co. CA now owns 1,068,250 shares of the transportation company's stock valued at $48,264,000 after purchasing an additional 638,350 shares during the last quarter. Institutional investors own 43.66% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have recently commented on the company. UBS Group raised Ryanair from a "hold" rating to a "strong-buy" rating in a research note on Monday, November 11th. Barclays raised shares of Ryanair from an "equal weight" rating to an "overweight" rating in a research note on Friday, October 25th. Sanford C. Bernstein reduced their price target on shares of Ryanair from $149.00 to $147.00 and set an "outperform" rating on the stock in a research note on Thursday, August 29th. Finally, StockNews.com raised shares of Ryanair from a "hold" rating to a "buy" rating in a research report on Thursday, November 14th. Four analysts have rated the stock with a hold rating, three have assigned a buy rating and four have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Buy" and an average target price of $154.67.

Check Out Our Latest Stock Analysis on RYAAY

Ryanair Stock Down 0.3 %

Shares of RYAAY traded down $0.12 during mid-day trading on Friday, hitting $45.45. 1,170,889 shares of the company traded hands, compared to its average volume of 1,579,335. The company has a market capitalization of $24.73 billion, a PE ratio of 15.15, a price-to-earnings-growth ratio of 2.65 and a beta of 1.51. The company has a quick ratio of 0.81, a current ratio of 0.81 and a debt-to-equity ratio of 0.22. The business has a 50 day moving average of $44.80 and a 200 day moving average of $86.02. Ryanair Holdings plc has a 1-year low of $36.96 and a 1-year high of $60.29.

Ryanair (NASDAQ:RYAAY - Get Free Report) last issued its earnings results on Monday, November 4th. The transportation company reported $2.82 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $2.91 by ($0.09). The firm had revenue of $5.57 billion during the quarter, compared to analysts' expectations of $5.59 billion. Ryanair had a return on equity of 19.92% and a net margin of 11.38%. During the same quarter last year, the business earned $2.88 EPS. Equities research analysts anticipate that Ryanair Holdings plc will post 2.97 EPS for the current year.

Ryanair Company Profile

(

Free Report)

Ryanair Holdings plc, together with its subsidiaries, provides scheduled-passenger airline services in Ireland, the United Kingdom, Italy, Spain, and internationally. It is also involved in the provision of various ancillary services, such as non-flight scheduled and Internet-related services, as well as in-flight sale of beverages, food, duty-free, and merchandise; and markets car hire, travel insurance, and accommodation services through its website and mobile app.

Read More

Before you consider Ryanair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryanair wasn't on the list.

While Ryanair currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.