Advisors Preferred LLC acquired a new stake in shares of CNX Resources Co. (NYSE:CNX - Free Report) during the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 45,521 shares of the oil and gas producer's stock, valued at approximately $1,699,000.

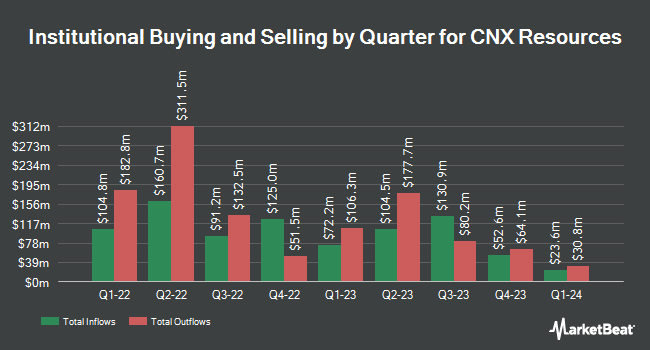

A number of other hedge funds have also modified their holdings of the stock. Sequoia Financial Advisors LLC lifted its stake in shares of CNX Resources by 3.5% during the third quarter. Sequoia Financial Advisors LLC now owns 13,135 shares of the oil and gas producer's stock valued at $428,000 after acquiring an additional 442 shares during the period. SeaBridge Investment Advisors LLC increased its position in shares of CNX Resources by 0.8% during the 4th quarter. SeaBridge Investment Advisors LLC now owns 90,301 shares of the oil and gas producer's stock worth $3,311,000 after purchasing an additional 759 shares during the last quarter. CWM LLC raised its holdings in shares of CNX Resources by 77.0% in the 3rd quarter. CWM LLC now owns 2,149 shares of the oil and gas producer's stock valued at $70,000 after purchasing an additional 935 shares during the period. Blue Trust Inc. raised its position in shares of CNX Resources by 135.4% in the third quarter. Blue Trust Inc. now owns 1,966 shares of the oil and gas producer's stock valued at $64,000 after purchasing an additional 1,131 shares during the period. Finally, GAMMA Investing LLC grew its holdings in CNX Resources by 62.1% in the 3rd quarter. GAMMA Investing LLC now owns 3,073 shares of the oil and gas producer's stock valued at $100,000 after buying an additional 1,177 shares in the last quarter. 95.16% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

CNX has been the topic of a number of recent analyst reports. TD Cowen initiated coverage on shares of CNX Resources in a research note on Wednesday, January 15th. They issued a "hold" rating and a $27.00 price objective on the stock. StockNews.com raised CNX Resources from a "sell" rating to a "hold" rating in a report on Monday, February 3rd. JPMorgan Chase & Co. cut shares of CNX Resources from a "neutral" rating to an "underweight" rating and boosted their target price for the stock from $31.00 to $37.00 in a research note on Thursday, December 5th. Truist Financial boosted their target price on shares of CNX Resources from $34.00 to $35.00 and gave the stock a "hold" rating in a report on Friday, December 6th. Finally, Morgan Stanley initiated coverage on CNX Resources in a research report on Friday, January 10th. They set an "underweight" rating and a $29.00 price objective for the company. Eight research analysts have rated the stock with a sell rating and seven have assigned a hold rating to the company's stock. Based on data from MarketBeat.com, CNX Resources has a consensus rating of "Reduce" and an average target price of $29.67.

View Our Latest Report on CNX

CNX Resources Price Performance

Shares of CNX Resources stock traded up $0.03 on Wednesday, reaching $29.85. The stock had a trading volume of 2,551,121 shares, compared to its average volume of 4,225,890. The business's 50 day moving average is $32.63 and its two-hundred day moving average is $32.41. The company has a market cap of $4.46 billion, a P/E ratio of -43.90, a price-to-earnings-growth ratio of 0.39 and a beta of 1.38. CNX Resources Co. has a 1 year low of $19.07 and a 1 year high of $41.93. The company has a current ratio of 0.33, a quick ratio of 0.32 and a debt-to-equity ratio of 0.45.

CNX Resources (NYSE:CNX - Get Free Report) last released its quarterly earnings results on Thursday, January 30th. The oil and gas producer reported $0.57 EPS for the quarter, beating analysts' consensus estimates of $0.43 by $0.14. CNX Resources had a negative net margin of 7.14% and a positive return on equity of 6.72%. As a group, research analysts anticipate that CNX Resources Co. will post 2.36 EPS for the current year.

Insider Activity

In related news, major shareholder Mfn Partners, Lp sold 1,075,000 shares of the firm's stock in a transaction that occurred on Monday, January 6th. The shares were sold at an average price of $31.09, for a total value of $33,421,750.00. Following the sale, the insider now directly owns 13,925,000 shares of the company's stock, valued at $432,928,250. This trade represents a 7.17 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Corporate insiders own 3.10% of the company's stock.

About CNX Resources

(

Free Report)

CNX Resources Corporation, an independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin. The company operates in two segments, Shale and Coalbed Methane (CBM). It produces and sells pipeline quality natural gas primarily for gas wholesalers.

Further Reading

Before you consider CNX Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CNX Resources wasn't on the list.

While CNX Resources currently has a "Strong Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.