Advisor Resource Council purchased a new stake in BWX Technologies, Inc. (NYSE:BWXT - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund purchased 4,944 shares of the technology company's stock, valued at approximately $537,000.

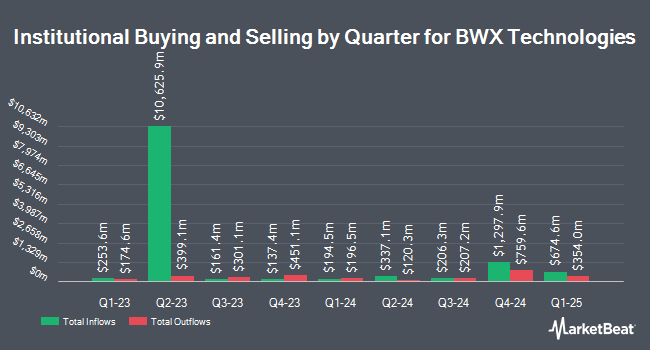

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Blue Trust Inc. raised its holdings in shares of BWX Technologies by 37.2% in the 2nd quarter. Blue Trust Inc. now owns 446 shares of the technology company's stock valued at $46,000 after purchasing an additional 121 shares during the period. Valeo Financial Advisors LLC grew its position in shares of BWX Technologies by 4.3% during the 3rd quarter. Valeo Financial Advisors LLC now owns 3,539 shares of the technology company's stock worth $385,000 after purchasing an additional 145 shares in the last quarter. Commonwealth Equity Services LLC grew its position in shares of BWX Technologies by 2.9% during the 2nd quarter. Commonwealth Equity Services LLC now owns 5,293 shares of the technology company's stock worth $503,000 after purchasing an additional 149 shares in the last quarter. XTX Topco Ltd grew its position in shares of BWX Technologies by 7.1% during the 2nd quarter. XTX Topco Ltd now owns 2,237 shares of the technology company's stock worth $213,000 after purchasing an additional 149 shares in the last quarter. Finally, Quent Capital LLC boosted its position in shares of BWX Technologies by 147.6% during the 3rd quarter. Quent Capital LLC now owns 255 shares of the technology company's stock worth $28,000 after acquiring an additional 152 shares in the last quarter. Institutional investors and hedge funds own 94.39% of the company's stock.

Wall Street Analyst Weigh In

BWXT has been the topic of several analyst reports. Deutsche Bank Aktiengesellschaft increased their price target on shares of BWX Technologies from $129.00 to $130.00 and gave the stock a "buy" rating in a research report on Wednesday. Barclays downgraded shares of BWX Technologies from an "equal weight" rating to an "underweight" rating and increased their price objective for the company from $75.00 to $90.00 in a research note on Wednesday, July 24th. StockNews.com downgraded shares of BWX Technologies from a "buy" rating to a "hold" rating in a research note on Wednesday. Finally, Truist Financial lifted their target price on shares of BWX Technologies from $95.00 to $106.00 and gave the stock a "hold" rating in a research note on Tuesday. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and five have issued a buy rating to the stock. According to data from MarketBeat.com, BWX Technologies presently has an average rating of "Moderate Buy" and an average price target of $110.67.

Check Out Our Latest Stock Analysis on BWX Technologies

BWX Technologies Price Performance

NYSE:BWXT traded up $2.68 during mid-day trading on Thursday, hitting $121.01. 1,021,656 shares of the stock traded hands, compared to its average volume of 626,037. The business's 50-day moving average price is $111.46 and its 200 day moving average price is $100.53. The company has a market cap of $11.06 billion, a PE ratio of 40.12, a price-to-earnings-growth ratio of 4.30 and a beta of 0.69. BWX Technologies, Inc. has a 12-month low of $74.69 and a 12-month high of $128.00. The company has a quick ratio of 2.23, a current ratio of 2.23 and a debt-to-equity ratio of 1.21.

BWX Technologies (NYSE:BWXT - Get Free Report) last released its earnings results on Monday, November 4th. The technology company reported $0.83 EPS for the quarter, beating the consensus estimate of $0.77 by $0.06. The company had revenue of $672.00 million for the quarter, compared to analyst estimates of $658.84 million. BWX Technologies had a net margin of 10.32% and a return on equity of 32.78%. The firm's quarterly revenue was up 13.9% compared to the same quarter last year. During the same quarter last year, the firm earned $0.67 EPS. On average, analysts expect that BWX Technologies, Inc. will post 3.2 EPS for the current fiscal year.

BWX Technologies Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 10th. Stockholders of record on Tuesday, November 19th will be given a $0.24 dividend. The ex-dividend date of this dividend is Tuesday, November 19th. This represents a $0.96 annualized dividend and a dividend yield of 0.79%. BWX Technologies's dividend payout ratio is 31.79%.

BWX Technologies Profile

(

Free Report)

BWX Technologies, Inc, together with its subsidiaries, manufactures and sells nuclear components in the United States, Canada, and internationally. It operates through two segments, Government Operations and Commercial Operations. The Government Operations segment designs and manufactures naval nuclear components, reactors, and nuclear fuel; fabrication activities; and supplies proprietary and sole-source valves, manifolds, and fittings to naval and commercial shipping customers.

Featured Articles

Before you consider BWX Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BWX Technologies wasn't on the list.

While BWX Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.