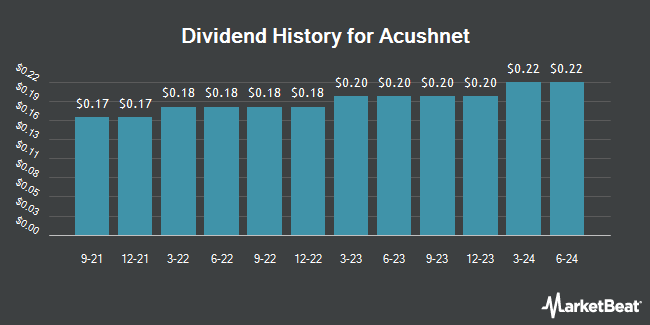

Acushnet Holdings Corp. (NYSE:GOLF - Get Free Report) declared a quarterly dividend on Thursday, November 7th,Wall Street Journal reports. Investors of record on Friday, December 6th will be paid a dividend of 0.215 per share on Friday, December 20th. This represents a $0.86 dividend on an annualized basis and a yield of 1.19%. The ex-dividend date of this dividend is Friday, December 6th.

Acushnet has raised its dividend payment by an average of 8.0% annually over the last three years. Acushnet has a dividend payout ratio of 24.9% meaning its dividend is sufficiently covered by earnings. Equities analysts expect Acushnet to earn $3.38 per share next year, which means the company should continue to be able to cover its $0.86 annual dividend with an expected future payout ratio of 25.4%.

Acushnet Stock Performance

GOLF stock traded up $1.52 during mid-day trading on Friday, reaching $72.53. The company had a trading volume of 472,807 shares, compared to its average volume of 293,039. Acushnet has a one year low of $53.68 and a one year high of $76.38. The stock has a market capitalization of $4.48 billion, a P/E ratio of 25.01 and a beta of 0.85. The company has a quick ratio of 1.27, a current ratio of 2.28 and a debt-to-equity ratio of 0.81. The stock's 50-day simple moving average is $63.73 and its two-hundred day simple moving average is $64.70.

Acushnet (NYSE:GOLF - Get Free Report) last issued its quarterly earnings data on Thursday, November 7th. The company reported $0.89 earnings per share for the quarter, beating the consensus estimate of $0.79 by $0.10. Acushnet had a net margin of 7.91% and a return on equity of 21.17%. The firm had revenue of $620.50 million for the quarter, compared to the consensus estimate of $620.40 million. During the same period last year, the firm posted $0.85 EPS. Acushnet's quarterly revenue was up 4.6% compared to the same quarter last year. Research analysts anticipate that Acushnet will post 3.02 EPS for the current year.

Analyst Ratings Changes

A number of equities analysts recently issued reports on the company. Truist Financial increased their price objective on Acushnet from $65.00 to $68.00 and gave the stock a "hold" rating in a report on Friday. Compass Point decreased their price target on Acushnet from $78.00 to $76.00 and set a "buy" rating for the company in a research note on Wednesday, August 7th. Finally, Jefferies Financial Group cut shares of Acushnet from a "buy" rating to a "hold" rating and cut their price objective for the company from $86.00 to $75.00 in a research note on Tuesday, September 17th. Three investment analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $71.40.

Check Out Our Latest Report on Acushnet

Acushnet Company Profile

(

Get Free Report)

Acushnet Holdings Corp. designs, develops, manufactures, and distributes golf products in the United States, Europe, the Middle East, Africa, Japan, Korea, and internationally. The company operates through four segments: Titleist Golf Balls, Titleist Golf Clubs, Titleist Golf Gear, and FootJoy Golf Wear.

Read More

Before you consider Acushnet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Acushnet wasn't on the list.

While Acushnet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.