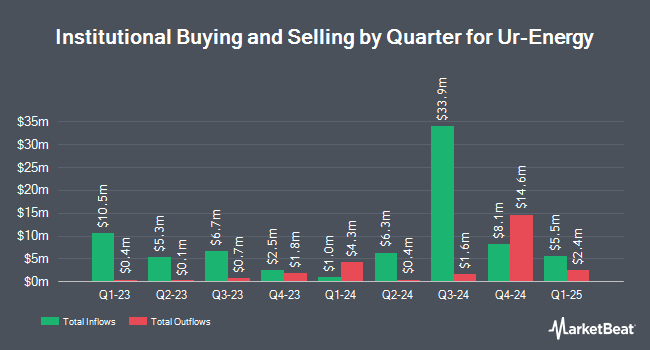

Acuitas Investments LLC bought a new stake in shares of Ur-Energy Inc. (NYSEAMERICAN:URG - Free Report) TSE: URE in the 4th quarter, according to its most recent filing with the SEC. The institutional investor bought 2,035,096 shares of the basic materials company's stock, valued at approximately $2,340,000. Ur-Energy comprises approximately 2.0% of Acuitas Investments LLC's investment portfolio, making the stock its 26th biggest holding. Acuitas Investments LLC owned 0.56% of Ur-Energy at the end of the most recent quarter.

Other hedge funds have also recently bought and sold shares of the company. FMR LLC grew its holdings in shares of Ur-Energy by 1,864.0% during the 3rd quarter. FMR LLC now owns 29,519 shares of the basic materials company's stock worth $35,000 after purchasing an additional 28,016 shares in the last quarter. Brave Asset Management Inc. bought a new position in Ur-Energy in the fourth quarter worth $41,000. Intech Investment Management LLC acquired a new stake in Ur-Energy during the third quarter worth $73,000. Ballentine Partners LLC increased its holdings in Ur-Energy by 235.6% in the 3rd quarter. Ballentine Partners LLC now owns 68,266 shares of the basic materials company's stock valued at $81,000 after buying an additional 47,922 shares during the period. Finally, JPMorgan Chase & Co. increased its holdings in Ur-Energy by 22.0% in the 3rd quarter. JPMorgan Chase & Co. now owns 147,268 shares of the basic materials company's stock valued at $175,000 after buying an additional 26,531 shares during the period. 57.51% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Separately, HC Wainwright reaffirmed a "buy" rating and set a $2.70 price objective on shares of Ur-Energy in a report on Tuesday, February 11th.

Check Out Our Latest Research Report on URG

Ur-Energy Price Performance

Shares of Ur-Energy stock traded down $0.02 during midday trading on Friday, hitting $0.94. 5,519,455 shares of the company were exchanged, compared to its average volume of 3,928,269. The company has a market capitalization of $343.49 million, a PE ratio of -7.26 and a beta of 1.10. Ur-Energy Inc. has a 52 week low of $0.91 and a 52 week high of $1.90.

Ur-Energy Profile

(

Free Report)

Ur-Energy Inc engages in the acquisition, exploration, development, and operation of uranium mineral properties. The company holds interests in 12 projects located in the United States. Its flagship property is the Lost Creek project comprising a total of approximately 1,800 unpatented mining claims and three Wyoming mineral leases covering an area of approximately 35,400 acres located in the Great Divide Basin, Wyoming.

Read More

Before you consider Ur-Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ur-Energy wasn't on the list.

While Ur-Energy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.