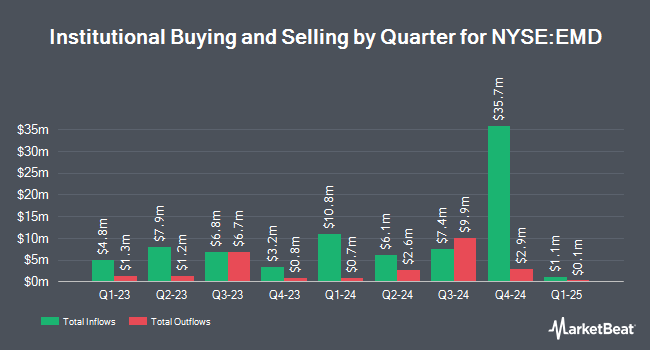

Advisors Asset Management Inc. grew its stake in shares of Western Asset Emerging Markets Debt Fund Inc. (NYSE:EMD - Free Report) by 24.6% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 502,914 shares of the company's stock after buying an additional 99,437 shares during the period. Advisors Asset Management Inc. owned 1.76% of Western Asset Emerging Markets Debt Fund worth $4,838,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other hedge funds have also recently modified their holdings of the company. Apollon Wealth Management LLC purchased a new stake in Western Asset Emerging Markets Debt Fund in the 4th quarter worth $245,000. Penserra Capital Management LLC purchased a new stake in shares of Western Asset Emerging Markets Debt Fund in the third quarter worth about $4,833,000. U.S. Capital Wealth Advisors LLC bought a new position in Western Asset Emerging Markets Debt Fund during the fourth quarter valued at approximately $602,000. Pathstone Holdings LLC grew its holdings in Western Asset Emerging Markets Debt Fund by 6.4% during the 3rd quarter. Pathstone Holdings LLC now owns 2,103,953 shares of the company's stock valued at $21,419,000 after buying an additional 125,714 shares in the last quarter. Finally, Jane Street Group LLC bought a new stake in Western Asset Emerging Markets Debt Fund in the 3rd quarter worth approximately $192,000. Hedge funds and other institutional investors own 33.05% of the company's stock.

Western Asset Emerging Markets Debt Fund Stock Down 0.5 %

Shares of NYSE EMD traded down $0.05 during midday trading on Monday, reaching $9.85. 152,929 shares of the stock traded hands, compared to its average volume of 196,888. The company's 50 day moving average is $9.84 and its 200 day moving average is $9.89. Western Asset Emerging Markets Debt Fund Inc. has a one year low of $8.89 and a one year high of $10.33.

Western Asset Emerging Markets Debt Fund Increases Dividend

The firm also recently disclosed a dividend, which will be paid on Tuesday, April 1st. Shareholders of record on Monday, March 24th will be paid a $0.09 dividend. This is a boost from Western Asset Emerging Markets Debt Fund's previous dividend of $0.09. The ex-dividend date of this dividend is Monday, March 24th.

Western Asset Emerging Markets Debt Fund Company Profile

(

Free Report)

Western Asset Emerging Markets Debt Fund Inc is an open ended fixed-income mutual fund launched and managed by Legg Mason Partners Fund Advisor, LLC. It is co-managed by Western Asset Management Company, Western Asset Management Company Limited and Western Asset Management Company Pte. Ltd. The fund invests in fixed income markets of emerging market countries across the globe.

Further Reading

Before you consider Western Asset Emerging Markets Debt Fund, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Asset Emerging Markets Debt Fund wasn't on the list.

While Western Asset Emerging Markets Debt Fund currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.