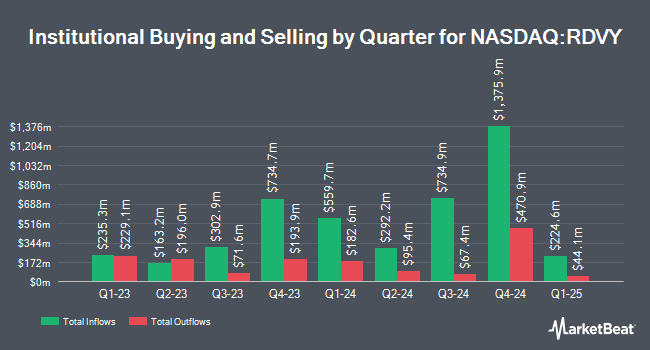

Advisory Alpha LLC reduced its stake in shares of First Trust NASDAQ Rising Dividend Achievers (NASDAQ:RDVY - Free Report) by 9.7% during the 4th quarter, according to its most recent filing with the SEC. The firm owned 38,357 shares of the company's stock after selling 4,106 shares during the period. Advisory Alpha LLC's holdings in First Trust NASDAQ Rising Dividend Achievers were worth $2,268,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in RDVY. Trueblood Wealth Management LLC grew its position in shares of First Trust NASDAQ Rising Dividend Achievers by 1.4% during the 4th quarter. Trueblood Wealth Management LLC now owns 12,233 shares of the company's stock valued at $723,000 after acquiring an additional 167 shares during the period. Financial Services Advisory Inc grew its position in shares of First Trust NASDAQ Rising Dividend Achievers by 1.2% during the 3rd quarter. Financial Services Advisory Inc now owns 14,883 shares of the company's stock valued at $881,000 after acquiring an additional 170 shares during the period. Crewe Advisors LLC grew its position in shares of First Trust NASDAQ Rising Dividend Achievers by 12.5% during the 3rd quarter. Crewe Advisors LLC now owns 1,635 shares of the company's stock valued at $97,000 after acquiring an additional 182 shares during the period. L & S Advisors Inc grew its position in shares of First Trust NASDAQ Rising Dividend Achievers by 1.0% during the 3rd quarter. L & S Advisors Inc now owns 19,350 shares of the company's stock valued at $1,146,000 after acquiring an additional 197 shares during the period. Finally, Wills Financial Group Inc. grew its position in shares of First Trust NASDAQ Rising Dividend Achievers by 4.9% during the 3rd quarter. Wills Financial Group Inc. now owns 4,544 shares of the company's stock valued at $269,000 after acquiring an additional 213 shares during the period.

First Trust NASDAQ Rising Dividend Achievers Stock Up 0.1 %

Shares of NASDAQ:RDVY traded up $0.05 during trading on Wednesday, reaching $62.70. 950,579 shares of the company's stock traded hands, compared to its average volume of 939,907. The firm has a market cap of $13.56 billion, a PE ratio of 10.08 and a beta of 1.15. First Trust NASDAQ Rising Dividend Achievers has a fifty-two week low of $50.24 and a fifty-two week high of $64.63. The company has a 50-day simple moving average of $61.44 and a 200-day simple moving average of $59.27.

First Trust NASDAQ Rising Dividend Achievers Cuts Dividend

The business also recently declared a dividend, which was paid on Tuesday, December 31st. Investors of record on Friday, December 13th were paid a $0.2956 dividend. The ex-dividend date was Friday, December 13th.

First Trust NASDAQ Rising Dividend Achievers Profile

(

Free Report)

The First Trust Rising Dividend Achievers ETF (RDVY) is an exchange-traded fund that is based on the NASDAQ US Rising Dividend Achievers index. The fund tracks an index of 50 large-cap stocks with rising, high-quality dividends. RDVY was launched on Jan 6, 2014 and is managed by First Trust.

Further Reading

Before you consider First Trust NASDAQ Rising Dividend Achievers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Trust NASDAQ Rising Dividend Achievers wasn't on the list.

While First Trust NASDAQ Rising Dividend Achievers currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.