Advisors Capital Management LLC bought a new position in shares of Alibaba Group Holding Limited (NYSE:BABA - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 6,455 shares of the specialty retailer's stock, valued at approximately $547,000.

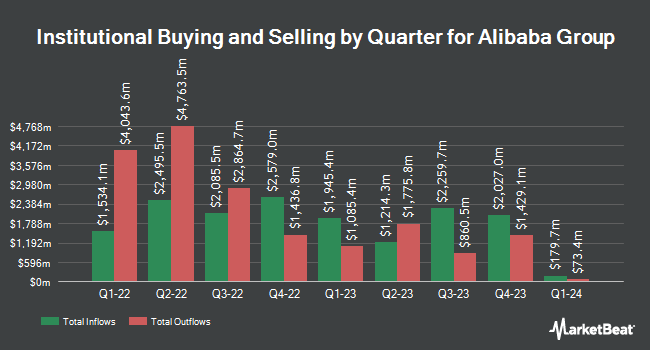

Several other hedge funds and other institutional investors have also bought and sold shares of the company. Decker Retirement Planning Inc. acquired a new position in shares of Alibaba Group in the 4th quarter valued at about $31,000. Sierra Ocean LLC bought a new stake in Alibaba Group in the fourth quarter worth approximately $32,000. Redwood Park Advisors LLC bought a new position in shares of Alibaba Group during the 4th quarter worth approximately $52,000. Kieckhefer Group LLC acquired a new stake in shares of Alibaba Group during the 4th quarter worth approximately $55,000. Finally, Vision Financial Markets LLC bought a new stake in shares of Alibaba Group in the 4th quarter valued at $55,000. Institutional investors and hedge funds own 13.47% of the company's stock.

Alibaba Group Price Performance

NYSE BABA traded up $2.28 during trading on Friday, reaching $109.03. The company's stock had a trading volume of 17,805,254 shares, compared to its average volume of 20,607,737. The stock has a market capitalization of $260.55 billion, a PE ratio of 15.76, a P/E/G ratio of 0.61 and a beta of 0.24. The company has a debt-to-equity ratio of 0.19, a current ratio of 1.48 and a quick ratio of 1.48. The firm has a fifty day moving average of $127.14 and a 200 day moving average of $104.77. Alibaba Group Holding Limited has a one year low of $68.36 and a one year high of $148.43.

Alibaba Group (NYSE:BABA - Get Free Report) last announced its earnings results on Thursday, February 20th. The specialty retailer reported $2.77 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.84 by ($0.07). The company had revenue of $38.38 billion for the quarter, compared to the consensus estimate of $38.19 billion. Alibaba Group had a net margin of 12.29% and a return on equity of 12.89%. Analysts expect that Alibaba Group Holding Limited will post 7.86 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Several equities research analysts have weighed in on BABA shares. Barclays lifted their price target on shares of Alibaba Group from $130.00 to $180.00 and gave the company an "overweight" rating in a research note on Friday, February 21st. StockNews.com raised Alibaba Group from a "hold" rating to a "buy" rating in a research note on Thursday, April 3rd. Benchmark raised their price objective on Alibaba Group from $118.00 to $190.00 and gave the company a "buy" rating in a research note on Friday, February 21st. Bank of America upped their target price on Alibaba Group from $117.00 to $150.00 and gave the stock a "buy" rating in a research report on Friday, February 21st. Finally, JPMorgan Chase & Co. lifted their price target on Alibaba Group from $125.00 to $170.00 and gave the company an "overweight" rating in a research note on Friday, February 21st. Fifteen equities research analysts have rated the stock with a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Buy" and a consensus target price of $150.36.

Check Out Our Latest Stock Report on Alibaba Group

Alibaba Group Company Profile

(

Free Report)

Alibaba Group Holding Limited, through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally. The company operates through seven segments: China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others.

Featured Articles

Before you consider Alibaba Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alibaba Group wasn't on the list.

While Alibaba Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.