Segall Bryant & Hamill LLC trimmed its stake in ADMA Biologics, Inc. (NASDAQ:ADMA - Free Report) by 22.1% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 351,339 shares of the biotechnology company's stock after selling 99,936 shares during the quarter. Segall Bryant & Hamill LLC owned 0.15% of ADMA Biologics worth $7,023,000 at the end of the most recent quarter.

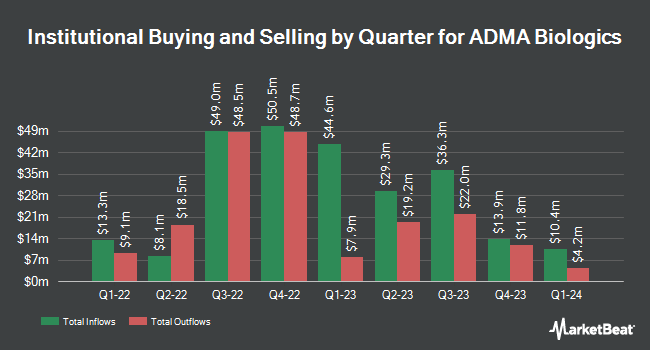

Other hedge funds have also added to or reduced their stakes in the company. Assenagon Asset Management S.A. boosted its holdings in ADMA Biologics by 2.7% in the third quarter. Assenagon Asset Management S.A. now owns 3,474,455 shares of the biotechnology company's stock worth $69,454,000 after acquiring an additional 92,281 shares in the last quarter. Seven Eight Capital LP purchased a new position in shares of ADMA Biologics in the second quarter worth $1,992,000. Principal Financial Group Inc. raised its stake in shares of ADMA Biologics by 785.7% in the third quarter. Principal Financial Group Inc. now owns 1,194,221 shares of the biotechnology company's stock worth $23,872,000 after purchasing an additional 1,059,394 shares during the last quarter. Louisiana State Employees Retirement System purchased a new position in shares of ADMA Biologics in the third quarter worth $2,253,000. Finally, Point72 Asset Management L.P. purchased a new position in shares of ADMA Biologics in the second quarter worth $1,157,000. 75.68% of the stock is owned by institutional investors.

ADMA Biologics Stock Performance

ADMA Biologics stock traded down $0.12 during mid-day trading on Friday, reaching $21.18. 2,104,407 shares of the stock traded hands, compared to its average volume of 3,637,081. The stock has a market capitalization of $5.01 billion, a PE ratio of 76.07 and a beta of 0.64. The company has a debt-to-equity ratio of 0.48, a current ratio of 7.09 and a quick ratio of 3.26. ADMA Biologics, Inc. has a 12-month low of $3.60 and a 12-month high of $23.64. The business's 50-day moving average is $18.80 and its 200-day moving average is $14.73.

ADMA Biologics (NASDAQ:ADMA - Get Free Report) last posted its quarterly earnings data on Thursday, November 7th. The biotechnology company reported $0.15 EPS for the quarter, beating analysts' consensus estimates of $0.13 by $0.02. The company had revenue of $119.84 million during the quarter, compared to analysts' expectations of $107.25 million. ADMA Biologics had a return on equity of 53.20% and a net margin of 17.80%. During the same quarter in the prior year, the business earned $0.01 earnings per share. As a group, sell-side analysts predict that ADMA Biologics, Inc. will post 0.52 EPS for the current fiscal year.

Insider Buying and Selling at ADMA Biologics

In other news, CEO Adam S. Grossman sold 236,889 shares of the company's stock in a transaction dated Monday, August 26th. The stock was sold at an average price of $17.69, for a total value of $4,190,566.41. Following the completion of the transaction, the chief executive officer now owns 2,059,726 shares of the company's stock, valued at $36,436,552.94. This represents a 10.31 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, Director Lawrence P. Guiheen sold 9,000 shares of the stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $18.47, for a total value of $166,230.00. Following the transaction, the director now directly owns 153,941 shares of the company's stock, valued at approximately $2,843,290.27. The trade was a 5.52 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 421,900 shares of company stock valued at $7,445,771. Company insiders own 3.70% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on ADMA shares. Raymond James boosted their price target on ADMA Biologics from $18.00 to $25.00 and gave the stock a "strong-buy" rating in a research note on Friday, November 8th. HC Wainwright boosted their price target on ADMA Biologics from $18.00 to $26.00 and gave the stock a "buy" rating in a research note on Friday, November 8th. Finally, Cantor Fitzgerald restated an "overweight" rating and issued a $20.00 price target on shares of ADMA Biologics in a research note on Friday, September 20th.

Read Our Latest Stock Analysis on ADMA Biologics

ADMA Biologics Company Profile

(

Free Report)

ADMA Biologics, Inc, a biopharmaceutical company, engages in developing, manufacturing, and marketing specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally. The company offers BIVIGAM, an intravenous immune globulin (IVIG) product indicated for the treatment of primary humoral immunodeficiency (PI); ASCENIV, an IVIG product for the treatment of PI; and Nabi-HB for the treatment of acute exposure to blood containing Hepatitis B surface antigen and other listed exposures to Hepatitis B.

Recommended Stories

Before you consider ADMA Biologics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADMA Biologics wasn't on the list.

While ADMA Biologics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.