Dynamic Technology Lab Private Ltd purchased a new stake in Progyny, Inc. (NASDAQ:PGNY - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor purchased 96,227 shares of the company's stock, valued at approximately $1,613,000. Dynamic Technology Lab Private Ltd owned 0.11% of Progyny at the end of the most recent quarter.

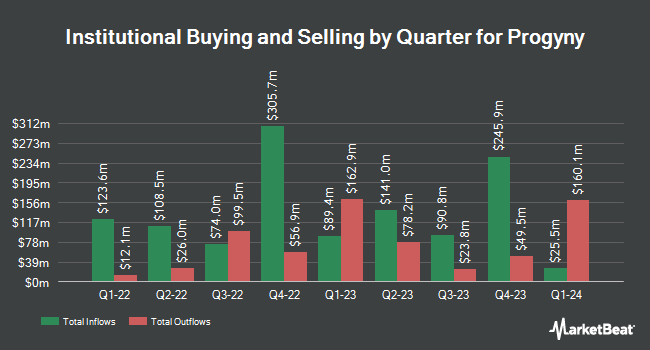

Other hedge funds also recently made changes to their positions in the company. Algert Global LLC raised its stake in Progyny by 138.7% during the third quarter. Algert Global LLC now owns 184,885 shares of the company's stock worth $3,099,000 after buying an additional 107,432 shares during the last quarter. Charles Schwab Investment Management Inc. raised its position in shares of Progyny by 0.6% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 673,446 shares of the company's stock worth $11,287,000 after acquiring an additional 4,007 shares in the last quarter. Pacer Advisors Inc. raised its position in shares of Progyny by 12,579.4% in the 3rd quarter. Pacer Advisors Inc. now owns 2,492,642 shares of the company's stock worth $41,777,000 after acquiring an additional 2,472,983 shares in the last quarter. Landscape Capital Management L.L.C. lifted its stake in shares of Progyny by 126.6% in the 3rd quarter. Landscape Capital Management L.L.C. now owns 167,157 shares of the company's stock valued at $2,802,000 after purchasing an additional 93,374 shares during the period. Finally, Intech Investment Management LLC boosted its position in shares of Progyny by 282.0% during the 3rd quarter. Intech Investment Management LLC now owns 42,013 shares of the company's stock valued at $704,000 after purchasing an additional 31,014 shares in the last quarter. 94.93% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of equities research analysts have weighed in on the company. Cantor Fitzgerald reiterated an "overweight" rating and issued a $25.00 target price on shares of Progyny in a report on Tuesday, October 1st. Canaccord Genuity Group downgraded shares of Progyny from a "buy" rating to a "hold" rating and dropped their target price for the company from $37.00 to $24.00 in a research report on Wednesday, August 7th. Barclays cut their target price on shares of Progyny from $30.00 to $17.00 and set an "overweight" rating on the stock in a research note on Thursday, November 14th. BTIG Research downgraded shares of Progyny from a "buy" rating to a "neutral" rating in a research note on Wednesday, August 7th. Finally, Canaccord Genuity Group cut their price objective on shares of Progyny from $18.00 to $17.00 and set a "hold" rating on the stock in a research report on Wednesday, November 13th. Eight analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $25.42.

Get Our Latest Analysis on PGNY

Progyny Price Performance

Shares of PGNY stock traded down $0.48 during trading hours on Tuesday, reaching $15.27. The company had a trading volume of 1,486,404 shares, compared to its average volume of 1,405,996. The company has a market cap of $1.30 billion, a price-to-earnings ratio of 26.33, a price-to-earnings-growth ratio of 1.78 and a beta of 1.44. Progyny, Inc. has a 12 month low of $13.39 and a 12 month high of $42.08. The business has a fifty day simple moving average of $16.23 and a 200-day simple moving average of $22.49.

Progyny (NASDAQ:PGNY - Get Free Report) last issued its quarterly earnings data on Tuesday, November 12th. The company reported $0.11 earnings per share for the quarter, missing the consensus estimate of $0.37 by ($0.26). Progyny had a net margin of 5.03% and a return on equity of 11.36%. The company had revenue of $286.63 million for the quarter, compared to the consensus estimate of $296.85 million. During the same quarter last year, the business posted $0.16 earnings per share. Progyny's revenue was up 2.0% on a year-over-year basis. On average, equities research analysts expect that Progyny, Inc. will post 0.58 earnings per share for the current year.

Progyny Company Profile

(

Free Report)

Progyny, Inc, a benefits management company, specializes in fertility and family building benefits solutions in the United States. Its fertility benefits solution includes differentiated benefits plan design, personalized concierge-style member support services, and selective network of fertility specialists.

Read More

Before you consider Progyny, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progyny wasn't on the list.

While Progyny currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.