Abacus Wealth Partners LLC boosted its holdings in Apple Inc. (NASDAQ:AAPL - Free Report) by 22.1% in the third quarter, according to its most recent filing with the SEC. The institutional investor owned 46,161 shares of the iPhone maker's stock after buying an additional 8,352 shares during the period. Apple accounts for approximately 1.6% of Abacus Wealth Partners LLC's holdings, making the stock its 12th biggest position. Abacus Wealth Partners LLC's holdings in Apple were worth $10,756,000 at the end of the most recent quarter.

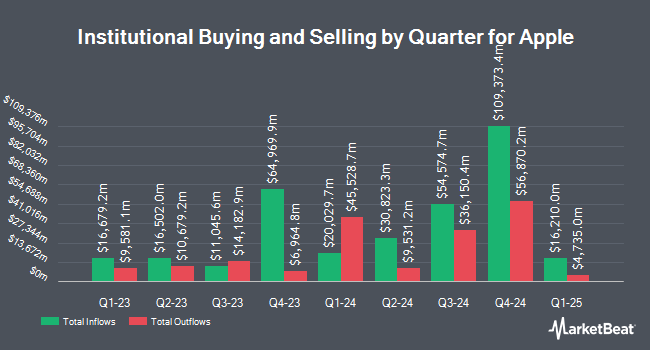

A number of other institutional investors have also bought and sold shares of AAPL. China Universal Asset Management Co. Ltd. boosted its position in shares of Apple by 127.4% during the first quarter. China Universal Asset Management Co. Ltd. now owns 75,479 shares of the iPhone maker's stock valued at $12,943,000 after buying an additional 42,282 shares during the period. Norden Group LLC boosted its position in shares of Apple by 10.8% during the first quarter. Norden Group LLC now owns 60,021 shares of the iPhone maker's stock valued at $10,292,000 after buying an additional 5,830 shares during the period. Ables Iannone Moore & Associates Inc. boosted its position in shares of Apple by 1.0% during the first quarter. Ables Iannone Moore & Associates Inc. now owns 112,505 shares of the iPhone maker's stock valued at $19,294,000 after buying an additional 1,162 shares during the period. Drexel Morgan & Co. boosted its position in shares of Apple by 0.3% during the first quarter. Drexel Morgan & Co. now owns 44,102 shares of the iPhone maker's stock valued at $7,563,000 after buying an additional 150 shares during the period. Finally, North Star Investment Management Corp. boosted its position in shares of Apple by 0.5% during the first quarter. North Star Investment Management Corp. now owns 263,747 shares of the iPhone maker's stock valued at $45,227,000 after buying an additional 1,275 shares during the period. Hedge funds and other institutional investors own 60.41% of the company's stock.

Insider Transactions at Apple

In related news, insider Chris Kondo sold 4,130 shares of Apple stock in a transaction on Monday, November 18th. The shares were sold at an average price of $228.87, for a total transaction of $945,233.10. Following the sale, the insider now directly owns 15,419 shares in the company, valued at $3,528,946.53. This trade represents a 21.13 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Timothy D. Cook sold 223,986 shares of Apple stock in a transaction on Wednesday, October 2nd. The stock was sold at an average price of $224.46, for a total transaction of $50,275,897.56. Following the sale, the chief executive officer now owns 3,280,180 shares in the company, valued at $736,269,202.80. This represents a 6.39 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 408,170 shares of company stock valued at $92,007,745. Insiders own 0.06% of the company's stock.

Apple Stock Performance

Shares of AAPL stock opened at $229.00 on Thursday. The company has a quick ratio of 0.83, a current ratio of 0.87 and a debt-to-equity ratio of 1.51. Apple Inc. has a 52 week low of $164.07 and a 52 week high of $237.49. The stock has a market capitalization of $3.46 trillion, a PE ratio of 37.66, a P/E/G ratio of 2.20 and a beta of 1.24. The firm has a 50 day moving average of $227.47 and a two-hundred day moving average of $217.40.

Apple (NASDAQ:AAPL - Get Free Report) last released its quarterly earnings data on Thursday, October 31st. The iPhone maker reported $1.64 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.60 by $0.04. The business had revenue of $94.93 billion during the quarter, compared to analysts' expectations of $94.52 billion. Apple had a net margin of 23.97% and a return on equity of 152.94%. The company's revenue for the quarter was up 6.1% on a year-over-year basis. During the same period in the previous year, the company earned $1.46 EPS. On average, research analysts predict that Apple Inc. will post 7.43 EPS for the current fiscal year.

Apple Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, November 14th. Stockholders of record on Monday, November 11th were given a dividend of $0.25 per share. The ex-dividend date of this dividend was Friday, November 8th. This represents a $1.00 annualized dividend and a dividend yield of 0.44%. Apple's dividend payout ratio (DPR) is currently 16.45%.

Wall Street Analyst Weigh In

A number of brokerages recently issued reports on AAPL. Melius Research reiterated a "buy" rating and issued a $265.00 price target on shares of Apple in a report on Tuesday, August 27th. StockNews.com lowered Apple from a "buy" rating to a "hold" rating in a report on Friday, November 1st. Evercore ISI restated a "buy" rating and set a $250.00 target price on shares of Apple in a report on Thursday, September 26th. JPMorgan Chase & Co. restated an "overweight" rating and set a $265.00 target price on shares of Apple in a report on Tuesday, September 10th. Finally, TD Cowen upped their price target on Apple from $220.00 to $250.00 and gave the stock a "buy" rating in a research report on Monday, July 29th. Two investment analysts have rated the stock with a sell rating, twelve have given a hold rating, twenty-two have issued a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $235.25.

Check Out Our Latest Research Report on Apple

Apple Company Profile

(

Free Report)

Apple Inc designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, and HomePod.

Further Reading

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report