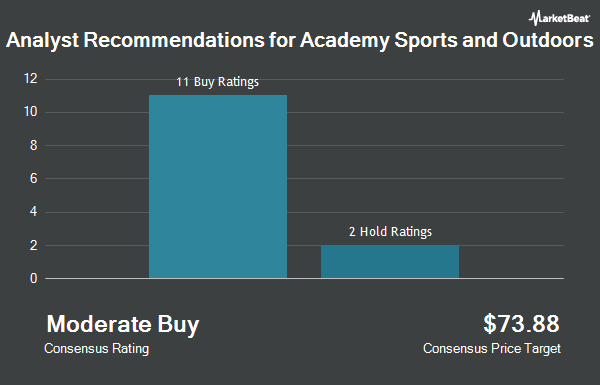

Shares of Academy Sports and Outdoors, Inc. (NASDAQ:ASO - Get Free Report) have earned an average rating of "Moderate Buy" from the fourteen analysts that are presently covering the firm, MarketBeat.com reports. Seven research analysts have rated the stock with a hold rating and seven have given a buy rating to the company. The average 1-year target price among brokerages that have updated their coverage on the stock in the last year is $62.50.

Several research firms have recently commented on ASO. Telsey Advisory Group reissued an "outperform" rating and issued a $65.00 price objective on shares of Academy Sports and Outdoors in a research note on Thursday, September 5th. Truist Financial raised their price objective on shares of Academy Sports and Outdoors from $60.00 to $63.00 and gave the company a "buy" rating in a report on Wednesday, September 11th. Wedbush reiterated an "outperform" rating and set a $65.00 target price on shares of Academy Sports and Outdoors in a research note on Wednesday, September 11th. Loop Capital restated a "buy" rating and issued a $77.00 price target on shares of Academy Sports and Outdoors in a research note on Wednesday, September 11th. Finally, Wells Fargo & Company increased their price objective on Academy Sports and Outdoors from $46.00 to $51.00 and gave the company an "equal weight" rating in a report on Wednesday, September 11th.

Check Out Our Latest Research Report on ASO

Insiders Place Their Bets

In other Academy Sports and Outdoors news, Director Jeffrey C. Tweedy sold 1,200 shares of the business's stock in a transaction on Wednesday, September 18th. The shares were sold at an average price of $62.00, for a total transaction of $74,400.00. Following the completion of the sale, the director now owns 8,906 shares in the company, valued at $552,172. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 2.19% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the company. Harbor Capital Advisors Inc. acquired a new stake in shares of Academy Sports and Outdoors during the third quarter worth $28,000. Headlands Technologies LLC acquired a new stake in shares of Academy Sports and Outdoors during the 1st quarter worth about $35,000. V Square Quantitative Management LLC bought a new stake in shares of Academy Sports and Outdoors during the third quarter worth approximately $40,000. Farther Finance Advisors LLC increased its stake in shares of Academy Sports and Outdoors by 98.4% during the third quarter. Farther Finance Advisors LLC now owns 738 shares of the company's stock worth $43,000 after purchasing an additional 366 shares during the period. Finally, Future Financial Wealth Managment LLC bought a new stake in Academy Sports and Outdoors in the 3rd quarter valued at $58,000.

Academy Sports and Outdoors Stock Performance

Shares of ASO stock traded down $0.64 during mid-day trading on Friday, reaching $51.38. The stock had a trading volume of 1,235,351 shares, compared to its average volume of 1,099,781. Academy Sports and Outdoors has a 1-year low of $44.21 and a 1-year high of $75.73. The firm has a market cap of $3.61 billion, a price-to-earnings ratio of 7.93, a PEG ratio of 0.98 and a beta of 1.37. The company has a current ratio of 1.66, a quick ratio of 0.41 and a debt-to-equity ratio of 0.25. The business's fifty day moving average is $55.41 and its 200-day moving average is $54.66.

Academy Sports and Outdoors (NASDAQ:ASO - Get Free Report) last posted its quarterly earnings results on Tuesday, September 10th. The company reported $2.03 EPS for the quarter, beating the consensus estimate of $1.96 by $0.07. The company had revenue of $1.55 billion for the quarter, compared to analyst estimates of $1.57 billion. Academy Sports and Outdoors had a net margin of 7.98% and a return on equity of 25.56%. The firm's revenue was down 2.2% on a year-over-year basis. During the same period in the prior year, the company earned $2.01 earnings per share. On average, research analysts forecast that Academy Sports and Outdoors will post 6.02 earnings per share for the current year.

Academy Sports and Outdoors Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Thursday, October 17th. Stockholders of record on Thursday, September 19th were given a $0.11 dividend. This represents a $0.44 annualized dividend and a dividend yield of 0.86%. The ex-dividend date of this dividend was Thursday, September 19th. Academy Sports and Outdoors's payout ratio is 6.79%.

About Academy Sports and Outdoors

(

Get Free ReportAcademy Sports and Outdoors, Inc, through its subsidiaries, operates as a sporting goods and outdoor recreational retailer in the United States. The company outdoor division comprises camping products, such as coolers and drinkware, and camping accessories and equipment,; fishing products, including marine equipment and fishing rods, reels, and baits and equipment; and hunting products, which includes firearms, ammunition, archery and archery equipment, camouflage apparel, waders, shooting accessories, gun safes, optics, airguns, and hunting equipment.

Featured Stories

Before you consider Academy Sports and Outdoors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Academy Sports and Outdoors wasn't on the list.

While Academy Sports and Outdoors currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.