Advance Auto Parts (NYSE:AAP - Get Free Report)'s stock had its "neutral" rating restated by equities research analysts at DA Davidson in a note issued to investors on Friday,Benzinga reports. They presently have a $45.00 price objective on the stock. DA Davidson's price target would suggest a potential upside of 17.83% from the stock's previous close.

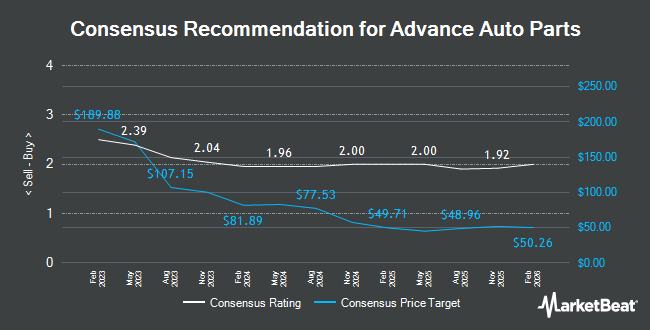

Several other equities analysts have also issued reports on AAP. The Goldman Sachs Group cut their target price on Advance Auto Parts from $60.00 to $43.00 and set a "neutral" rating on the stock in a research note on Friday. Evercore ISI dropped their target price on shares of Advance Auto Parts from $71.00 to $67.00 and set an "in-line" rating on the stock in a research report on Tuesday, October 22nd. Wedbush reaffirmed an "outperform" rating and issued a $55.00 price target on shares of Advance Auto Parts in a report on Friday. TD Cowen dropped their price objective on shares of Advance Auto Parts from $65.00 to $55.00 and set a "hold" rating on the stock in a report on Friday, August 23rd. Finally, Royal Bank of Canada lowered their price target on Advance Auto Parts from $52.00 to $46.00 and set a "sector perform" rating for the company in a research report on Monday. One investment analyst has rated the stock with a sell rating, fifteen have issued a hold rating and one has assigned a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus target price of $49.14.

Check Out Our Latest Analysis on Advance Auto Parts

Advance Auto Parts Stock Down 7.3 %

Shares of AAP stock traded down $3.01 on Friday, hitting $38.19. The stock had a trading volume of 3,178,065 shares, compared to its average volume of 2,041,584. Advance Auto Parts has a one year low of $35.59 and a one year high of $88.56. The business has a 50 day moving average price of $39.06 and a 200 day moving average price of $54.63. The company has a market cap of $2.28 billion, a PE ratio of 3,819.00, a P/E/G ratio of 1.33 and a beta of 1.17. The company has a quick ratio of 0.30, a current ratio of 1.23 and a debt-to-equity ratio of 0.69.

Advance Auto Parts (NYSE:AAP - Get Free Report) last announced its quarterly earnings results on Thursday, August 22nd. The company reported $0.75 earnings per share for the quarter, missing the consensus estimate of $0.97 by ($0.22). The business had revenue of $2.68 billion during the quarter, compared to analysts' expectations of $2.67 billion. Advance Auto Parts had a return on equity of 0.05% and a net margin of 0.01%. Advance Auto Parts's revenue for the quarter was down .1% on a year-over-year basis. During the same period in the previous year, the company posted $1.43 EPS. Research analysts anticipate that Advance Auto Parts will post 2.19 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently made changes to their positions in the business. Diversified Trust Co grew its holdings in shares of Advance Auto Parts by 3.5% during the second quarter. Diversified Trust Co now owns 6,787 shares of the company's stock worth $430,000 after buying an additional 232 shares in the last quarter. OLD National Bancorp IN raised its holdings in Advance Auto Parts by 6.8% in the 2nd quarter. OLD National Bancorp IN now owns 3,697 shares of the company's stock valued at $234,000 after acquiring an additional 237 shares during the last quarter. Covestor Ltd lifted its stake in Advance Auto Parts by 8.5% in the 1st quarter. Covestor Ltd now owns 3,395 shares of the company's stock worth $289,000 after purchasing an additional 266 shares in the last quarter. Sei Investments Co. lifted its stake in Advance Auto Parts by 0.5% in the 2nd quarter. Sei Investments Co. now owns 59,679 shares of the company's stock worth $3,779,000 after purchasing an additional 277 shares in the last quarter. Finally, Qsemble Capital Management LP grew its position in shares of Advance Auto Parts by 7.6% in the second quarter. Qsemble Capital Management LP now owns 4,036 shares of the company's stock valued at $256,000 after purchasing an additional 285 shares in the last quarter. Hedge funds and other institutional investors own 88.75% of the company's stock.

Advance Auto Parts Company Profile

(

Get Free Report)

Advance Auto Parts, Inc provides automotive replacement parts, accessories, batteries, and maintenance items for domestic and imported cars, vans, sport utility vehicles, and light and heavy duty trucks. The company offers battery accessories; belts and hoses; brakes and brake pads; chassis and climate control parts; clutches and drive shafts; engines and engine parts; exhaust systems and parts; hub assemblies; ignition components and wires; radiators and cooling parts; starters and alternators; and steering and alignment parts.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Advance Auto Parts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advance Auto Parts wasn't on the list.

While Advance Auto Parts currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.