Advyzon Investment Management LLC bought a new stake in shares of Merck & Co., Inc. (NYSE:MRK - Free Report) in the 4th quarter, according to its most recent filing with the SEC. The institutional investor bought 7,432 shares of the company's stock, valued at approximately $739,000.

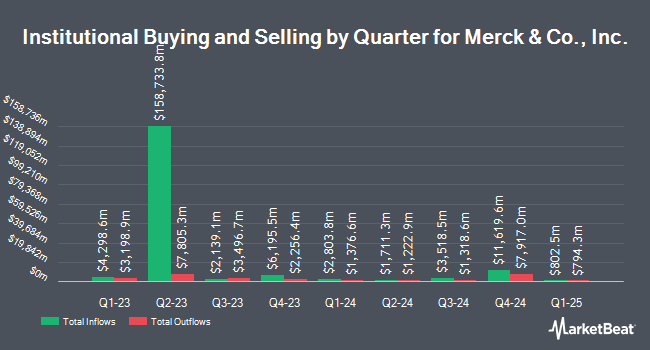

Several other large investors have also recently bought and sold shares of the stock. Wellington Management Group LLP increased its holdings in Merck & Co., Inc. by 4.6% in the 3rd quarter. Wellington Management Group LLP now owns 75,809,383 shares of the company's stock valued at $8,608,914,000 after buying an additional 3,327,404 shares during the period. International Assets Investment Management LLC increased its holdings in Merck & Co., Inc. by 11,876.3% in the 3rd quarter. International Assets Investment Management LLC now owns 2,971,554 shares of the company's stock valued at $337,450,000 after buying an additional 2,946,742 shares during the period. Van ECK Associates Corp increased its holdings in Merck & Co., Inc. by 748.0% in the 4th quarter. Van ECK Associates Corp now owns 3,149,841 shares of the company's stock valued at $313,346,000 after buying an additional 2,778,388 shares during the period. Two Sigma Advisers LP increased its holdings in Merck & Co., Inc. by 157.9% in the 3rd quarter. Two Sigma Advisers LP now owns 4,264,100 shares of the company's stock valued at $484,231,000 after buying an additional 2,610,800 shares during the period. Finally, Caisse DE Depot ET Placement DU Quebec increased its holdings in Merck & Co., Inc. by 68.7% in the 3rd quarter. Caisse DE Depot ET Placement DU Quebec now owns 5,388,551 shares of the company's stock valued at $611,924,000 after buying an additional 2,194,463 shares during the period. 76.07% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several equities research analysts have issued reports on the stock. Daiwa America lowered shares of Merck & Co., Inc. from a "strong-buy" rating to a "hold" rating in a report on Monday, November 11th. Deutsche Bank Aktiengesellschaft lowered shares of Merck & Co., Inc. from a "buy" rating to a "hold" rating and lowered their target price for the stock from $128.00 to $105.00 in a report on Tuesday. Wells Fargo & Company lowered their target price on shares of Merck & Co., Inc. from $125.00 to $110.00 and set an "equal weight" rating on the stock in a report on Friday, November 1st. Daiwa Capital Markets lowered shares of Merck & Co., Inc. from a "buy" rating to a "neutral" rating in a report on Monday, November 11th. Finally, Truist Financial reaffirmed a "hold" rating and issued a $110.00 target price (down previously from $130.00) on shares of Merck & Co., Inc. in a report on Wednesday, January 8th. One investment analyst has rated the stock with a sell rating, eleven have assigned a hold rating, nine have given a buy rating and three have assigned a strong buy rating to the company. According to data from MarketBeat, Merck & Co., Inc. has a consensus rating of "Moderate Buy" and a consensus target price of $116.39.

Get Our Latest Analysis on Merck & Co., Inc.

Insider Activity at Merck & Co., Inc.

In other Merck & Co., Inc. news, Director Inge G. Thulin purchased 2,833 shares of the firm's stock in a transaction dated Thursday, February 6th. The stock was bought at an average cost of $88.25 per share, with a total value of $250,012.25. Following the purchase, the director now directly owns 2,933 shares of the company's stock, valued at $258,837.25. The trade was a 2,833.00 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which can be accessed through this link. Also, insider Cristal N. Downing sold 2,361 shares of the firm's stock in a transaction that occurred on Thursday, February 6th. The stock was sold at an average price of $88.76, for a total transaction of $209,562.36. Following the transaction, the insider now directly owns 7,085 shares of the company's stock, valued at $628,864.60. This represents a 24.99 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.09% of the stock is currently owned by corporate insiders.

Merck & Co., Inc. Trading Up 2.0 %

Merck & Co., Inc. stock traded up $1.72 during trading hours on Friday, reaching $89.40. 15,641,321 shares of the company's stock traded hands, compared to its average volume of 17,774,290. The company has a debt-to-equity ratio of 0.79, a quick ratio of 1.15 and a current ratio of 1.36. Merck & Co., Inc. has a fifty-two week low of $81.04 and a fifty-two week high of $134.63. The firm has a market capitalization of $226.14 billion, a price-to-earnings ratio of 13.28, a PEG ratio of 0.77 and a beta of 0.38. The firm's 50 day moving average is $95.46 and its 200-day moving average is $104.21.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last announced its quarterly earnings results on Tuesday, February 4th. The company reported $1.72 earnings per share for the quarter, missing analysts' consensus estimates of $1.85 by ($0.13). The firm had revenue of $15.62 billion during the quarter, compared to analyst estimates of $15.51 billion. Merck & Co., Inc. had a net margin of 26.67% and a return on equity of 45.35%. The business's revenue was up 6.8% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.03 earnings per share. On average, analysts predict that Merck & Co., Inc. will post 9.01 earnings per share for the current year.

Merck & Co., Inc. Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, April 7th. Investors of record on Monday, March 17th will be given a $0.81 dividend. The ex-dividend date is Monday, March 17th. This represents a $3.24 dividend on an annualized basis and a dividend yield of 3.62%. Merck & Co., Inc.'s dividend payout ratio is 48.14%.

Merck & Co., Inc. declared that its Board of Directors has authorized a stock repurchase program on Tuesday, January 28th that allows the company to buyback $10.00 billion in shares. This buyback authorization allows the company to purchase up to 4.1% of its shares through open market purchases. Shares buyback programs are often a sign that the company's leadership believes its shares are undervalued.

About Merck & Co., Inc.

(

Free Report)

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

Recommended Stories

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report