Advisors Asset Management Inc. trimmed its stake in shares of U.S. Bancorp (NYSE:USB - Free Report) by 23.8% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 170,239 shares of the financial services provider's stock after selling 53,231 shares during the period. Advisors Asset Management Inc.'s holdings in U.S. Bancorp were worth $7,785,000 as of its most recent SEC filing.

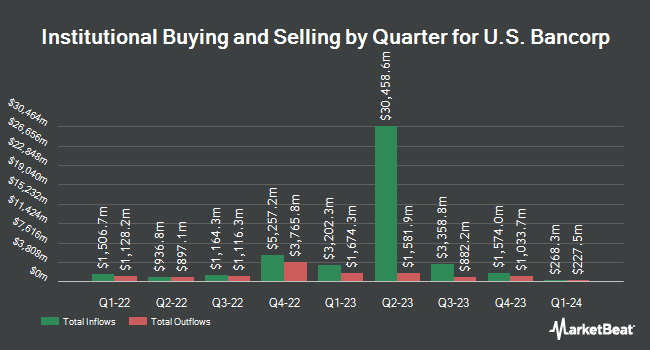

Other hedge funds and other institutional investors have also made changes to their positions in the company. McAdam LLC boosted its holdings in shares of U.S. Bancorp by 2.5% during the 3rd quarter. McAdam LLC now owns 8,503 shares of the financial services provider's stock worth $389,000 after buying an additional 209 shares during the period. Covestor Ltd boosted its holdings in U.S. Bancorp by 15.2% in the 3rd quarter. Covestor Ltd now owns 1,741 shares of the financial services provider's stock valued at $80,000 after purchasing an additional 230 shares during the period. Valmark Advisers Inc. boosted its holdings in U.S. Bancorp by 2.9% in the 2nd quarter. Valmark Advisers Inc. now owns 8,707 shares of the financial services provider's stock valued at $346,000 after purchasing an additional 242 shares during the period. Phillips Wealth Planners LLC boosted its holdings in U.S. Bancorp by 2.1% in the 3rd quarter. Phillips Wealth Planners LLC now owns 12,056 shares of the financial services provider's stock valued at $593,000 after purchasing an additional 243 shares during the period. Finally, Waldron Private Wealth LLC boosted its holdings in U.S. Bancorp by 1.9% in the 2nd quarter. Waldron Private Wealth LLC now owns 13,285 shares of the financial services provider's stock valued at $534,000 after purchasing an additional 247 shares during the period. 77.60% of the stock is currently owned by institutional investors and hedge funds.

U.S. Bancorp Stock Performance

Shares of NYSE:USB traded up $0.91 during midday trading on Thursday, reaching $51.65. The company's stock had a trading volume of 1,286,763 shares, compared to its average volume of 8,321,780. The stock has a fifty day moving average of $47.33 and a 200 day moving average of $43.91. U.S. Bancorp has a twelve month low of $36.49 and a twelve month high of $51.76. The firm has a market capitalization of $80.58 billion, a PE ratio of 15.52, a P/E/G ratio of 2.97 and a beta of 1.02. The company has a quick ratio of 0.81, a current ratio of 0.81 and a debt-to-equity ratio of 1.04.

U.S. Bancorp (NYSE:USB - Get Free Report) last posted its quarterly earnings data on Wednesday, October 16th. The financial services provider reported $1.03 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.99 by $0.04. The business had revenue of $6.86 billion for the quarter, compared to the consensus estimate of $6.90 billion. U.S. Bancorp had a net margin of 12.92% and a return on equity of 12.91%. The company's revenue was down 2.4% compared to the same quarter last year. During the same period last year, the firm posted $1.05 earnings per share. On average, equities analysts expect that U.S. Bancorp will post 3.93 EPS for the current fiscal year.

U.S. Bancorp announced that its Board of Directors has initiated a stock repurchase plan on Thursday, September 12th that allows the company to repurchase $5.00 billion in outstanding shares. This repurchase authorization allows the financial services provider to buy up to 7% of its shares through open market purchases. Shares repurchase plans are typically a sign that the company's board of directors believes its shares are undervalued.

U.S. Bancorp Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were given a dividend of $0.50 per share. This is a boost from U.S. Bancorp's previous quarterly dividend of $0.49. This represents a $2.00 annualized dividend and a yield of 3.87%. The ex-dividend date of this dividend was Monday, September 30th. U.S. Bancorp's dividend payout ratio (DPR) is presently 61.16%.

Insider Buying and Selling

In other news, insider Jodi L. Richard sold 25,000 shares of U.S. Bancorp stock in a transaction dated Friday, October 18th. The stock was sold at an average price of $49.03, for a total transaction of $1,225,750.00. Following the sale, the insider now owns 129,790 shares in the company, valued at approximately $6,363,603.70. The trade was a 16.15 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 0.23% of the stock is owned by company insiders.

Analysts Set New Price Targets

A number of analysts have issued reports on the stock. Evercore ISI boosted their price objective on shares of U.S. Bancorp from $51.00 to $54.00 and gave the company an "in-line" rating in a report on Wednesday, October 30th. The Goldman Sachs Group dropped their target price on shares of U.S. Bancorp from $48.00 to $46.00 and set a "neutral" rating for the company in a research report on Wednesday, September 11th. Morgan Stanley upgraded shares of U.S. Bancorp from an "equal weight" rating to an "overweight" rating and boosted their target price for the company from $54.00 to $57.00 in a research report on Monday, September 30th. Robert W. Baird set a $54.00 target price on shares of U.S. Bancorp in a research report on Thursday, October 17th. Finally, Royal Bank of Canada set a $53.00 price objective on shares of U.S. Bancorp in a research report on Thursday, October 17th. Thirteen investment analysts have rated the stock with a hold rating and eight have given a buy rating to the company's stock. According to data from MarketBeat.com, U.S. Bancorp presently has an average rating of "Hold" and a consensus price target of $51.22.

Read Our Latest Research Report on USB

U.S. Bancorp Profile

(

Free Report)

U.S. Bancorp, a financial services holding company, provides various financial services to individuals, businesses, institutional organizations, governmental entities, and other financial institutions in the United States. It operates through Wealth, Corporate, Commercial and Institutional Banking; Consumer and Business Banking; Payment Services; and Treasury and Corporate Support segments.

Featured Stories

Before you consider U.S. Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and U.S. Bancorp wasn't on the list.

While U.S. Bancorp currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.