Advantage Alpha Capital Partners LP reduced its stake in Trupanion, Inc. (NASDAQ:TRUP - Free Report) by 22.5% during the 3rd quarter, according to the company in its most recent filing with the SEC. The fund owned 63,499 shares of the financial services provider's stock after selling 18,414 shares during the quarter. Advantage Alpha Capital Partners LP owned 0.15% of Trupanion worth $2,666,000 at the end of the most recent reporting period.

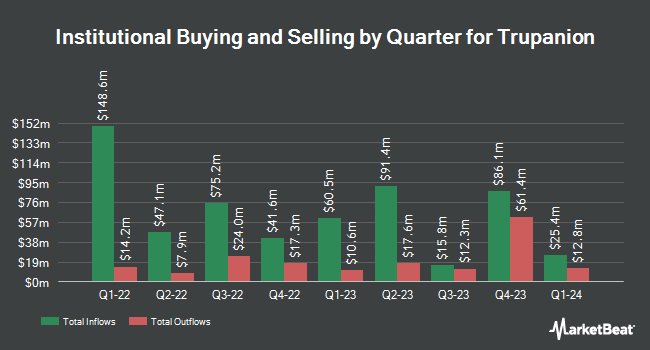

A number of other hedge funds and other institutional investors have also recently bought and sold shares of TRUP. Louisiana State Employees Retirement System boosted its stake in shares of Trupanion by 2.8% in the 2nd quarter. Louisiana State Employees Retirement System now owns 18,200 shares of the financial services provider's stock valued at $535,000 after buying an additional 500 shares during the period. GAMMA Investing LLC raised its holdings in Trupanion by 70.4% in the third quarter. GAMMA Investing LLC now owns 1,442 shares of the financial services provider's stock valued at $61,000 after acquiring an additional 596 shares in the last quarter. WINTON GROUP Ltd lifted its stake in Trupanion by 1.9% in the second quarter. WINTON GROUP Ltd now owns 37,673 shares of the financial services provider's stock worth $1,108,000 after acquiring an additional 685 shares during the last quarter. CANADA LIFE ASSURANCE Co grew its holdings in Trupanion by 2.0% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 43,060 shares of the financial services provider's stock worth $1,188,000 after acquiring an additional 830 shares in the last quarter. Finally, Quest Partners LLC acquired a new position in shares of Trupanion during the third quarter worth $37,000.

Trupanion Stock Performance

Shares of Trupanion stock traded up $0.89 on Tuesday, reaching $54.35. 357,290 shares of the stock were exchanged, compared to its average volume of 678,444. The company has a current ratio of 1.66, a quick ratio of 1.66 and a debt-to-equity ratio of 0.40. The firm has a market capitalization of $2.30 billion, a PE ratio of -169.34 and a beta of 1.69. Trupanion, Inc. has a 1-year low of $19.69 and a 1-year high of $57.90. The business has a fifty day moving average price of $49.19 and a two-hundred day moving average price of $39.67.

Trupanion (NASDAQ:TRUP - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The financial services provider reported $0.03 earnings per share for the quarter, beating analysts' consensus estimates of ($0.06) by $0.09. Trupanion had a negative return on equity of 4.36% and a negative net margin of 1.08%. The firm had revenue of $327.50 million for the quarter, compared to the consensus estimate of $321.79 million. During the same period in the previous year, the business earned ($0.10) earnings per share. The company's revenue for the quarter was up 14.6% compared to the same quarter last year. As a group, research analysts anticipate that Trupanion, Inc. will post -0.23 earnings per share for the current fiscal year.

Insider Activity at Trupanion

In other Trupanion news, SVP Emily Dreyer sold 900 shares of the company's stock in a transaction on Monday, November 25th. The stock was sold at an average price of $54.55, for a total value of $49,095.00. Following the sale, the senior vice president now owns 23,808 shares of the company's stock, valued at approximately $1,298,726.40. This represents a 3.64 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Margaret Tooth sold 7,500 shares of Trupanion stock in a transaction on Wednesday, August 28th. The stock was sold at an average price of $46.48, for a total value of $348,600.00. Following the transaction, the chief executive officer now directly owns 99,984 shares of the company's stock, valued at $4,647,256.32. This trade represents a 6.98 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 25,416 shares of company stock worth $1,304,618 over the last 90 days. Company insiders own 5.50% of the company's stock.

Analysts Set New Price Targets

Several brokerages have recently weighed in on TRUP. Bank of America raised their target price on Trupanion from $47.00 to $56.00 and gave the stock a "buy" rating in a research report on Friday, September 20th. Stifel Nicolaus boosted their price objective on shares of Trupanion from $30.00 to $40.00 and gave the stock a "hold" rating in a research report on Monday, September 23rd. Evercore ISI raised shares of Trupanion to a "strong-buy" rating in a research report on Friday, August 9th. Piper Sandler upped their price objective on shares of Trupanion from $45.00 to $57.00 and gave the company a "neutral" rating in a research note on Thursday, October 31st. Finally, Northland Securities boosted their target price on Trupanion from $45.00 to $50.00 and gave the company a "market perform" rating in a report on Thursday, October 31st. Three analysts have rated the stock with a hold rating, three have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, Trupanion presently has an average rating of "Moderate Buy" and an average price target of $44.67.

Get Our Latest Report on TRUP

Trupanion Profile

(

Free Report)

Trupanion, Inc, together with its subsidiaries, provides medical insurance for cats and dogs on a monthly subscription basis in the United States, Canada, Continental Europe, and Australia. The company operates in two segments, Subscription Business and Other Business. It serves pet owners and veterinarians.

Further Reading

Before you consider Trupanion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trupanion wasn't on the list.

While Trupanion currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.