ACV Auctions (NASDAQ:ACVA - Get Free Report) was upgraded by Bank of America from a "neutral" rating to a "buy" rating in a research note issued on Wednesday,Briefing.com Automated Import reports. The brokerage currently has a $20.00 price target on the stock, down from their previous price target of $22.00. Bank of America's price objective suggests a potential upside of 45.14% from the stock's previous close.

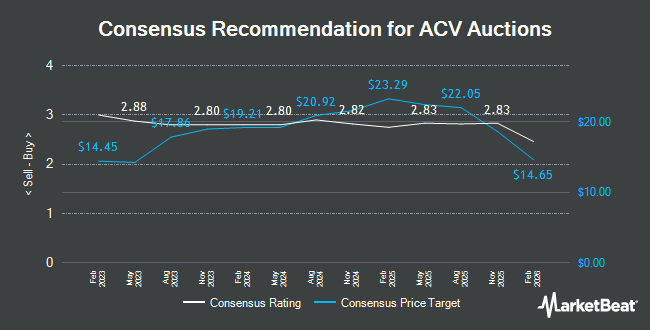

Other analysts have also issued reports about the stock. Citigroup upped their price target on shares of ACV Auctions from $22.00 to $27.00 and gave the stock a "buy" rating in a research note on Wednesday, November 27th. B. Riley increased their target price on shares of ACV Auctions from $24.00 to $27.00 and gave the company a "buy" rating in a research note on Tuesday, November 26th. Stephens raised shares of ACV Auctions to a "hold" rating in a research note on Saturday, February 1st. Needham & Company LLC cut their target price on shares of ACV Auctions from $28.00 to $25.00 and set a "buy" rating for the company in a research note on Thursday, February 20th. Finally, JMP Securities reissued a "market outperform" rating and set a $25.00 target price on shares of ACV Auctions in a research note on Monday, December 16th. Three investment analysts have rated the stock with a hold rating and eight have assigned a buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $23.05.

Get Our Latest Analysis on ACV Auctions

ACV Auctions Trading Up 5.2 %

ACV Auctions stock opened at $13.78 on Wednesday. The company has a quick ratio of 1.56, a current ratio of 1.56 and a debt-to-equity ratio of 0.28. The firm has a 50-day moving average price of $19.67 and a two-hundred day moving average price of $19.94. The firm has a market capitalization of $2.33 billion, a price-to-earnings ratio of -28.12 and a beta of 1.73. ACV Auctions has a 52-week low of $12.77 and a 52-week high of $23.46.

ACV Auctions (NASDAQ:ACVA - Get Free Report) last issued its quarterly earnings results on Wednesday, February 19th. The company reported ($0.14) earnings per share for the quarter, topping analysts' consensus estimates of ($0.15) by $0.01. The company had revenue of $159.51 million during the quarter, compared to analyst estimates of $156.77 million. ACV Auctions had a negative net margin of 12.51% and a negative return on equity of 12.94%. Sell-side analysts expect that ACV Auctions will post -0.07 earnings per share for the current year.

Insider Buying and Selling at ACV Auctions

In other ACV Auctions news, CFO William Zerella sold 15,000 shares of the company's stock in a transaction that occurred on Tuesday, January 7th. The shares were sold at an average price of $20.57, for a total value of $308,550.00. Following the transaction, the chief financial officer now owns 462,452 shares in the company, valued at approximately $9,512,637.64. This represents a 3.14 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Michael Waterman sold 30,162 shares of the company's stock in a transaction that occurred on Tuesday, January 7th. The shares were sold at an average price of $20.53, for a total transaction of $619,225.86. Following the completion of the transaction, the insider now owns 314,738 shares in the company, valued at approximately $6,461,571.14. This represents a 8.75 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 92,662 shares of company stock worth $1,935,451. 8.50% of the stock is currently owned by company insiders.

Institutional Trading of ACV Auctions

Several large investors have recently added to or reduced their stakes in the business. Moody National Bank Trust Division boosted its holdings in shares of ACV Auctions by 64.6% during the 4th quarter. Moody National Bank Trust Division now owns 79,199 shares of the company's stock worth $1,711,000 after buying an additional 31,094 shares during the period. Quadrature Capital Ltd bought a new stake in ACV Auctions in the 3rd quarter valued at $566,000. TimesSquare Capital Management LLC raised its stake in shares of ACV Auctions by 6.7% in the 4th quarter. TimesSquare Capital Management LLC now owns 1,891,627 shares of the company's stock valued at $40,859,000 after buying an additional 118,421 shares in the last quarter. JPMorgan Chase & Co. raised its stake in shares of ACV Auctions by 10.9% in the 3rd quarter. JPMorgan Chase & Co. now owns 3,167,615 shares of the company's stock valued at $64,398,000 after buying an additional 311,465 shares in the last quarter. Finally, Quantbot Technologies LP acquired a new position in shares of ACV Auctions in the 3rd quarter valued at $2,035,000. 88.55% of the stock is owned by institutional investors.

ACV Auctions Company Profile

(

Get Free Report)

ACV Auctions Inc operates a digital marketplace that connects buyers and sellers for the online auction of wholesale vehicles. The company's marketplace platform includes digital marketplace, which connects buyers and sellers by providing online auction, which facilitates real-time transactions of wholesale vehicles; Run List for pre-filtering and pre-screening of vehicles up to 24 hours prior to an auction taking place; ACV transportation service to enable the buyers to see real-time transportation quotes and status reports of the vehicle; ACV capital, a short-term inventory financing services for buyers to purchase vehicles; and Go Green's seller assurance service for against claims related to defects in the vehicle.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ACV Auctions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACV Auctions wasn't on the list.

While ACV Auctions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.