Accent Capital Management LLC grew its stake in JPMorgan Chase & Co. (NYSE:JPM - Free Report) by 84.4% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 14,861 shares of the financial services provider's stock after buying an additional 6,802 shares during the quarter. JPMorgan Chase & Co. makes up 1.8% of Accent Capital Management LLC's portfolio, making the stock its 12th biggest holding. Accent Capital Management LLC's holdings in JPMorgan Chase & Co. were worth $3,134,000 as of its most recent filing with the Securities & Exchange Commission.

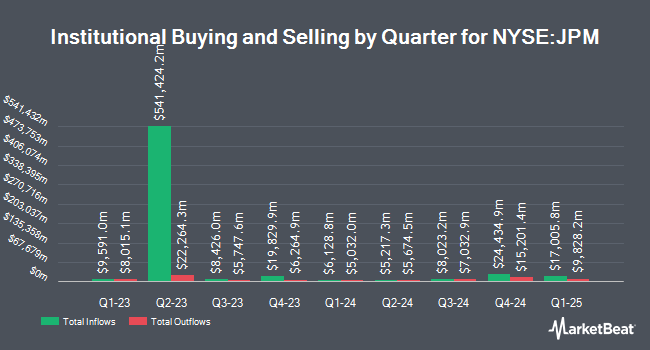

Several other institutional investors have also recently made changes to their positions in JPM. Capital International Investors lifted its position in shares of JPMorgan Chase & Co. by 1.9% in the first quarter. Capital International Investors now owns 42,294,992 shares of the financial services provider's stock valued at $8,471,687,000 after acquiring an additional 778,297 shares in the last quarter. Capital World Investors raised its stake in JPMorgan Chase & Co. by 0.4% during the 1st quarter. Capital World Investors now owns 34,422,011 shares of the financial services provider's stock valued at $6,894,729,000 after purchasing an additional 150,812 shares during the period. Dimensional Fund Advisors LP boosted its stake in JPMorgan Chase & Co. by 4.8% in the 2nd quarter. Dimensional Fund Advisors LP now owns 22,696,963 shares of the financial services provider's stock worth $4,590,412,000 after purchasing an additional 1,040,594 shares during the period. Capital Research Global Investors grew its holdings in JPMorgan Chase & Co. by 23.3% during the 1st quarter. Capital Research Global Investors now owns 17,200,124 shares of the financial services provider's stock valued at $3,445,185,000 after buying an additional 3,252,451 shares in the last quarter. Finally, International Assets Investment Management LLC purchased a new stake in JPMorgan Chase & Co. during the 3rd quarter valued at approximately $1,888,088,000. Institutional investors own 71.55% of the company's stock.

JPMorgan Chase & Co. Trading Up 1.6 %

NYSE:JPM traded up $3.80 during midday trading on Friday, hitting $248.56. The stock had a trading volume of 7,994,315 shares, compared to its average volume of 9,093,902. The stock has a 50-day moving average of $222.25 and a 200 day moving average of $211.36. The company has a market capitalization of $699.78 billion, a price-to-earnings ratio of 13.82, a PEG ratio of 3.53 and a beta of 1.10. JPMorgan Chase & Co. has a one year low of $152.71 and a one year high of $249.15. The company has a quick ratio of 0.89, a current ratio of 0.89 and a debt-to-equity ratio of 1.27.

JPMorgan Chase & Co. (NYSE:JPM - Get Free Report) last announced its quarterly earnings results on Friday, October 11th. The financial services provider reported $4.37 earnings per share for the quarter, topping the consensus estimate of $4.02 by $0.35. The firm had revenue of $43.32 billion during the quarter, compared to analysts' expectations of $41.43 billion. JPMorgan Chase & Co. had a net margin of 19.64% and a return on equity of 16.71%. The company's revenue was up 6.5% compared to the same quarter last year. During the same quarter in the prior year, the company earned $4.33 EPS. As a group, sell-side analysts forecast that JPMorgan Chase & Co. will post 17.62 EPS for the current year.

JPMorgan Chase & Co. Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Stockholders of record on Friday, October 4th were issued a $1.25 dividend. This is a boost from JPMorgan Chase & Co.'s previous quarterly dividend of $1.15. This represents a $5.00 dividend on an annualized basis and a dividend yield of 2.01%. The ex-dividend date of this dividend was Friday, October 4th. JPMorgan Chase & Co.'s dividend payout ratio (DPR) is currently 27.82%.

Analysts Set New Price Targets

Several analysts have commented on JPM shares. Evercore ISI boosted their price target on shares of JPMorgan Chase & Co. from $217.00 to $230.00 and gave the stock an "outperform" rating in a research note on Monday, October 14th. Citigroup boosted their target price on JPMorgan Chase & Co. from $215.00 to $250.00 and gave the stock a "neutral" rating in a research report on Tuesday. Robert W. Baird cut JPMorgan Chase & Co. from a "neutral" rating to an "underperform" rating and set a $200.00 price target for the company. in a report on Thursday, November 7th. Morgan Stanley cut JPMorgan Chase & Co. from an "overweight" rating to an "equal weight" rating and upped their price objective for the stock from $220.00 to $224.00 in a report on Monday, September 30th. Finally, Oppenheimer lowered shares of JPMorgan Chase & Co. from an "outperform" rating to a "market perform" rating in a report on Wednesday. Two research analysts have rated the stock with a sell rating, eight have issued a hold rating and ten have assigned a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $229.31.

Get Our Latest Research Report on JPMorgan Chase & Co.

JPMorgan Chase & Co. Company Profile

(

Free Report)

JPMorgan Chase & Co operates as a financial services company worldwide. It operates through four segments: Consumer & Community Banking (CCB), Corporate & Investment Bank (CIB), Commercial Banking (CB), and Asset & Wealth Management (AWM). The CCB segment offers deposit, investment and lending products, cash management, and payments and services; mortgage origination and servicing activities; residential mortgages and home equity loans; and credit cards, auto loans, leases, and travel services to consumers and small businesses through bank branches, ATMs, and digital and telephone banking.

See Also

Before you consider JPMorgan Chase & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JPMorgan Chase & Co. wasn't on the list.

While JPMorgan Chase & Co. currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.