AdaptHealth (NASDAQ:AHCO - Get Free Report) had its price target lowered by analysts at Robert W. Baird from $16.00 to $14.00 in a research report issued to clients and investors on Wednesday, Benzinga reports. The firm presently has an "outperform" rating on the stock. Robert W. Baird's price objective would suggest a potential upside of 39.03% from the company's current price.

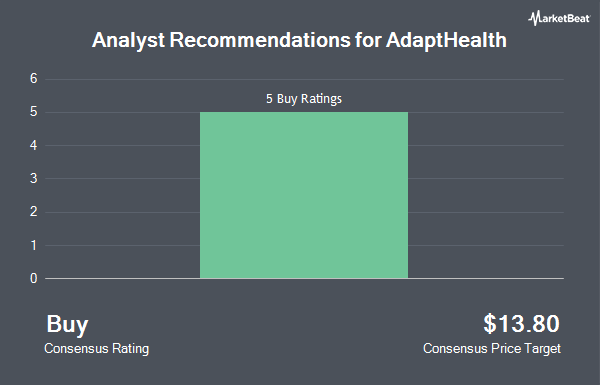

Separately, Royal Bank of Canada reissued an "outperform" rating and issued a $13.00 price objective on shares of AdaptHealth in a research report on Monday, August 12th. One analyst has rated the stock with a sell rating, one has given a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $11.36.

Get Our Latest Stock Report on AdaptHealth

AdaptHealth Stock Performance

AdaptHealth stock traded up $0.89 during midday trading on Wednesday, reaching $10.07. 1,495,926 shares of the company's stock were exchanged, compared to its average volume of 1,063,358. The company has a debt-to-equity ratio of 1.38, a quick ratio of 0.94 and a current ratio of 1.15. The stock's 50-day simple moving average is $10.76 and its 200 day simple moving average is $10.44. The firm has a market cap of $1.35 billion, a price-to-earnings ratio of -1.88, a P/E/G ratio of 1.63 and a beta of 1.11. AdaptHealth has a 52 week low of $6.37 and a 52 week high of $11.90.

AdaptHealth (NASDAQ:AHCO - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The company reported $0.15 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.17 by ($0.02). The firm had revenue of $805.90 million for the quarter, compared to analyst estimates of $809.32 million. AdaptHealth had a positive return on equity of 9.58% and a negative net margin of 21.20%. The business's revenue was up .2% on a year-over-year basis. During the same quarter in the prior year, the business posted $0.19 EPS. On average, analysts expect that AdaptHealth will post 0.87 earnings per share for the current fiscal year.

Insider Activity

In other news, COO Shaw Rietkerk sold 25,000 shares of the firm's stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $11.24, for a total value of $281,000.00. Following the transaction, the chief operating officer now owns 212,611 shares in the company, valued at $2,389,747.64. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. In related news, Director David Solomon Williams III sold 4,000 shares of AdaptHealth stock in a transaction on Thursday, August 29th. The stock was sold at an average price of $11.26, for a total transaction of $45,040.00. Following the sale, the director now directly owns 36,899 shares in the company, valued at approximately $415,482.74. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, COO Shaw Rietkerk sold 25,000 shares of AdaptHealth stock in a transaction on Friday, September 20th. The stock was sold at an average price of $11.24, for a total value of $281,000.00. Following the sale, the chief operating officer now owns 212,611 shares in the company, valued at $2,389,747.64. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 4.43% of the company's stock.

Hedge Funds Weigh In On AdaptHealth

Institutional investors have recently added to or reduced their stakes in the business. Covestor Ltd lifted its holdings in shares of AdaptHealth by 279.6% in the 1st quarter. Covestor Ltd now owns 3,109 shares of the company's stock worth $36,000 after acquiring an additional 2,290 shares during the last quarter. Canada Pension Plan Investment Board bought a new position in AdaptHealth during the 2nd quarter valued at approximately $58,000. Blue Trust Inc. bought a new position in shares of AdaptHealth during the second quarter valued at approximately $85,000. Innealta Capital LLC purchased a new stake in shares of AdaptHealth in the 2nd quarter worth about $101,000. Finally, Quest Partners LLC boosted its stake in shares of AdaptHealth by 11,522.7% during the 2nd quarter. Quest Partners LLC now owns 10,228 shares of the company's stock valued at $102,000 after purchasing an additional 10,140 shares in the last quarter. 82.67% of the stock is currently owned by institutional investors.

About AdaptHealth

(

Get Free Report)

AdaptHealth Corp., together with its subsidiaries, sells home medical equipment (HME), medical supplies, and home and related services in the United States. The company provides sleep therapy equipment, supplies, and related services, such as CPAP and bi-PAP services to individuals suffering from obstructive sleep apnea; medical devices and supplies, including continuous glucose monitors and insulin pumps for the treatment of diabetes; HME to patients discharged from acute care and other facilities; oxygen and related chronic therapy services in the home; and other HME devices and supplies on behalf of chronically ill patients with wound care, urological, incontinence, ostomy, and nutritional supply needs.

Further Reading

Before you consider AdaptHealth, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AdaptHealth wasn't on the list.

While AdaptHealth currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.