Cantor Fitzgerald restated their neutral rating on shares of Acadia Healthcare (NASDAQ:ACHC - Free Report) in a research report report published on Tuesday,Benzinga reports. The firm currently has a $52.00 price target on the stock.

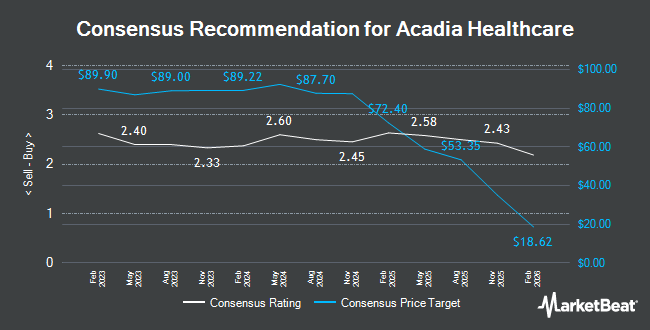

ACHC has been the subject of several other reports. Barclays decreased their price target on shares of Acadia Healthcare from $76.00 to $43.00 and set an "overweight" rating for the company in a research report on Friday, November 22nd. Royal Bank of Canada decreased their target price on shares of Acadia Healthcare from $94.00 to $64.00 and set an "outperform" rating for the company in a research report on Monday, November 18th. KeyCorp started coverage on shares of Acadia Healthcare in a report on Friday, October 11th. They issued a "sector weight" rating on the stock. Finally, StockNews.com cut Acadia Healthcare from a "hold" rating to a "sell" rating in a research report on Friday, November 22nd. One research analyst has rated the stock with a sell rating, four have given a hold rating and six have assigned a buy rating to the company. According to data from MarketBeat.com, Acadia Healthcare has an average rating of "Hold" and a consensus target price of $75.44.

Get Our Latest Stock Analysis on ACHC

Acadia Healthcare Stock Down 2.3 %

Shares of ACHC traded down $0.93 during mid-day trading on Tuesday, hitting $39.87. The company's stock had a trading volume of 1,692,342 shares, compared to its average volume of 1,035,024. The company has a current ratio of 1.07, a quick ratio of 1.07 and a debt-to-equity ratio of 0.60. The company's 50-day moving average is $46.85 and its 200-day moving average is $62.46. Acadia Healthcare has a 52-week low of $36.50 and a 52-week high of $87.77. The firm has a market capitalization of $3.70 billion, a price-to-earnings ratio of 12.53, a PEG ratio of 1.82 and a beta of 1.30.

Acadia Healthcare (NASDAQ:ACHC - Get Free Report) last posted its earnings results on Wednesday, October 30th. The company reported $0.91 earnings per share for the quarter, topping analysts' consensus estimates of $0.90 by $0.01. The company had revenue of $815.60 million during the quarter, compared to analyst estimates of $819.42 million. Acadia Healthcare had a return on equity of 11.12% and a net margin of 8.99%. Acadia Healthcare's revenue was up 8.7% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.91 earnings per share. On average, equities research analysts forecast that Acadia Healthcare will post 3.38 EPS for the current fiscal year.

Institutional Investors Weigh In On Acadia Healthcare

Institutional investors and hedge funds have recently modified their holdings of the company. Cetera Advisors LLC acquired a new stake in Acadia Healthcare during the 1st quarter valued at approximately $540,000. SG Americas Securities LLC boosted its holdings in Acadia Healthcare by 435.6% in the second quarter. SG Americas Securities LLC now owns 18,227 shares of the company's stock valued at $1,231,000 after purchasing an additional 14,824 shares during the last quarter. Blue Trust Inc. grew its position in Acadia Healthcare by 86.1% during the 2nd quarter. Blue Trust Inc. now owns 536 shares of the company's stock worth $36,000 after purchasing an additional 248 shares during the period. TCW Group Inc. raised its stake in shares of Acadia Healthcare by 63.8% during the 2nd quarter. TCW Group Inc. now owns 62,888 shares of the company's stock valued at $4,247,000 after buying an additional 24,487 shares during the last quarter. Finally, Vaughan Nelson Investment Management L.P. lifted its holdings in shares of Acadia Healthcare by 67.9% in the 2nd quarter. Vaughan Nelson Investment Management L.P. now owns 733,505 shares of the company's stock valued at $49,541,000 after buying an additional 296,625 shares during the period.

About Acadia Healthcare

(

Get Free Report)

Acadia Healthcare Company, Inc provides behavioral healthcare services in the United States and Puerto Rico. The company develops and operates acute inpatient psychiatric facilities, specialty treatment facilities comprising residential recovery facilities and eating disorder facilities, comprehensive treatment centers, and residential treatment centers, as well as facilities offering outpatient behavioral healthcare services for the behavioral healthcare and recovery needs of communities.

Featured Articles

Before you consider Acadia Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Acadia Healthcare wasn't on the list.

While Acadia Healthcare currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.