Advisors Asset Management Inc. boosted its stake in Kohl's Co. (NYSE:KSS - Free Report) by 6.5% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 504,947 shares of the company's stock after purchasing an additional 31,028 shares during the quarter. Advisors Asset Management Inc. owned approximately 0.45% of Kohl's worth $10,654,000 as of its most recent filing with the Securities & Exchange Commission.

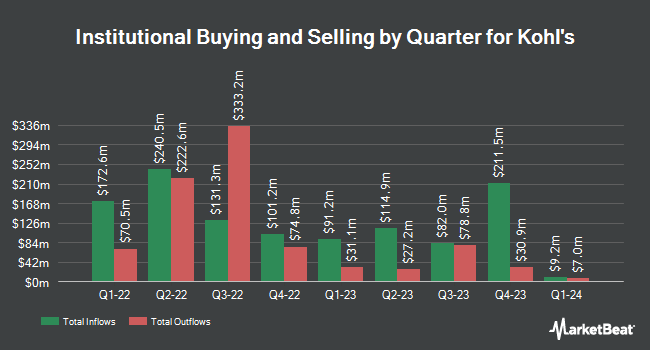

A number of other hedge funds have also added to or reduced their stakes in the stock. Dimensional Fund Advisors LP grew its position in Kohl's by 0.8% during the second quarter. Dimensional Fund Advisors LP now owns 6,434,081 shares of the company's stock worth $147,923,000 after buying an additional 52,126 shares in the last quarter. American Century Companies Inc. increased its position in shares of Kohl's by 26.3% in the second quarter. American Century Companies Inc. now owns 3,093,773 shares of the company's stock worth $71,126,000 after purchasing an additional 643,913 shares during the last quarter. AQR Capital Management LLC raised its stake in Kohl's by 348.0% in the second quarter. AQR Capital Management LLC now owns 2,180,952 shares of the company's stock valued at $50,118,000 after purchasing an additional 1,694,162 shares in the last quarter. Squarepoint Ops LLC lifted its position in Kohl's by 6,076.8% during the second quarter. Squarepoint Ops LLC now owns 1,834,509 shares of the company's stock valued at $42,175,000 after purchasing an additional 1,804,809 shares during the last quarter. Finally, Bank of New York Mellon Corp grew its stake in Kohl's by 0.7% in the 2nd quarter. Bank of New York Mellon Corp now owns 1,647,703 shares of the company's stock worth $37,881,000 after buying an additional 10,925 shares in the last quarter. Hedge funds and other institutional investors own 98.04% of the company's stock.

Analyst Upgrades and Downgrades

KSS has been the topic of several recent research reports. TD Cowen lowered Kohl's from a "buy" rating to a "hold" rating and reduced their price objective for the company from $25.00 to $21.00 in a research report on Friday, August 30th. JPMorgan Chase & Co. downgraded shares of Kohl's from a "neutral" rating to an "underweight" rating and set a $19.00 price target on the stock. in a research note on Thursday, August 29th. Morgan Stanley lowered shares of Kohl's to an "underweight" rating and reduced their target price for the company from $18.00 to $17.00 in a report on Tuesday, August 27th. Robert W. Baird cut their price target on shares of Kohl's from $27.00 to $25.00 and set an "outperform" rating for the company in a research report on Thursday, August 29th. Finally, Citigroup dropped their target price on Kohl's from $19.00 to $18.00 and set a "neutral" rating for the company in a report on Monday. Two analysts have rated the stock with a sell rating, five have issued a hold rating and one has issued a buy rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $20.43.

Read Our Latest Report on Kohl's

Insiders Place Their Bets

In other Kohl's news, EVP Feeney Siobhan Mc sold 16,367 shares of Kohl's stock in a transaction dated Thursday, October 3rd. The shares were sold at an average price of $19.27, for a total value of $315,392.09. Following the completion of the transaction, the executive vice president now directly owns 136,799 shares of the company's stock, valued at approximately $2,636,116.73. The trade was a 10.69 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Corporate insiders own 0.86% of the company's stock.

Kohl's Trading Up 0.4 %

KSS stock traded up $0.07 on Thursday, reaching $16.38. The company's stock had a trading volume of 1,265,574 shares, compared to its average volume of 6,015,455. The firm has a market cap of $1.82 billion, a PE ratio of 6.40, a PEG ratio of 1.17 and a beta of 1.94. The business has a fifty day simple moving average of $19.06 and a two-hundred day simple moving average of $20.99. Kohl's Co. has a 12-month low of $16.14 and a 12-month high of $29.60. The company has a debt-to-equity ratio of 0.98, a quick ratio of 0.16 and a current ratio of 1.08.

Kohl's (NYSE:KSS - Get Free Report) last announced its earnings results on Wednesday, August 28th. The company reported $0.59 EPS for the quarter, beating analysts' consensus estimates of $0.46 by $0.13. Kohl's had a net margin of 1.66% and a return on equity of 7.43%. The firm had revenue of $3.53 billion for the quarter, compared to analysts' expectations of $3.69 billion. During the same quarter in the previous year, the business posted $0.52 EPS. The company's quarterly revenue was down 4.2% on a year-over-year basis. As a group, research analysts forecast that Kohl's Co. will post 1.81 EPS for the current year.

Kohl's Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 24th. Shareholders of record on Wednesday, December 11th will be paid a dividend of $0.50 per share. This represents a $2.00 dividend on an annualized basis and a yield of 12.21%. The ex-dividend date of this dividend is Wednesday, December 11th. Kohl's's payout ratio is 78.43%.

Kohl's Profile

(

Free Report)

Kohl's Corporation operates as an omnichannel retailer in the United States. It offers branded apparel, footwear, accessories, beauty, and home products through its stores and website. The company provides its products primarily under the brand names of Croft & Barrow, Jumping Beans, SO, Sonoma Goods for Life, and Tek Gear, as well as Food Network, LC Lauren Conrad, Nine West, and Simply Vera Vera Wang.

Recommended Stories

Before you consider Kohl's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kohl's wasn't on the list.

While Kohl's currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.