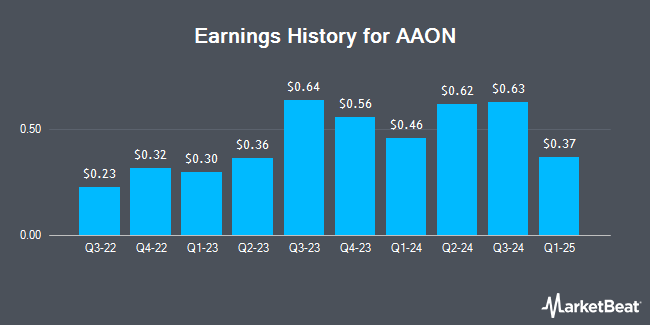

AAON (NASDAQ:AAON - Get Free Report) released its quarterly earnings results on Thursday. The construction company reported $0.63 earnings per share for the quarter, beating analysts' consensus estimates of $0.57 by $0.06, Briefing.com reports. AAON had a return on equity of 26.02% and a net margin of 15.60%. The firm had revenue of $327.25 million during the quarter, compared to analysts' expectations of $315.80 million. During the same period last year, the firm posted $0.64 EPS. The business's revenue was up 4.9% on a year-over-year basis.

AAON Price Performance

NASDAQ:AAON opened at $138.24 on Monday. The stock's 50-day simple moving average is $106.07 and its 200 day simple moving average is $91.58. The company has a market cap of $11.20 billion, a P/E ratio of 62.27 and a beta of 0.79. The company has a debt-to-equity ratio of 0.12, a quick ratio of 1.70 and a current ratio of 2.99. AAON has a 52-week low of $57.19 and a 52-week high of $139.63.

AAON Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Friday, September 27th. Stockholders of record on Friday, September 6th were issued a $0.08 dividend. The ex-dividend date of this dividend was Friday, September 6th. This represents a $0.32 dividend on an annualized basis and a dividend yield of 0.23%. AAON's dividend payout ratio (DPR) is 14.41%.

Analyst Upgrades and Downgrades

Several equities research analysts have recently commented on AAON shares. StockNews.com raised AAON from a "sell" rating to a "hold" rating in a research note on Friday, September 20th. Baird R W upgraded AAON from a "hold" rating to a "strong-buy" rating in a research report on Monday, October 28th. Robert W. Baird raised their price target on AAON from $130.00 to $138.00 and gave the stock an "outperform" rating in a research report on Friday. DA Davidson raised their price target on AAON from $102.00 to $150.00 and gave the stock a "buy" rating in a research report on Friday. Finally, Sidoti lowered AAON from a "buy" rating to a "neutral" rating and raised their price target for the stock from $102.00 to $111.00 in a research report on Tuesday, October 22nd. Two analysts have rated the stock with a hold rating, three have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $133.00.

Read Our Latest Stock Report on AAON

About AAON

(

Get Free Report)

AAON, Inc, together with its subsidiaries, engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada. The company operates through three segments: AAON Oklahoma, AAON Coil Products, and BASX. It offers rooftop units, data center cooling solutions, cleanroom systems, chillers, packaged outdoor mechanical rooms, air handling units, makeup air units, energy recovery units, condensing units, geothermal/water-source heat pumps, coils, and controls.

Recommended Stories

Before you consider AAON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AAON wasn't on the list.

While AAON currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.