Sei Investments Co. increased its position in shares of ADT Inc. (NYSE:ADT - Free Report) by 1,132.1% in the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 243,702 shares of the security and automation business's stock after purchasing an additional 223,922 shares during the period. Sei Investments Co.'s holdings in ADT were worth $1,684,000 as of its most recent SEC filing.

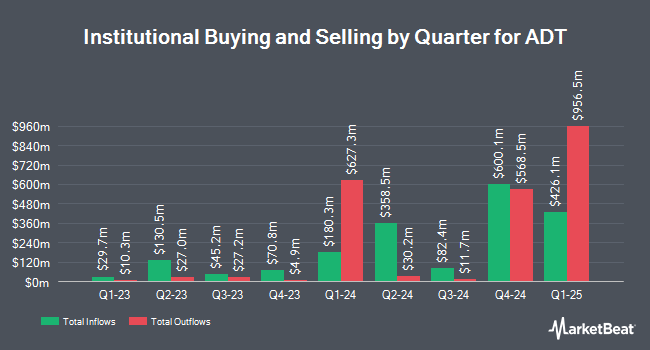

A number of other hedge funds have also recently added to or reduced their stakes in ADT. American Century Companies Inc. raised its stake in shares of ADT by 96.1% during the 4th quarter. American Century Companies Inc. now owns 170,768 shares of the security and automation business's stock worth $1,180,000 after buying an additional 83,689 shares in the last quarter. Quantbot Technologies LP grew its holdings in ADT by 47.1% during the fourth quarter. Quantbot Technologies LP now owns 366,793 shares of the security and automation business's stock worth $2,535,000 after acquiring an additional 117,423 shares during the period. Sciencast Management LP purchased a new position in ADT in the fourth quarter worth $100,000. Magnetar Financial LLC acquired a new stake in ADT in the fourth quarter valued at $73,000. Finally, Xponance Inc. lifted its holdings in ADT by 37.1% in the fourth quarter. Xponance Inc. now owns 15,077 shares of the security and automation business's stock valued at $104,000 after acquiring an additional 4,079 shares during the period. Institutional investors and hedge funds own 87.22% of the company's stock.

ADT Price Performance

Shares of ADT stock traded down $0.26 on Thursday, hitting $7.71. The company's stock had a trading volume of 12,383,611 shares, compared to its average volume of 7,437,452. The company has a market capitalization of $6.75 billion, a P/E ratio of 8.38 and a beta of 1.42. ADT Inc. has a 52-week low of $6.10 and a 52-week high of $8.39. The firm has a fifty day moving average price of $7.73 and a 200-day moving average price of $7.43. The company has a quick ratio of 0.64, a current ratio of 0.81 and a debt-to-equity ratio of 1.93.

ADT Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Thursday, April 3rd. Shareholders of record on Thursday, March 13th were issued a $0.055 dividend. This represents a $0.22 annualized dividend and a dividend yield of 2.86%. The ex-dividend date of this dividend was Thursday, March 13th. ADT's dividend payout ratio (DPR) is presently 41.51%.

Analysts Set New Price Targets

A number of brokerages have recently issued reports on ADT. Royal Bank of Canada reiterated a "sector perform" rating and issued a $9.00 price target on shares of ADT in a report on Wednesday, January 29th. Morgan Stanley increased their target price on shares of ADT from $8.50 to $9.00 and gave the company an "equal weight" rating in a report on Thursday, December 12th. Finally, Barclays raised ADT from an "underweight" rating to an "equal weight" rating and boosted their price target for the stock from $7.00 to $9.00 in a research note on Friday, April 4th.

View Our Latest Report on ADT

ADT Profile

(

Free Report)

ADT Inc provides security, interactive, and smart home solutions to residential and small business customers in the United States. It operates through two segments, Consumer and Small Business, and Solar. The company provides burglar and life safety alarms, smart security cameras, smart home automation systems, and video surveillance systems.

Featured Stories

Before you consider ADT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADT wasn't on the list.

While ADT currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.