GSA Capital Partners LLP reduced its stake in shares of ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD - Free Report) by 62.9% during the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 67,096 shares of the biopharmaceutical company's stock after selling 113,604 shares during the quarter. GSA Capital Partners LLP's holdings in ACADIA Pharmaceuticals were worth $1,032,000 as of its most recent filing with the SEC.

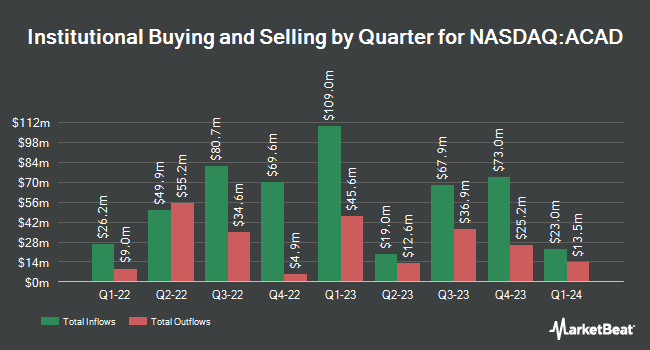

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Park Place Capital Corp acquired a new position in shares of ACADIA Pharmaceuticals during the third quarter worth $25,000. Values First Advisors Inc. purchased a new stake in ACADIA Pharmaceuticals during the 3rd quarter worth $27,000. Covestor Ltd lifted its holdings in ACADIA Pharmaceuticals by 70.5% in the 1st quarter. Covestor Ltd now owns 2,032 shares of the biopharmaceutical company's stock worth $38,000 after buying an additional 840 shares in the last quarter. Headlands Technologies LLC purchased a new position in ACADIA Pharmaceuticals in the 1st quarter valued at about $48,000. Finally, Stonepine Capital Management LLC acquired a new stake in shares of ACADIA Pharmaceuticals during the second quarter valued at about $81,000. 96.71% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling at ACADIA Pharmaceuticals

In other ACADIA Pharmaceuticals news, CEO Stephen Davis sold 31,747 shares of the business's stock in a transaction dated Monday, August 19th. The shares were sold at an average price of $15.28, for a total transaction of $485,094.16. Following the completion of the transaction, the chief executive officer now directly owns 186,555 shares of the company's stock, valued at $2,850,560.40. The trade was a 14.54 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, COO Brendan Teehan sold 9,534 shares of the business's stock in a transaction dated Monday, August 19th. The stock was sold at an average price of $15.28, for a total transaction of $145,679.52. Following the sale, the chief operating officer now owns 52,177 shares in the company, valued at $797,264.56. This trade represents a 15.45 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 51,014 shares of company stock valued at $779,494 in the last ninety days. Company insiders own 28.30% of the company's stock.

Wall Street Analyst Weigh In

ACAD has been the topic of several recent analyst reports. Cantor Fitzgerald cut their price target on ACADIA Pharmaceuticals from $37.00 to $28.00 and set an "overweight" rating on the stock in a research note on Wednesday, August 7th. StockNews.com downgraded shares of ACADIA Pharmaceuticals from a "strong-buy" rating to a "buy" rating in a research report on Thursday. Raymond James restated a "market perform" rating on shares of ACADIA Pharmaceuticals in a research note on Thursday, October 10th. Royal Bank of Canada reduced their price objective on shares of ACADIA Pharmaceuticals from $29.00 to $26.00 and set an "outperform" rating on the stock in a research note on Wednesday, August 7th. Finally, Citigroup decreased their price objective on shares of ACADIA Pharmaceuticals from $30.00 to $23.00 and set a "buy" rating for the company in a report on Thursday, August 8th. Six equities research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company. Based on data from MarketBeat, ACADIA Pharmaceuticals has a consensus rating of "Moderate Buy" and an average price target of $25.56.

Get Our Latest Research Report on ACAD

ACADIA Pharmaceuticals Stock Performance

Shares of NASDAQ ACAD traded down $0.25 during midday trading on Friday, hitting $16.77. The company's stock had a trading volume of 1,826,798 shares, compared to its average volume of 1,681,694. ACADIA Pharmaceuticals Inc. has a 1-year low of $14.15 and a 1-year high of $32.59. The firm's fifty day moving average price is $15.56 and its 200-day moving average price is $16.01. The firm has a market cap of $2.79 billion, a P/E ratio of 21.50 and a beta of 0.38.

ACADIA Pharmaceuticals (NASDAQ:ACAD - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The biopharmaceutical company reported $0.20 EPS for the quarter, beating the consensus estimate of $0.14 by $0.06. ACADIA Pharmaceuticals had a net margin of 13.83% and a return on equity of 25.83%. The business had revenue of $250.40 million during the quarter, compared to analyst estimates of $248.83 million. During the same period in the previous year, the business posted ($0.40) EPS. The company's quarterly revenue was up 18.3% on a year-over-year basis. As a group, research analysts predict that ACADIA Pharmaceuticals Inc. will post 0.72 earnings per share for the current fiscal year.

ACADIA Pharmaceuticals Profile

(

Free Report)

ACADIA Pharmaceuticals Inc, a biopharmaceutical company, focuses on the development and commercialization innovative medicines that address unmet medical needs in central nervous system (CNS) disorders and rare diseases in the United States. The company offers NUPLAZID (pimavanserin) for the treatment of hallucinations and delusions associated with Parkinson's disease psychosis; and DAYBUE, a novel synthetic analog of the amino-terminal tripeptide of insulin-like growth factor 1 for treatment of Rett Syndrome.

See Also

Before you consider ACADIA Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACADIA Pharmaceuticals wasn't on the list.

While ACADIA Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.