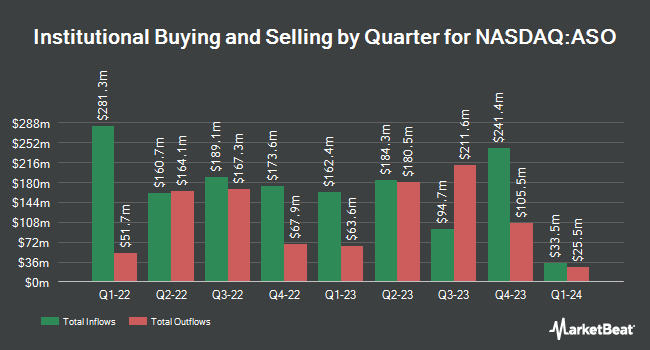

UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lessened its stake in shares of Academy Sports and Outdoors, Inc. (NASDAQ:ASO - Free Report) by 8.0% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 133,354 shares of the company's stock after selling 11,635 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned approximately 0.19% of Academy Sports and Outdoors worth $7,783,000 at the end of the most recent reporting period.

Several other hedge funds have also added to or reduced their stakes in the stock. Zurcher Kantonalbank Zurich Cantonalbank raised its position in Academy Sports and Outdoors by 3.3% in the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 17,973 shares of the company's stock worth $1,049,000 after buying an additional 569 shares during the last quarter. Townsquare Capital LLC purchased a new position in shares of Academy Sports and Outdoors during the third quarter valued at approximately $240,000. FMR LLC boosted its holdings in Academy Sports and Outdoors by 15.3% in the third quarter. FMR LLC now owns 10,739,463 shares of the company's stock worth $626,755,000 after purchasing an additional 1,422,971 shares during the last quarter. Qsemble Capital Management LP bought a new stake in Academy Sports and Outdoors in the 3rd quarter worth approximately $633,000. Finally, Cerity Partners LLC lifted its holdings in shares of Academy Sports and Outdoors by 127.8% during the 3rd quarter. Cerity Partners LLC now owns 116,264 shares of the company's stock valued at $6,785,000 after buying an additional 65,220 shares during the period.

Academy Sports and Outdoors Trading Up 4.3 %

NASDAQ:ASO traded up $2.17 during midday trading on Tuesday, hitting $52.58. 4,171,298 shares of the company traded hands, compared to its average volume of 1,460,514. The company has a current ratio of 1.66, a quick ratio of 0.41 and a debt-to-equity ratio of 0.25. The firm's fifty day moving average is $51.59 and its 200-day moving average is $53.47. The firm has a market capitalization of $3.70 billion, a P/E ratio of 7.78, a P/E/G ratio of 0.97 and a beta of 1.31. Academy Sports and Outdoors, Inc. has a 12-month low of $44.73 and a 12-month high of $75.73.

Academy Sports and Outdoors (NASDAQ:ASO - Get Free Report) last released its earnings results on Tuesday, December 10th. The company reported $0.98 EPS for the quarter, missing analysts' consensus estimates of $1.28 by ($0.30). Academy Sports and Outdoors had a net margin of 7.98% and a return on equity of 25.56%. The business had revenue of $1.34 billion for the quarter, compared to the consensus estimate of $1.39 billion. During the same period in the prior year, the company posted $1.38 EPS. The company's quarterly revenue was down 3.9% compared to the same quarter last year. On average, sell-side analysts predict that Academy Sports and Outdoors, Inc. will post 6 EPS for the current year.

Academy Sports and Outdoors Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Wednesday, December 18th will be issued a $0.11 dividend. The ex-dividend date of this dividend is Wednesday, December 18th. This represents a $0.44 dividend on an annualized basis and a dividend yield of 0.84%. Academy Sports and Outdoors's payout ratio is 6.79%.

Wall Street Analysts Forecast Growth

Several brokerages have recently weighed in on ASO. Evercore ISI cut shares of Academy Sports and Outdoors from an "outperform" rating to an "in-line" rating and lowered their price objective for the stock from $65.00 to $60.00 in a research note on Thursday, October 3rd. Jefferies Financial Group dropped their price target on shares of Academy Sports and Outdoors from $68.00 to $64.00 and set a "buy" rating on the stock in a research note on Wednesday, September 11th. Loop Capital restated a "buy" rating and issued a $77.00 price objective on shares of Academy Sports and Outdoors in a research note on Wednesday, September 11th. TD Cowen lifted their target price on Academy Sports and Outdoors from $54.00 to $56.00 and gave the company a "hold" rating in a research report on Wednesday, September 11th. Finally, Truist Financial cut Academy Sports and Outdoors from a "buy" rating to a "hold" rating and reduced their price target for the stock from $63.00 to $50.00 in a research report on Tuesday, November 19th. Eight equities research analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. According to MarketBeat.com, Academy Sports and Outdoors currently has a consensus rating of "Hold" and a consensus target price of $61.21.

Read Our Latest Research Report on Academy Sports and Outdoors

Insiders Place Their Bets

In other news, Director Jeffrey C. Tweedy sold 1,200 shares of the business's stock in a transaction on Wednesday, September 18th. The stock was sold at an average price of $62.00, for a total value of $74,400.00. Following the completion of the transaction, the director now directly owns 8,906 shares of the company's stock, valued at approximately $552,172. The trade was a 11.87 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Company insiders own 2.19% of the company's stock.

About Academy Sports and Outdoors

(

Free Report)

Academy Sports and Outdoors, Inc, through its subsidiaries, operates as a sporting goods and outdoor recreational retailer in the United States. The company outdoor division comprises camping products, such as coolers and drinkware, and camping accessories and equipment,; fishing products, including marine equipment and fishing rods, reels, and baits and equipment; and hunting products, which includes firearms, ammunition, archery and archery equipment, camouflage apparel, waders, shooting accessories, gun safes, optics, airguns, and hunting equipment.

See Also

Before you consider Academy Sports and Outdoors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Academy Sports and Outdoors wasn't on the list.

While Academy Sports and Outdoors currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.