Access Investment Management LLC cut its stake in shares of Customers Bancorp, Inc. (NYSE:CUBI - Free Report) by 66.6% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 94,110 shares of the bank's stock after selling 187,315 shares during the period. Customers Bancorp accounts for approximately 1.3% of Access Investment Management LLC's portfolio, making the stock its 25th largest holding. Access Investment Management LLC owned approximately 0.30% of Customers Bancorp worth $4,371,000 at the end of the most recent reporting period.

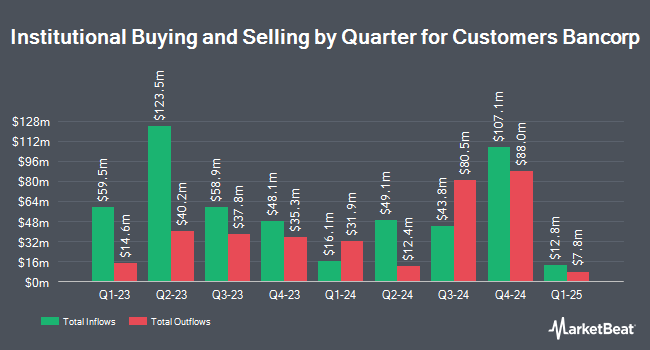

A number of other large investors also recently modified their holdings of CUBI. Hood River Capital Management LLC grew its position in Customers Bancorp by 94.3% during the second quarter. Hood River Capital Management LLC now owns 549,063 shares of the bank's stock worth $26,344,000 after buying an additional 266,462 shares in the last quarter. Assenagon Asset Management S.A. increased its position in shares of Customers Bancorp by 88.9% in the third quarter. Assenagon Asset Management S.A. now owns 479,739 shares of the bank's stock worth $22,284,000 after purchasing an additional 225,785 shares during the last quarter. Peregrine Capital Management LLC purchased a new stake in Customers Bancorp in the second quarter valued at approximately $7,690,000. Vanguard Group Inc. lifted its position in Customers Bancorp by 5.4% during the first quarter. Vanguard Group Inc. now owns 2,186,920 shares of the bank's stock valued at $116,038,000 after purchasing an additional 111,654 shares during the last quarter. Finally, American Century Companies Inc. grew its stake in Customers Bancorp by 14.6% in the 2nd quarter. American Century Companies Inc. now owns 686,825 shares of the bank's stock worth $32,954,000 after buying an additional 87,557 shares in the last quarter. 89.29% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

CUBI has been the topic of a number of research reports. Piper Sandler lowered their price target on Customers Bancorp from $61.00 to $55.00 and set a "neutral" rating on the stock in a research report on Monday, November 4th. Keefe, Bruyette & Woods downgraded Customers Bancorp from an "outperform" rating to a "market perform" rating and dropped their target price for the stock from $57.00 to $52.00 in a research report on Monday, November 4th. StockNews.com cut shares of Customers Bancorp from a "hold" rating to a "sell" rating in a research report on Monday, November 4th. Hovde Group lowered shares of Customers Bancorp from an "outperform" rating to a "market perform" rating and set a $49.00 price objective for the company. in a report on Friday, August 9th. Finally, DA Davidson upped their price objective on shares of Customers Bancorp from $71.00 to $79.00 and gave the company a "buy" rating in a research note on Monday, July 29th. One investment analyst has rated the stock with a sell rating, five have issued a hold rating, three have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, Customers Bancorp has an average rating of "Hold" and a consensus target price of $61.11.

View Our Latest Stock Analysis on CUBI

Insider Transactions at Customers Bancorp

In other news, insider Glenn Hedde sold 5,002 shares of the business's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $53.68, for a total value of $268,507.36. Following the completion of the transaction, the insider now directly owns 66,256 shares of the company's stock, valued at approximately $3,556,622.08. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. In other news, insider Glenn Hedde sold 5,002 shares of the firm's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $53.68, for a total value of $268,507.36. Following the sale, the insider now directly owns 66,256 shares in the company, valued at approximately $3,556,622.08. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO Samvir S. Sidhu acquired 2,500 shares of the business's stock in a transaction dated Tuesday, August 13th. The stock was purchased at an average cost of $45.53 per share, for a total transaction of $113,825.00. Following the transaction, the chief executive officer now owns 144,504 shares in the company, valued at approximately $6,579,267.12. The trade was a 0.00 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Corporate insiders own 6.92% of the company's stock.

Customers Bancorp Stock Up 6.8 %

Shares of CUBI stock traded up $3.60 during mid-day trading on Monday, hitting $56.55. The stock had a trading volume of 698,580 shares, compared to its average volume of 371,372. Customers Bancorp, Inc. has a 12-month low of $40.75 and a 12-month high of $68.49. The company has a debt-to-equity ratio of 0.78, a current ratio of 0.93 and a quick ratio of 0.92. The firm's 50-day moving average is $47.22 and its two-hundred day moving average is $49.00. The firm has a market capitalization of $1.79 billion, a P/E ratio of 8.93 and a beta of 1.61.

Customers Bancorp (NYSE:CUBI - Get Free Report) last released its quarterly earnings data on Thursday, October 31st. The bank reported $1.34 earnings per share for the quarter, missing analysts' consensus estimates of $1.43 by ($0.09). The business had revenue of $167.10 million during the quarter, compared to analysts' expectations of $191.61 million. Customers Bancorp had a return on equity of 13.55% and a net margin of 15.22%. The firm's revenue was down 23.2% compared to the same quarter last year. During the same period last year, the company earned $2.59 earnings per share. On average, analysts predict that Customers Bancorp, Inc. will post 5.63 earnings per share for the current fiscal year.

Customers Bancorp Profile

(

Free Report)

Customers Bancorp, Inc operates as the bank holding company for Customers Bank that provides financial products and services to individual consumers, and small and middle market businesses. The company provides deposit banking products, which includes commercial and consumer checking, non-interest-bearing and interest-bearing demand, MMDA, savings, and time deposit accounts.

Featured Stories

Before you consider Customers Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Customers Bancorp wasn't on the list.

While Customers Bancorp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.