A. O. Smith (NYSE:AOS - Get Free Report) was upgraded by equities researchers at StockNews.com from a "hold" rating to a "buy" rating in a note issued to investors on Tuesday.

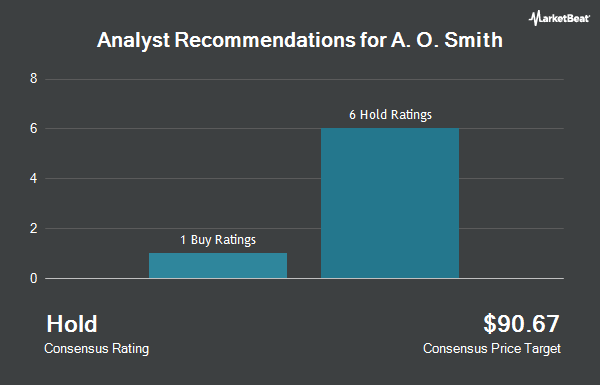

A number of other analysts also recently issued reports on AOS. UBS Group upgraded shares of A. O. Smith from a "sell" rating to a "neutral" rating and raised their price target for the stock from $75.00 to $80.00 in a report on Wednesday, October 23rd. Stifel Nicolaus decreased their price target on A. O. Smith from $91.00 to $90.00 and set a "buy" rating on the stock in a research note on Wednesday, December 11th. Robert W. Baird cut their price objective on A. O. Smith from $82.00 to $81.00 and set a "neutral" rating for the company in a research report on Wednesday, October 23rd. Citigroup decreased their target price on shares of A. O. Smith from $85.00 to $78.00 and set a "neutral" rating on the stock in a research report on Monday, December 9th. Finally, DA Davidson cut shares of A. O. Smith from a "buy" rating to a "neutral" rating and set a $80.00 price target for the company. in a research report on Wednesday, October 23rd. Six research analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $83.17.

Read Our Latest Report on A. O. Smith

A. O. Smith Price Performance

Shares of NYSE:AOS traded down $0.65 during midday trading on Tuesday, hitting $68.25. The company had a trading volume of 943,639 shares, compared to its average volume of 1,055,710. A. O. Smith has a twelve month low of $67.17 and a twelve month high of $92.44. The stock has a market cap of $9.90 billion, a price-to-earnings ratio of 17.96, a price-to-earnings-growth ratio of 1.92 and a beta of 1.18. The company has a debt-to-equity ratio of 0.06, a current ratio of 1.67 and a quick ratio of 1.02. The business's 50-day simple moving average is $72.14 and its 200-day simple moving average is $78.92.

A. O. Smith (NYSE:AOS - Get Free Report) last posted its quarterly earnings results on Tuesday, October 22nd. The industrial products company reported $0.82 EPS for the quarter, hitting the consensus estimate of $0.82. A. O. Smith had a return on equity of 30.09% and a net margin of 14.41%. The business had revenue of $957.80 million for the quarter, compared to analyst estimates of $960.36 million. During the same quarter in the previous year, the firm earned $0.90 EPS. On average, research analysts predict that A. O. Smith will post 3.77 earnings per share for the current year.

Institutional Investors Weigh In On A. O. Smith

Hedge funds have recently added to or reduced their stakes in the business. University of Texas Texas AM Investment Management Co. acquired a new stake in shares of A. O. Smith in the second quarter valued at $25,000. Quarry LP raised its position in A. O. Smith by 214.9% in the 2nd quarter. Quarry LP now owns 359 shares of the industrial products company's stock valued at $29,000 after purchasing an additional 245 shares in the last quarter. Waldron Private Wealth LLC purchased a new position in shares of A. O. Smith in the 3rd quarter valued at about $32,000. Wolff Wiese Magana LLC acquired a new position in shares of A. O. Smith during the third quarter worth about $37,000. Finally, Brooklyn Investment Group purchased a new stake in shares of A. O. Smith during the third quarter worth approximately $43,000. 76.10% of the stock is currently owned by institutional investors and hedge funds.

A. O. Smith Company Profile

(

Get Free Report)

A. O. Smith Corporation manufactures and markets residential and commercial gas and electric water heaters, boilers, heat pumps, tanks, and water treatment products in North America, China, Europe, and India. The company offers water heaters for residences, restaurants, hotels, office buildings, laundries, car washes, and small businesses; boilers for hospitals, schools, hotels, and other large commercial buildings, as well as homes, apartments, and condominiums; and water treatment products comprising point-of-entry water softeners, well water solutions, and whole-home water filtration products, and point-of-use carbon and reverse osmosis products for residences, restaurants, hotels, and offices.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider A. O. Smith, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and A. O. Smith wasn't on the list.

While A. O. Smith currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for February 2025. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.