Harvest Portfolios Group Inc. lifted its stake in shares of Advanced Micro Devices, Inc. (NASDAQ:AMD - Free Report) by 4.4% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 146,445 shares of the semiconductor manufacturer's stock after purchasing an additional 6,168 shares during the quarter. Harvest Portfolios Group Inc.'s holdings in Advanced Micro Devices were worth $24,029,000 at the end of the most recent quarter.

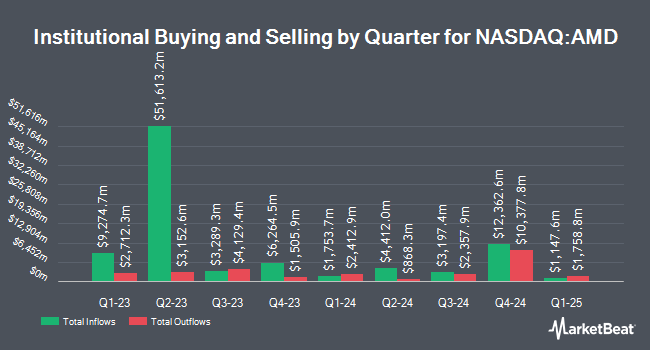

Several other hedge funds have also recently modified their holdings of AMD. Invictus Private Wealth LLC raised its holdings in Advanced Micro Devices by 93.3% during the third quarter. Invictus Private Wealth LLC now owns 52,472 shares of the semiconductor manufacturer's stock worth $8,610,000 after purchasing an additional 25,333 shares in the last quarter. Financial Security Advisor Inc. acquired a new position in Advanced Micro Devices during the 3rd quarter worth approximately $208,000. Catalina Capital Group LLC raised its stake in shares of Advanced Micro Devices by 9.6% during the 3rd quarter. Catalina Capital Group LLC now owns 7,761 shares of the semiconductor manufacturer's stock worth $1,273,000 after buying an additional 679 shares in the last quarter. Beacon Financial Advisory LLC lifted its holdings in shares of Advanced Micro Devices by 6.2% in the 3rd quarter. Beacon Financial Advisory LLC now owns 1,769 shares of the semiconductor manufacturer's stock valued at $290,000 after buying an additional 103 shares during the period. Finally, Avidian Wealth Enterprises LLC grew its holdings in Advanced Micro Devices by 2.4% during the third quarter. Avidian Wealth Enterprises LLC now owns 6,058 shares of the semiconductor manufacturer's stock worth $994,000 after acquiring an additional 141 shares during the period. 71.34% of the stock is owned by institutional investors and hedge funds.

Advanced Micro Devices Trading Up 2.4 %

Shares of AMD traded up $3.44 during mid-day trading on Wednesday, reaching $145.10. The company had a trading volume of 32,815,758 shares, compared to its average volume of 56,340,484. Advanced Micro Devices, Inc. has a fifty-two week low of $111.22 and a fifty-two week high of $227.30. The firm has a fifty day simple moving average of $154.39 and a 200-day simple moving average of $155.64. The stock has a market cap of $235.47 billion, a price-to-earnings ratio of 128.84, a price-to-earnings-growth ratio of 1.96 and a beta of 1.71. The company has a current ratio of 2.50, a quick ratio of 1.78 and a debt-to-equity ratio of 0.03.

Advanced Micro Devices (NASDAQ:AMD - Get Free Report) last issued its earnings results on Tuesday, October 29th. The semiconductor manufacturer reported $0.92 earnings per share for the quarter, meeting analysts' consensus estimates of $0.92. The firm had revenue of $6.82 billion for the quarter, compared to analysts' expectations of $6.71 billion. Advanced Micro Devices had a return on equity of 6.62% and a net margin of 7.52%. The firm's revenue for the quarter was up 17.6% compared to the same quarter last year. During the same quarter last year, the firm earned $0.53 earnings per share. On average, sell-side analysts anticipate that Advanced Micro Devices, Inc. will post 2.53 EPS for the current fiscal year.

Analyst Ratings Changes

A number of equities research analysts have commented on the company. Wedbush reissued an "outperform" rating and issued a $200.00 target price on shares of Advanced Micro Devices in a report on Wednesday, July 31st. Bank of America reiterated a "buy" rating and issued a $180.00 price objective on shares of Advanced Micro Devices in a research note on Thursday, October 3rd. Evercore ISI upped their target price on shares of Advanced Micro Devices from $193.00 to $198.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 30th. Morgan Stanley decreased their price target on Advanced Micro Devices from $178.00 to $169.00 and set an "equal weight" rating on the stock in a research note on Wednesday, October 30th. Finally, BNP Paribas raised Advanced Micro Devices to a "strong-buy" rating in a research note on Wednesday, July 31st. One research analyst has rated the stock with a sell rating, three have assigned a hold rating, twenty-eight have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $192.79.

Check Out Our Latest Analysis on Advanced Micro Devices

About Advanced Micro Devices

(

Free Report)

Advanced Micro Devices, Inc operates as a semiconductor company worldwide. It operates through Data Center, Client, Gaming, and Embedded segments. The company offers x86 microprocessors and graphics processing units (GPUs) as an accelerated processing unit, chipsets, data center, and professional GPUs; and embedded processors, and semi-custom system-on-chip (SoC) products, microprocessor and SoC development services and technology, data processing unites, field programmable gate arrays (FPGA), and adaptive SoC products.

Recommended Stories

Before you consider Advanced Micro Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list.

While Advanced Micro Devices currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.