Abacus FCF Advisors LLC increased its position in shares of Nutanix, Inc. (NASDAQ:NTNX - Free Report) by 49.7% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 45,207 shares of the technology company's stock after purchasing an additional 15,013 shares during the period. Abacus FCF Advisors LLC's holdings in Nutanix were worth $2,766,000 at the end of the most recent quarter.

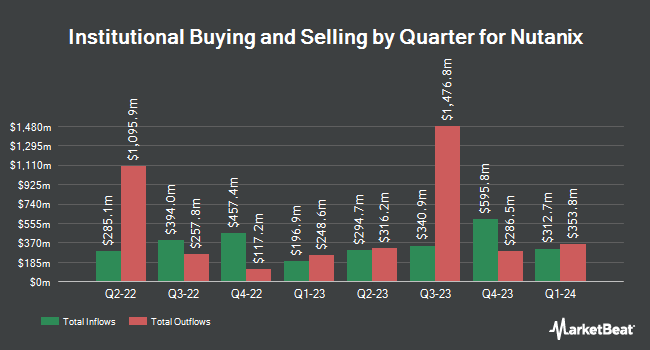

A number of other institutional investors also recently bought and sold shares of NTNX. Renaissance Technologies LLC increased its holdings in shares of Nutanix by 6.5% during the 4th quarter. Renaissance Technologies LLC now owns 4,418,900 shares of the technology company's stock worth $270,348,000 after buying an additional 268,400 shares during the last quarter. Legal & General Group Plc grew its position in Nutanix by 60.4% in the fourth quarter. Legal & General Group Plc now owns 949,226 shares of the technology company's stock worth $58,074,000 after acquiring an additional 357,520 shares during the period. Polymer Capital Management US LLC acquired a new stake in Nutanix during the fourth quarter worth $281,000. Benchmark Investment Advisors LLC purchased a new stake in Nutanix in the fourth quarter valued at $380,000. Finally, Federated Hermes Inc. lifted its stake in shares of Nutanix by 4.6% in the 4th quarter. Federated Hermes Inc. now owns 2,000,729 shares of the technology company's stock valued at $122,551,000 after purchasing an additional 87,775 shares during the last quarter. 85.25% of the stock is owned by hedge funds and other institutional investors.

Nutanix Price Performance

Shares of NASDAQ NTNX traded down $2.74 during mid-day trading on Friday, hitting $59.30. The company had a trading volume of 4,399,701 shares, compared to its average volume of 2,512,611. Nutanix, Inc. has a 1-year low of $43.35 and a 1-year high of $79.99. The company has a market capitalization of $15.81 billion, a PE ratio of -169.43, a price-to-earnings-growth ratio of 11.80 and a beta of 0.84. The business's 50-day simple moving average is $69.57 and its 200 day simple moving average is $66.68.

Analyst Upgrades and Downgrades

NTNX has been the subject of a number of recent analyst reports. Wells Fargo & Company raised their price objective on Nutanix from $75.00 to $85.00 and gave the stock an "equal weight" rating in a research report on Thursday, February 27th. Northland Securities upgraded shares of Nutanix from a "market perform" rating to an "outperform" rating and lifted their price target for the company from $77.00 to $97.00 in a research report on Thursday, February 27th. Morgan Stanley upped their price objective on shares of Nutanix from $78.00 to $85.00 and gave the stock an "overweight" rating in a report on Tuesday, December 17th. StockNews.com cut shares of Nutanix from a "strong-buy" rating to a "buy" rating in a research report on Friday, February 21st. Finally, Barclays set a $94.00 target price on Nutanix and gave the company an "overweight" rating in a research report on Thursday, February 27th. One equities research analyst has rated the stock with a hold rating, thirteen have issued a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, Nutanix currently has an average rating of "Buy" and a consensus target price of $87.85.

Read Our Latest Stock Analysis on NTNX

Insider Buying and Selling at Nutanix

In other Nutanix news, CEO Rajiv Ramaswami sold 7,740 shares of the business's stock in a transaction that occurred on Monday, March 24th. The shares were sold at an average price of $75.00, for a total transaction of $580,500.00. Following the completion of the transaction, the chief executive officer now owns 558,366 shares in the company, valued at $41,877,450. The trade was a 1.37 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Steven J. Gomo sold 7,000 shares of the firm's stock in a transaction on Friday, February 28th. The shares were sold at an average price of $76.16, for a total transaction of $533,120.00. Following the completion of the sale, the director now owns 3,050 shares in the company, valued at $232,288. The trade was a 69.65 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 5,610,886 shares of company stock valued at $417,646,356 in the last quarter. Corporate insiders own 6.80% of the company's stock.

About Nutanix

(

Free Report)

Nutanix, Inc engages in the provision of a cloud platform leveraging web-scale engineering and consumer-grade design. It operates through the following geographic segments: United States, Europe, the Middle East, Africa, Asia Pacific, and Other Americas. The firm also provides software solutions and cloud services to customers' enterprise infrastructure.

Read More

Before you consider Nutanix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutanix wasn't on the list.

While Nutanix currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.