Acushnet (NYSE:GOLF - Get Free Report) had its price target decreased by KeyCorp from $80.00 to $77.00 in a note issued to investors on Friday,Benzinga reports. The brokerage currently has an "overweight" rating on the stock. KeyCorp's price objective points to a potential upside of 18.79% from the stock's previous close.

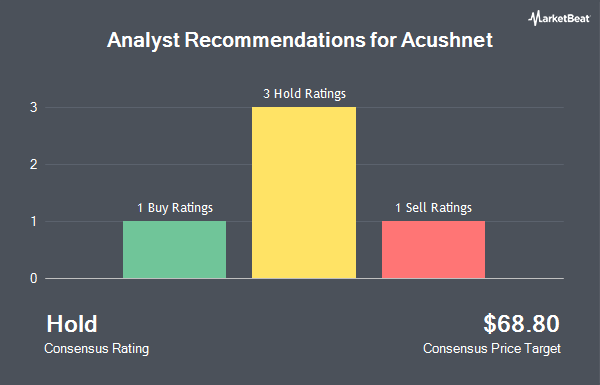

Several other equities research analysts have also recently weighed in on GOLF. Truist Financial upped their price target on Acushnet from $65.00 to $68.00 and gave the stock a "hold" rating in a research note on Friday, November 8th. JPMorgan Chase & Co. downgraded shares of Acushnet from a "neutral" rating to an "underweight" rating and reduced their target price for the stock from $69.00 to $64.00 in a research report on Thursday, January 23rd. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating and three have given a buy rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $72.80.

Get Our Latest Report on Acushnet

Acushnet Trading Up 1.1 %

Shares of NYSE:GOLF traded up $0.70 on Friday, hitting $64.82. The company had a trading volume of 528,054 shares, compared to its average volume of 338,314. The firm's 50-day simple moving average is $68.82 and its two-hundred day simple moving average is $67.59. The firm has a market capitalization of $3.94 billion, a price-to-earnings ratio of 22.05 and a beta of 0.86. The company has a quick ratio of 1.14, a current ratio of 2.10 and a debt-to-equity ratio of 0.79. Acushnet has a 1 year low of $58.54 and a 1 year high of $76.65.

Acushnet (NYSE:GOLF - Get Free Report) last issued its quarterly earnings data on Thursday, February 27th. The company reported ($0.02) EPS for the quarter, topping the consensus estimate of ($0.33) by $0.31. Acushnet had a net margin of 7.78% and a return on equity of 21.45%. The business had revenue of $445.17 billion during the quarter, compared to analyst estimates of $454.83 million. Equities analysts anticipate that Acushnet will post 3.06 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Acushnet

Institutional investors and hedge funds have recently modified their holdings of the stock. Blue Trust Inc. grew its position in Acushnet by 100.6% during the 4th quarter. Blue Trust Inc. now owns 351 shares of the company's stock valued at $25,000 after purchasing an additional 176 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its holdings in shares of Acushnet by 1.3% during the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 16,100 shares of the company's stock valued at $1,144,000 after buying an additional 213 shares during the last quarter. CANADA LIFE ASSURANCE Co increased its position in shares of Acushnet by 1.6% during the fourth quarter. CANADA LIFE ASSURANCE Co now owns 13,404 shares of the company's stock valued at $953,000 after acquiring an additional 217 shares in the last quarter. Point72 Asia Singapore Pte. Ltd. raised its holdings in Acushnet by 39.6% in the 4th quarter. Point72 Asia Singapore Pte. Ltd. now owns 818 shares of the company's stock worth $58,000 after acquiring an additional 232 shares during the last quarter. Finally, Semanteon Capital Management LP lifted its position in Acushnet by 3.0% in the 4th quarter. Semanteon Capital Management LP now owns 9,659 shares of the company's stock valued at $687,000 after acquiring an additional 281 shares in the last quarter. 53.12% of the stock is currently owned by institutional investors.

About Acushnet

(

Get Free Report)

Acushnet Holdings Corp. designs, develops, manufactures, and distributes golf products in the United States, Europe, the Middle East, Africa, Japan, Korea, and internationally. The company operates through four segments: Titleist Golf Balls, Titleist Golf Clubs, Titleist Golf Gear, and FootJoy Golf Wear.

See Also

Before you consider Acushnet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Acushnet wasn't on the list.

While Acushnet currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.