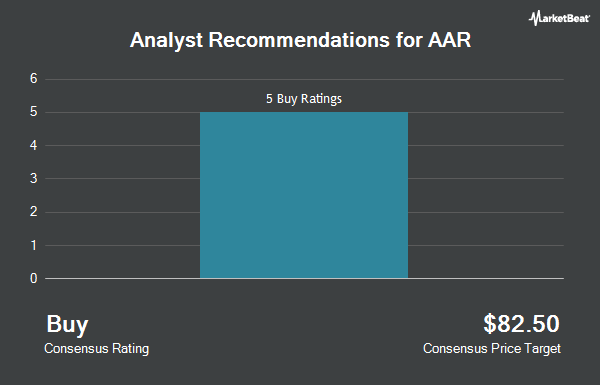

Shares of AAR Corp. (NYSE:AIR - Get Free Report) have been given a consensus rating of "Buy" by the five brokerages that are covering the stock, Marketbeat Ratings reports. Five research analysts have rated the stock with a buy recommendation. The average 1 year price objective among analysts that have issued a report on the stock in the last year is $81.00.

AIR has been the subject of several research reports. StockNews.com raised shares of AAR from a "sell" rating to a "hold" rating in a report on Monday, October 21st. Benchmark restated a "buy" rating and issued a $83.00 target price on shares of AAR in a research note on Friday, October 4th. Finally, Royal Bank of Canada reiterated an "outperform" rating and set a $75.00 price target on shares of AAR in a research report on Monday, November 4th.

Read Our Latest Stock Analysis on AAR

AAR Stock Performance

NYSE:AIR traded up $0.01 during trading hours on Thursday, reaching $60.60. 222,014 shares of the stock were exchanged, compared to its average volume of 294,529. AAR has a 52 week low of $54.71 and a 52 week high of $76.34. The company has a quick ratio of 1.45, a current ratio of 3.06 and a debt-to-equity ratio of 0.81. The stock has a market capitalization of $2.18 billion, a P/E ratio of 33.30 and a beta of 1.59. The firm has a 50 day simple moving average of $64.62 and a 200-day simple moving average of $66.02.

AAR (NYSE:AIR - Get Free Report) last announced its quarterly earnings data on Monday, September 23rd. The aerospace company reported $0.85 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.82 by $0.03. AAR had a return on equity of 10.22% and a net margin of 2.67%. The firm had revenue of $661.70 million for the quarter, compared to analysts' expectations of $645.60 million. During the same period last year, the business posted $0.78 earnings per share. The firm's revenue for the quarter was up 20.4% on a year-over-year basis. As a group, sell-side analysts forecast that AAR will post 3.63 earnings per share for the current fiscal year.

Institutional Investors Weigh In On AAR

Large investors have recently made changes to their positions in the company. Principal Financial Group Inc. grew its holdings in AAR by 18.5% in the 3rd quarter. Principal Financial Group Inc. now owns 500,200 shares of the aerospace company's stock worth $32,693,000 after buying an additional 77,974 shares in the last quarter. Allspring Global Investments Holdings LLC grew its stake in shares of AAR by 41.0% in the second quarter. Allspring Global Investments Holdings LLC now owns 551,439 shares of the aerospace company's stock worth $40,090,000 after purchasing an additional 160,363 shares in the last quarter. Earnest Partners LLC increased its holdings in shares of AAR by 3.2% during the second quarter. Earnest Partners LLC now owns 1,588,893 shares of the aerospace company's stock valued at $115,513,000 after purchasing an additional 48,630 shares during the period. Daiwa Securities Group Inc. acquired a new position in shares of AAR during the second quarter valued at $2,330,000. Finally, Resolute Capital Asset Partners LLC raised its stake in shares of AAR by 54.3% during the second quarter. Resolute Capital Asset Partners LLC now owns 30,000 shares of the aerospace company's stock valued at $2,181,000 after purchasing an additional 10,562 shares in the last quarter. Institutional investors and hedge funds own 90.74% of the company's stock.

About AAR

(

Get Free ReportAAR Corp. provides products and services to commercial aviation, government, and defense markets worldwide. The Parts Supply segment leases and sells aircraft components and replacement parts. The Repair & Engineering segment provides airframe maintenance services, such as airframe inspection, painting, line maintenance, airframe modification, structural repair, avionics service and installation, exterior and interior refurbishment, and engineering and support services; component repair services comprising maintenance, repair, and overhaul (MRO) services, engine and airframe accessories, and interior refurbishment; and landing gear overhaul services, including repair services on wheels and brakes.

Read More

Before you consider AAR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AAR wasn't on the list.

While AAR currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.