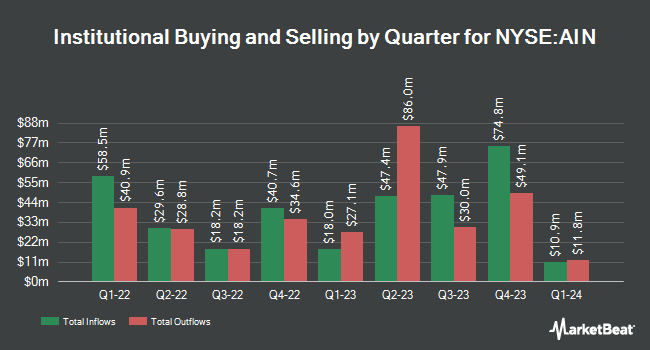

MQS Management LLC bought a new position in shares of Albany International Corp. (NYSE:AIN - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm bought 9,008 shares of the textile maker's stock, valued at approximately $800,000.

Several other institutional investors have also recently made changes to their positions in the business. Hilltop National Bank grew its position in shares of Albany International by 14.7% during the second quarter. Hilltop National Bank now owns 1,045 shares of the textile maker's stock worth $88,000 after purchasing an additional 134 shares in the last quarter. GAMMA Investing LLC grew its position in shares of Albany International by 27.4% during the second quarter. GAMMA Investing LLC now owns 674 shares of the textile maker's stock worth $57,000 after purchasing an additional 145 shares in the last quarter. Creative Planning grew its position in shares of Albany International by 3.0% during the second quarter. Creative Planning now owns 5,018 shares of the textile maker's stock worth $424,000 after purchasing an additional 147 shares in the last quarter. Arizona State Retirement System grew its position in shares of Albany International by 2.0% during the second quarter. Arizona State Retirement System now owns 8,744 shares of the textile maker's stock worth $738,000 after purchasing an additional 175 shares in the last quarter. Finally, Dakota Wealth Management grew its position in shares of Albany International by 1.5% during the second quarter. Dakota Wealth Management now owns 13,211 shares of the textile maker's stock worth $1,116,000 after purchasing an additional 195 shares in the last quarter. Hedge funds and other institutional investors own 97.37% of the company's stock.

Insider Buying and Selling

In other Albany International news, CEO Gunnar Kleveland acquired 1,400 shares of the stock in a transaction that occurred on Tuesday, November 5th. The stock was bought at an average cost of $71.25 per share, for a total transaction of $99,750.00. Following the completion of the transaction, the chief executive officer now owns 8,284 shares of the company's stock, valued at approximately $590,235. The trade was a 0.00 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link. In other Albany International news, CEO Gunnar Kleveland acquired 1,400 shares of the stock in a transaction that occurred on Tuesday, November 5th. The stock was bought at an average cost of $71.25 per share, for a total transaction of $99,750.00. Following the completion of the transaction, the chief executive officer now owns 8,284 shares of the company's stock, valued at approximately $590,235. The trade was a 0.00 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link. Also, SVP Robert Alan Hansen purchased 1,050 shares of the stock in a transaction dated Tuesday, November 5th. The shares were purchased at an average price of $71.26 per share, with a total value of $74,823.00. Following the completion of the transaction, the senior vice president now owns 8,387 shares of the company's stock, valued at approximately $597,657.62. This trade represents a 0.00 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last three months, insiders acquired 3,450 shares of company stock worth $245,813. Company insiders own 0.76% of the company's stock.

Analyst Ratings Changes

Several analysts recently issued reports on AIN shares. Truist Financial cut their target price on Albany International from $91.00 to $85.00 and set a "buy" rating for the company in a research report on Friday, November 1st. StockNews.com upgraded Albany International from a "hold" rating to a "buy" rating in a research note on Thursday, August 15th. Finally, TD Cowen reduced their price target on Albany International from $95.00 to $81.00 and set a "buy" rating for the company in a report on Friday, October 4th. One analyst has rated the stock with a sell rating, one has assigned a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat.com, Albany International has a consensus rating of "Hold" and an average target price of $88.00.

View Our Latest Analysis on AIN

Albany International Price Performance

Shares of AIN stock traded up $0.83 during trading hours on Wednesday, reaching $82.11. The company had a trading volume of 199,700 shares, compared to its average volume of 161,852. The company has a debt-to-equity ratio of 0.36, a quick ratio of 2.94 and a current ratio of 3.68. The stock has a fifty day moving average of $79.41 and a 200-day moving average of $84.73. The company has a market capitalization of $2.57 billion, a price-to-earnings ratio of 25.79, a PEG ratio of 2.63 and a beta of 1.29. Albany International Corp. has a 12-month low of $67.39 and a 12-month high of $99.41.

Albany International (NYSE:AIN - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The textile maker reported $0.80 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.45 by $0.35. The business had revenue of $298.40 million during the quarter, compared to analyst estimates of $304.51 million. Albany International had a return on equity of 12.20% and a net margin of 7.92%. The business's revenue was up 6.2% compared to the same quarter last year. During the same period in the prior year, the business earned $1.02 earnings per share. On average, equities analysts anticipate that Albany International Corp. will post 3.2 earnings per share for the current year.

Albany International Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, October 7th. Investors of record on Tuesday, September 3rd were given a $0.26 dividend. The ex-dividend date of this dividend was Tuesday, September 3rd. This represents a $1.04 annualized dividend and a yield of 1.27%. Albany International's payout ratio is 32.50%.

About Albany International

(

Free Report)

Albany International Corp., together with its subsidiaries, engages in the machine clothing and engineered composites businesses. The company operates in two segments, Machine Clothing (MC) and Albany Engineered Composites (AEC). The MC segment designs, manufactures, and markets paper machine clothing for use in the manufacturing of papers, paperboards, tissues, towels, pulps, nonwovens, building products, tannery, and textiles, as well as fiber cement and several other industrial applications.

See Also

Before you consider Albany International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albany International wasn't on the list.

While Albany International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.