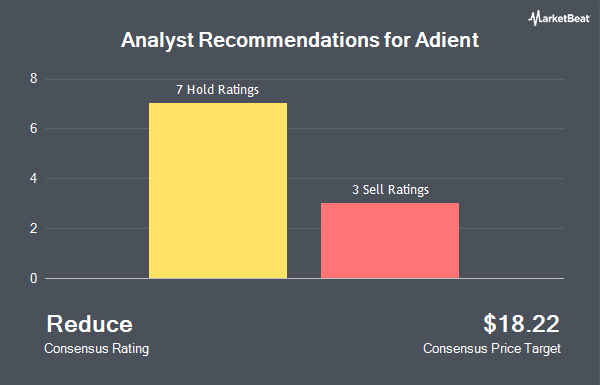

Adient plc (NYSE:ADNT - Get Free Report) has earned a consensus recommendation of "Reduce" from the nine research firms that are currently covering the firm, Marketbeat reports. Two research analysts have rated the stock with a sell recommendation and seven have given a hold recommendation to the company. The average 12 month price objective among brokers that have covered the stock in the last year is $20.88.

ADNT has been the subject of a number of recent research reports. Barclays lowered their price objective on shares of Adient from $24.00 to $21.00 and set an "equal weight" rating for the company in a report on Wednesday, January 22nd. Bank of America lowered Adient from a "neutral" rating to an "underperform" rating and lowered their target price for the company from $24.00 to $18.00 in a research note on Tuesday, March 4th. UBS Group raised their target price on shares of Adient from $19.00 to $20.00 and gave the stock a "neutral" rating in a report on Wednesday, January 29th. JPMorgan Chase & Co. cut their price target on shares of Adient from $24.00 to $21.00 and set a "neutral" rating on the stock in a report on Monday, January 27th. Finally, Wells Fargo & Company cut shares of Adient from an "overweight" rating to an "equal weight" rating and decreased their price objective for the company from $27.00 to $20.00 in a research report on Monday, December 16th.

Read Our Latest Analysis on Adient

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently made changes to their positions in the company. Point72 Hong Kong Ltd purchased a new position in Adient during the fourth quarter valued at $25,000. R Squared Ltd bought a new position in shares of Adient in the 4th quarter worth about $32,000. Versant Capital Management Inc boosted its stake in Adient by 10,316.7% during the fourth quarter. Versant Capital Management Inc now owns 1,875 shares of the company's stock worth $32,000 after acquiring an additional 1,857 shares in the last quarter. IFP Advisors Inc boosted its position in shares of Adient by 6,924.2% in the 4th quarter. IFP Advisors Inc now owns 2,318 shares of the company's stock worth $40,000 after purchasing an additional 2,285 shares in the last quarter. Finally, Sterling Capital Management LLC grew its stake in shares of Adient by 803.6% in the fourth quarter. Sterling Capital Management LLC now owns 2,738 shares of the company's stock worth $47,000 after acquiring an additional 2,435 shares during the last quarter. Hedge funds and other institutional investors own 92.44% of the company's stock.

Adient Price Performance

Shares of NYSE:ADNT traded down $1.57 during trading on Monday, reaching $13.53. The company had a trading volume of 2,277,502 shares, compared to its average volume of 1,296,939. The company has a fifty day moving average of $16.11 and a two-hundred day moving average of $18.58. The company has a current ratio of 1.08, a quick ratio of 0.86 and a debt-to-equity ratio of 1.11. The stock has a market capitalization of $1.14 billion, a P/E ratio of 676.25, a price-to-earnings-growth ratio of 0.34 and a beta of 2.27. Adient has a 12 month low of $13.34 and a 12 month high of $33.74.

Adient (NYSE:ADNT - Get Free Report) last issued its quarterly earnings results on Tuesday, January 28th. The company reported $0.27 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.32 by ($0.05). Adient had a positive return on equity of 6.94% and a negative net margin of 0.01%. During the same period in the prior year, the business posted $0.31 EPS. Equities research analysts forecast that Adient will post 1.76 earnings per share for the current year.

About Adient

(

Get Free ReportAdient plc engages in the design, development, manufacture, and market of seating systems and components for passenger cars, commercial vehicles, and light trucks. The company's automotive seating solutions include complete seating systems, frames, mechanisms, foams, head restraints, armrests, and trim covers.

Further Reading

Before you consider Adient, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adient wasn't on the list.

While Adient currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.