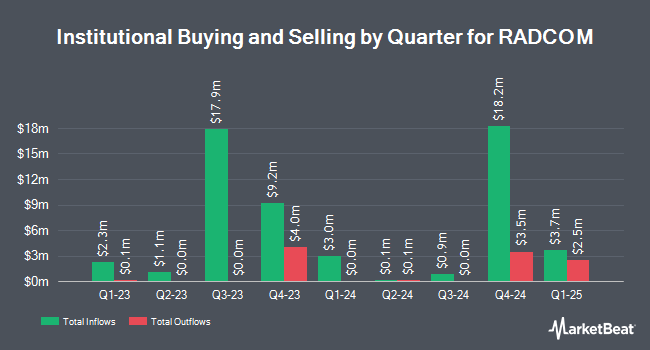

Acuitas Investments LLC boosted its stake in shares of RADCOM Ltd. (NASDAQ:RDCM - Free Report) by 21.6% during the 4th quarter, according to its most recent 13F filing with the SEC. The firm owned 183,498 shares of the technology company's stock after buying an additional 32,631 shares during the period. RADCOM makes up approximately 1.9% of Acuitas Investments LLC's holdings, making the stock its 28th biggest holding. Acuitas Investments LLC owned 1.17% of RADCOM worth $2,268,000 as of its most recent SEC filing.

Separately, Legato Capital Management LLC bought a new stake in shares of RADCOM in the fourth quarter valued at about $848,000. Institutional investors and hedge funds own 48.32% of the company's stock.

RADCOM Price Performance

NASDAQ:RDCM traded down $0.98 on Friday, hitting $12.81. 102,284 shares of the company's stock were exchanged, compared to its average volume of 121,758. The firm has a 50-day moving average price of $12.96 and a 200-day moving average price of $11.35. RADCOM Ltd. has a 52 week low of $8.52 and a 52 week high of $15.98. The company has a market cap of $200.60 million, a P/E ratio of 29.11 and a beta of 0.90.

RADCOM (NASDAQ:RDCM - Get Free Report) last released its earnings results on Wednesday, February 12th. The technology company reported $0.14 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.19 by ($0.05). RADCOM had a return on equity of 8.18% and a net margin of 11.42%. On average, research analysts expect that RADCOM Ltd. will post 0.54 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

A number of equities research analysts recently issued reports on the company. Needham & Company LLC reissued a "buy" rating and issued a $16.00 target price on shares of RADCOM in a research report on Friday, January 17th. StockNews.com upgraded shares of RADCOM from a "buy" rating to a "strong-buy" rating in a report on Friday, February 14th.

View Our Latest Report on RADCOM

RADCOM Profile

(

Free Report)

RADCOM Ltd. provides 5G ready cloud-native, network intelligence, and service assurance solutions for telecom operators or communication service providers (CSPs). It offers RADCOM ACE, including RADCOM Service Assurance, a cloud-native, 5G-ready, and virtualized service assurance solutions, which allows telecom operators to gain end-to-end network visibility and customer experience insights across all networks; RADCOM Network Visibility, a cloud-native network packet broker and filtering solution that allows CSPs to manage network traffic at scale across multiple cloud environments, and control the visibility layer to perform analysis of select datasets; and RADCOM Network Insights, a business intelligence solution that offers insights for multiple use cases enabled by data captured and correlated through RADCOM Network Visibility and RADCOM Service Assurance.

Read More

Before you consider RADCOM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RADCOM wasn't on the list.

While RADCOM currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.